Indian EV Charger market to grow at 46.5 percent CAGR in 2022-2030: IESA

India Energy Storage Alliance (IESA) has released its 3rd edition of '2022 India Electric Vehicle Charging Infrastructure & Battery Swapping Market Overview Report'. The document comprehensively covers the current market trends and forecast of EV chargers in India by various charger types in terms of revenue, capacity, and volume.

The research report routes three different market projection scenarios for the ensuing decade - worst case, business as usual (BAU), and national EV scenario. It also includes a chapter on the analysis of central and state EV policies with respect to EV charging and battery swapping.

Further, the IESA report features a chapter on industry overview and key developments, consisting of demand side analysis, supply side analysis, business and tariff model for EV charging, key challenges addressed, and upcoming trends in EV charging.

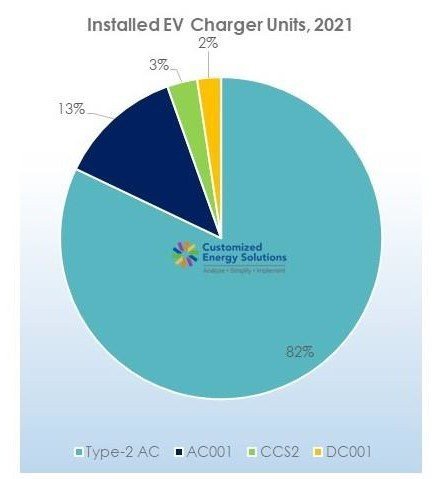

According to the report's BAU scenario, the Indian EV charger market would expand at a CAGR of 46.5 percent between 2022 and 2030, and is predicted to reach annual sales of 0.9 million units by 2030, with almost 85 percent of those projected to be type-2 AC chargers.

EV charger market represents public, captive, and private (e-4W) charge points deployed in the country. The report takes into account all types of chargers of 3.3kW and above ratings.

In 2021, the total EV chargers supplied were more than 17,000 units. This includes chargers supplied by OEMs to be sold along with e-4W, procurement by PSU, commercial fleet operators, bus operators and CPOs.

The report notes that EV charger demand in India witnessed an increase this year owing to tenders announced by PSUs such as Convergence Energy Services Limited (CESL), NTPC Vidyut Vyapar Nigam Ltd., Indian Oil Corporation Limited (IOCL), and Kerala State Electricity Board (KSEB), which put together amounts to about 6,000 charging stations by 2023.

Further, real estate developer companies such as Omaxe, Lodha Group, MyGate, and Rustomjee Group collaborated with EV charging station developer companies to deploy EV charging solutions in their new and existing properties, the report adds.

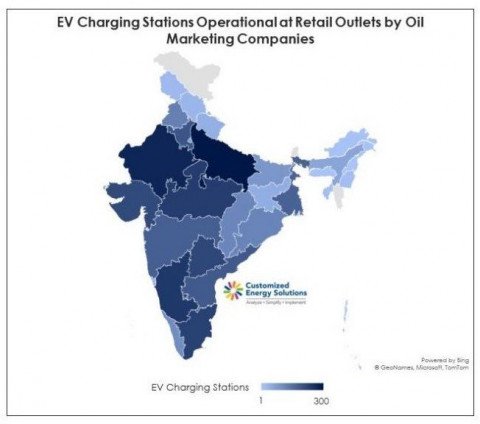

On policy front, the report has commended the efforts taken by the Union Government's Department of Heavy Industries through FAME Scheme and release of EOI for the deployment of charging stations, which has resulted in wide-spread installation of chargers across the country.

State governments are also taking active steps to increase EV charging network by providing attractive incentives in the form of capital subsidy and 100 percent reimbursement of state GST. Some states have even identified EV charging as a separate category in their energy tariff orders, the report observes.

In particular, the IESA report mentions Haryana, Kerala, Madhya Pradesh and Andhra Pradesh for providing attractive capital subsidy for deployment of limited number of fast and slow EV chargers. Further, Delhi and Maharashtra are identified as favourable locations for installing of private charging due to availability of additional state subsidy.

Lastly, low utilization rate of public charging stations has been identified as deterring investor and charge point operators in expanding their fleets. However, the report finds that with increased EV usage by commercial fleet operators and private buyers, the utilization rates are expected to increase in the coming years.

IESA Report: Key factors propelling the EV charger market's expansion in the current decade

- Rise in sales of lithium-ion based EVs, which is expected to be 54.6 million from 2022 to 2030 under BAU scenario.

- Presence of supportive policies and regulations in some states including capital subsidy for deployment of slow and fast EV chargers, allocation of specific percentage for EV charging ready parking spots in new commercial and residential buildings, and so on.

- Tenders by government agencies such as CESL, NTPC, IOCL, KSEB and Delhi Transco Limited are expected in deployment of more than 6,000 EV charging stations between 2022 to 2023.

- Collaboration among EV makers like Hero Electric, BYD India, Ather Energy and charge point operators such as Charge Zone and Magenta ChargeGrid will boost setting up of new EV charging stations in forecast period.

To learn more about the report, visit IESA.