The World Bank named 15 global chief executive officers — including Tata Sons' N Chandrasekaran — to a special group dubbed the "Private Sector Investment Lab" to funnel more private capital into the global energy transition and boost cleantech investment in developing countries.

The group will first look at increasing financing for renewable energy projects and related infrastructure.

Mark Carney, UN special envoy on climate action, said the bank and CEOs will work "to develop, test, implement and ultimately scale financing structures that can most effectively mobilize private capital."

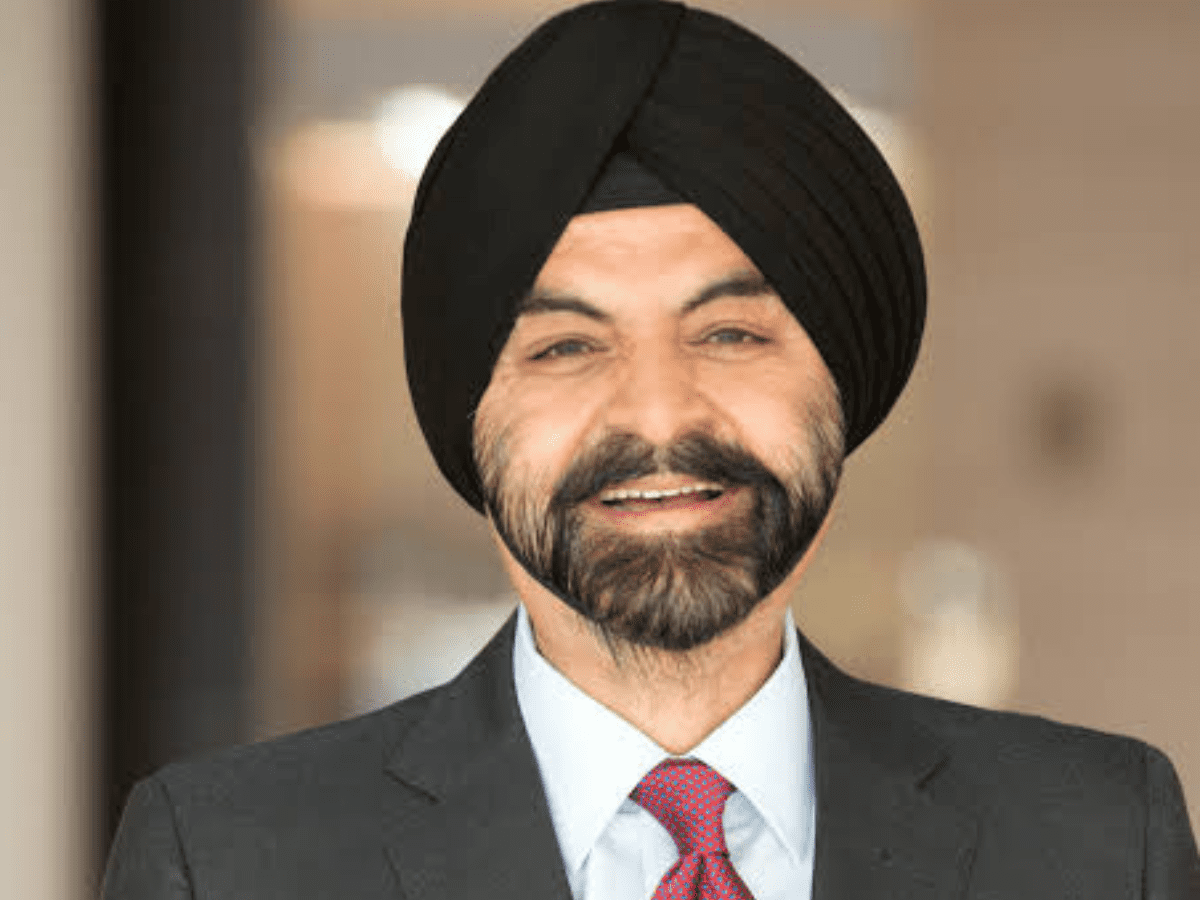

World Bank President Ajay Banga said that "Results won't come overnight, but if successful, this group has the potential to unlock significant investment that will deliver jobs and better quality of life for people living throughout the Global South - the surest way to drive a nail into the coffin of poverty."

Banga, who took office in June, is working to increase the bank's lending to work beyond traditional development projects to tackle climate change, pandemics and other global challenges. He has said the bank alone cannot finance a global energy transition.

In addition to Vadera and Chandrasekaran, the group includes Dilhan Pillay Sandrasegara of Temasek, Feike Sijbesma of Royal Philips, Thomas Buberl of AXA, Hironori Kamezawa of Mitsubishi UFJ Financial Group, Larry Fink of BlackRock, Sim Tshabalala of Standard Bank, Damilola Ogunbiyi of Sustainable Energy for All, Shemara Wikramanayake of Macquarie, Noel Quinn of HSBC, Hendrik du Toit of Ninety One, Jessica Tan of Ping An Group, Mark Gallogly of Three Cairns Group, Bill Winters of Standard Chartered.