Global Progress in 'Green' transition: Japan, China, South Korea

Energy storage solutions, whether applied to the power grid or EVs, make systems more flexible and are suitable for meeting low cost, low carbon electricity demands. Following is a glimpse into the energy scenario, energy storage development and, and e-mobility movement around the world, put together by Team ETN.*

JAPAN

Japan is one of the largest manufacturers of batteries in Asia. By 2030, the country has set a target of achieving 150 GWh of domestic production capacity of batteries used in EVs and ESS. At present, the capacity stands at 20 GWh. The country has witnessed drop in global share of Li-ion batteries used in EVs to 21 percent in 2020, as against 40 percent in 2015. On ESS front, the global share of Japanese production has dropped from 27 percent in 2016 to a mere 5 percent in 2020.

Despite a big energy producer by itself, Japan hit global headlines this year for frequent power outages and blackouts in major cities, owing to a series of disruptions out of earthquake incidents and massive heat waves across the country. While the government aims for renewable energy to make up a third of the nation's power generation by 2030, there is an immense opportunity for grid-connected stationary battery energy storage systems (BESS) installations in the country in the coming years to secure energy stability.

CHINA

Energy Storage

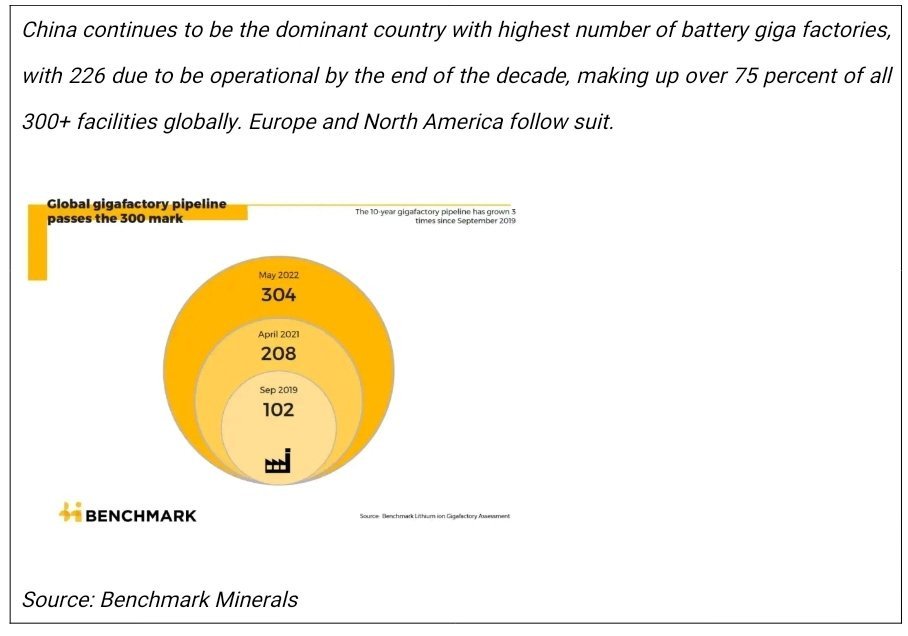

With China aiming for about 50 percent of its electricity generation from renewable power by 2025, the country's energy storage market is expected to hit 100 GWh by 2025, thereby overtaking Europe and United States to become the fast-growing energy storage market in the world. The country is already one of the world's largest battery manufacturing and demand market, with a current capacity of 70 GW worth US$1.2 billion in 2021, and is projected to reach 170 GW worth $6 billion by 2025.

In March this year, China's National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) jointly released an implementation plan for energy storage during the 14th FYP period. It calls for a wider ecosystem of government and private stakeholders to build the sector, and emphasizes the role of market forces, including generation utilities and independent service providers, in investing in storage projects. By 2030, the country plans to build up domestic capabilities in all core ES technologies to meet emerging demand for power systems.

| Japan, China, South Korea: Latest BESS projects (announced/ under-construction) |

|

|

|

|

|

SOUTH KOREA

Energy Storage

In the last 10 years, South Korea accelerated its energy storage market to reach world's largest deployment accounting for about 50 percent in 2018. Apart from geo-political and strategic advantages, the presence of large battery manufacturing base in the country puts ES imperative in the national energy and development plans.

| Japan, China, South Korea: Latest Green Hydrogen projects (announced/ under-construction) |

|

|

|

|

|

Hydrogen

On the Hydrogen front, the South Korean government's spending on hydrogen projects in FY2021 amounts to about $702 million, with a further $2.3 billion committed to establishing a public-private hydrogen-powered fuel cell electric vehicle (FCEV) market by the end of 2022. It is to be noted that five South Korean conglomerates jointly announced plans to invest over $38 billion into the hydrogen economy by 2030 last year.

* This story is part of an exclusive ETN series tracing latest developments in green energy sectors across different global regions. For other articles in the series, use the following thread '2022 Global Progress in 'Green' transition.