India enters global race for giga factories

On May 12, the Union Cabinet gave a final nod to the much-awaited Production Linked Incentive (PLI) scheme for ACC battery storage, ETN magazine interviewed Dr. Rahul Walawalkar, President of India Energy Storage Alliance (IESA) to understand the journey that led to this milestone, India's battery storage market, and the next steps Indian companies should watch out for.

Q: IESA and your leadership have been at the forefront of accelerating the adoption of energy storage and e-mobility in India, please tell us about the journey so far.

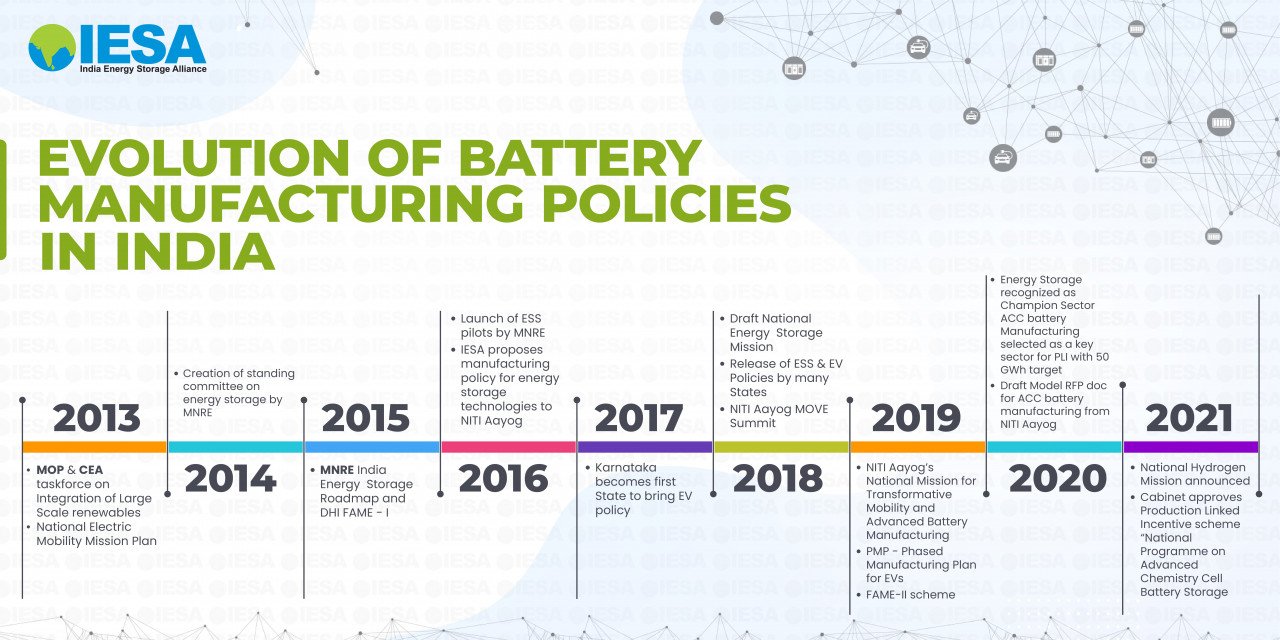

A: The journey started back in 2010 when we started the India operations for Customized Energy Solutions (CES). CES has been involved in shaping up the US energy storage market through their own work as well as with the Energy Storage Association (ESA) since 2004. When we started the India operations, we realized that India presents a possibly bigger opportunity for advanced energy storage technologies but there was a complete lack of awareness about the technology, and all kinds of policy changes were required to open up the market. So, in 2012 CES started India Energy Storage Alliance (IESA) with the vision of creating awareness about advanced energy storage technologies and creating a vibrant market for these technologies in India.

Later in 2016, the IESA leadership circle suggested that based on the learnings from the solar industry, where between 2012 to 2016 solar industry had started to take off in a big way but there was hardly any manufacturing happening and the government was considering putting some domestic manufacturing under 'Make in India', so we thought: this is a good time. Then, some of the early Gigafactories were starting up in China and Tesla had just announced their Gigafactory plans for the US, so we started exploring if we can have a similar giga factory plan for India.

We started with a modest target of setting the 10GWh power by 2020 as an initial target and submitted a proposal to NITI Aayog in March 2016. So, it has been a five-year journey since, and now the PLI has been approved but the vision is much bigger under Mr. Amitabh Kant's leadership and the government is now promoting manufacturing of 50GWh within 5-7 years. Though this has taken slightly longer than expected, it is a great start and we are not too far behind Europe in terms of starting this journey.

Q: The government has allocated INR18,100 crore for the ACC Battery Storage manufacturing program, can you elaborate on how these funds will be allocated?

A: The ACC program has evolved over the last two years. This is perhaps the most studied and discussed program with all the stakeholders since it is the first-ever scheme to be brought out by the NITI Aayog. The program is designed for advanced chemistry cell battery manufacturing, therefore it is limited to electrochemical storage technologies but within that, the program allows all forms of electrochemical technologies that meet the criteria to be eligible for the manufacturing incentive.

The program starts with technologies that have at least 50 watt-hours per kg as energy density and goes up to technologies that have 350 watt-hours per kg or more -- which are the latest generation technologies. The second parameter considered is cycle life. It is also a very important parameter because different applications require different cycles, and the programme allows for technologies that have 1000 cycles and it goes up to those having 10,000 cycles or greater. So, if you are lower on the energy density then it is expected that to be eligible for the incentive program you need to at least have superior cycle life or if you have the highest energy density then you can be eligible for the incentive given with lower cycle life which is consistent with applications such as consumer electronics or automotive where 1000 or maybe 1500 cycles are more than sufficient, but the energy density is very important. Whereas for some of the stationary applications the energy density is not as important, but cycle life is, as most of the utilities are looking for a 20 years duration for financing these projects. Therefore, this is a perfect balance where the government is not determining which technologies will get money as long as the technology being manufactured can be set up at 5GW or higher scale and meets the criteria.

This program is also linked to production, and unlike some of the earlier programmes, the government wants companies to take the technology risk and make sure that they invest in technologies that are actually manufactured. The companies will have to undergo testing for the products manufactured to validate that they are meeting the criteria and depending on that they can get anywhere from the base amount to almost two or two-and-a-half of base incentive amount if they can produce batteries superior in performance. There is complete flexibility provided for testing and product manufacturing in this programme.

We are also happy that IESA was one of the key stakeholders who enabled the programme to be opened for more than 16 battery chemistries. The original program was for EV applications and that would have limited the incentive to 3-4 electrochemical batteries but based on IESA intervention, NITI Aayog expanded the scope and today 16+ battery chemistries are eligible to avail incentive in this program.

Another important development is that there is also a niche ACC program where an additional 5GWh capacity is being allocated where individual manufacturing could be 500MWh or possibly smaller, this could be very good for attracting investment from some of the cutting-edge technology. These were some of the recommendations put forth by IESA and we thank NITI Aayog's Amitabh Kant and R B Gupta for considering them. This will now enable is to attract both, investment in commercial-grade technology which can compete with technology being manufactured in China, Korea, the US, and the EU, and also to promote domestic R&D and attract international early-stage companies to come in and set up plants in India which could lay the foundation for next-generation giga factories in India.

Q: How many years this programme is planned for and how will the funds be allocated?

A: The government has allocated is more than INR18,100 crore for the programme, there will be money allocated to related programmes to support ACC battery manufacturing including some funding to the Department of Science and Technology (DST) for supporting R&D. But this money will be available for the period of five years and that window starts in another couple of years. So, it is expected that by the end of this month [May 2021] or early next month RFP will be out for all the key stakeholders to review then the company will have to 2-4 months to submit a detailed application. Once the application is submitted there are two primary criteria on which the winners will be selected, the scale of manufacturing and domestic value addition. Also, how fast the domestic value addition will happen within the first five years of operation of the facility.

So, if two companies are setting up the same size manufacturing plant then a company that can localize more value in India will get higher weightage and there is a 20 percent weightage for the financial parameter, i.e. how less subsidy you are asking from the government. So, the base amount of incentive money is fixed at INR 2000 per kWh (roughly $25 per kWh) but it is also capped at 20 percent of the cell price and since it is expected that by the time this manufacturing facility has come online the cell prices will be below $100 so in such case, the maximum amount of incentive which most of the companies can get will be around $15 but that is still a big amount when you are considering sub $100 cell price but that's one of the parameters based on which the winners will be selected.

We are expecting more than 80GWh of bids to be submitted for the programme, in fact, if some of the international players also start participating then the bids could go higher than 100GWh but based on the interaction of the IESA team with the existing players in the market we are confident we will get 70-80GWh of bids. Out of which, only 50GWh will be eligible for the incentive so there is going to be an exciting competition during this phase.

After this, the winners have to submit every quarter the test results of the cells which are produced to make sure which incentive bracket they fit in and they need to submit GST invoices or some other proof that would show they were able to sell those batteries in the market. They could even export it, those successful in selling it internationally will also be eligible for the incentives. NITI Aayog designed this programme after consultation with several ministries including the Department of Heavy Industries (DHI), Ministry of New & Renewable Energy (MNRE), Ministry of Power (MoP), and several other agencies including DST. DHI will serve as the implementing agency, and it will be responsible for the distribution of the money. The entire process is defined, including the testing criteria and all the other parameters. Most of the players have this information available, if not, they can reach out to IESA and we will be happy to help them in understanding the programme.

Q: You mentioned that more than 80GWh of bids could be submitted for the programme, and if international players participate then the bids could be above 100GWh. So, would Indian companies be able to license technology from foreign partners?

A: This is an area where there is a lot of innovation taking place around the globe. There are Indian companies who have now, for more than a year, been in touch with technology partners and some of these companies have already formed joint ventures or are finalizing license agreements for some of these technologies. So, technologies are available, and in fact, every major technology company is interested in India as a market--If we consider countries, after China, the US, India will be the third-largest market before 2030. If we include Europe as a market then India will be the fourth-largest market. Therefore, no technology company can ignore India as a market.

IESA annual market assessment suggests that between now and 2027, the cumulative market potential in base-case is 400GWh, and in terms of upper-case, this potential could be more than 600GWh. This programme is quite an optimum size for meeting India's requirements. With this incentive and some of the duties getting constituted under the Aatmanirbhar Bharat (self-reliant India) initiative, it is almost a no-brainer that any tech company that wants to get access to the Indian market will need to participate in the ACC PLI programme.

Q: As we are aware, ACC battery manufacturing requires heavy investments, how will Indian companies get the necessary finance for this?

A: This is an important question. Traditionally, Indian industries have been comfortable with the assembling-kind of opportunity where you are not investing in the core technology manufacturing, but essentially importing core components and assembling them. That is how the auto industry, telecom, cell phone manufacturing is working.

But IESA strongly recommended working on building core technology in India and thanks to the visionary leadership of PM Modi and CEO of NITI Aayog, Amitabh Kant, we have realized we cannot keep making the same mistakes. So the government has considered this in the PLI scheme.

If we see the way the PLI programme is designed, we need to have at least 60 percent domestic value addition; the complete supply chain is looked after in this programme which is why the investment amount will be huge but ultimately ACC battery cells are going to be the engine for industries for the next 15 years. These technologies are useful for renewable integration, power backup, diesel minimization, electric vehicles -- not just on roads but drones, electric planes, marine applications-- and consumer electronics devices such as cell phones, etc. So, there are numerous applications, and we are at the cusp of a technology transition that will dominate the industry for the next 20-30 years, possibly even longer.

The last battery technology to reach this scale was lead-acid batteries and they dominated the world for more than 100 years. Although many new technologies will come, companies that will set up facility under this will have a long commercial opportunity, and companies who invest in this can consider 20 percent EBITDA (earnings before interest, taxes, depreciation, and amortization), and if you consider the investment money they are getting, then this can be greater than 25 percent. So, there is no better opportunity than this for companies considering investing in ACC battery manufacturing.

Q: Advance chemistry cell requires critical raw materials like Lithium for manufacturing Li-ion batteries, reports suggest India has limited reserves of Lithium, so how will critical raw materials be secured for indigenous facilities?

This again is a very important question. In fact one of the concerns due to which the ACC program got derailed by almost a year was because people started to think that India does not have enough lithium reserves so we should go for sodium or some other next-generation batteries.

However, people in the know were aware that in Li-ion batteries, the energy exchange or ions that are getting exchanged are Lithium, but in terms of the materials – Lithium amounts to less than 5 percent of the cost of the material going into the Li-ion battery. Depending on the battery chemistry, it could even be as low as 2-3 percent.

Therefore, depending on the battery chemistries, there are several minerals required such as iron, copper, aluminum, phosphorous, nickel, manganese, cobalt. India already has reserved for many of these materials, the global supply chain has also developed. For example, every country that is manufacturing or setting up a giga factory does not have the domestic supply for Li-ion battery manufacturing they rely on other countries which have reserves. Ultimately this is a business decision if the supply chain needs to be developed locally or they can take benefit of abundant reserves available in Australia, or countries in Latin America. These countries have a very well-developed mining sector and they are currently looking to partner with Indian companies.

The Indian government has already set up a separate PSU, Khanij Bidesh India Ltd. (KABIL) specifically to secure critical raw materials needed for Indian industries. KABIL has already signed MoU and partnership agreements with some of the international mining companies.

Apart from that, in India Lithium exploration was stopped until 2017, in fact, IESA and some of the other stakeholders initiated the dialogue to allow Lithium exploration which was only granted in 2018. Within the last two years, initial deposits of Lithium have been found -- one in Karnataka and another in the Eastern part of India – whether they are economical to be mined is something that has to be decided but these things will develop. With the ACC program mandating 60 percent domestic value addition, there is a big opportunity to get raw materials from outside but if you can process them to the purity and quality required for battery-grade then there is tremendous value addition available there. These are the kind of opportunities the Indian companies need to focus on right now.

Another important aspect is, in Li-ion battery the materials do not get destroyed during use, unlike fossil fuels. In the case of Li-ion battery, all the mined and processed materials can be almost 100% recycled if not then 90% recycled and reused within battery manufacturing as well as many other applications such as medical-grade pharmaceuticals or lubricants. Around the world, billions of dollars are being invested in the recycling of advanced chemistry cells and this problem will be solved. So, for the next 5-6 years we will be counting on freshly mined material but later the share of recycled material as a part of the new battery manufacturing supply chain will start going up.

IESA has launched IRRI (IESA Re-use and Recycling Initiative) program, and we are working with key stakeholders and government agencies to enable this.

Q: What are some of the learnings India can take from other countries that have set up giga factories already?

A: This is an area where technological changes happen very rapidly so companies entering this area have to invest heavily into R&D and be on top of technological changes. We are of the view that there is not one single silver bullet, there are multiple technologies used in various applications. We think there is a great opportunity for multiple technologies to coexist but the foundation of this is R&D. Apart from R&D we need to invest heavily in skill development.

This being a new field, India does not have skilled manpower to address this, IESA under IESA Academy had already started conducting hands-on training for cell manufacturing and have partnered with SECRI, CMET, and other National Labs for training people and we will be scaling it. Apart from this, we need to have a program where we can tap into the number of Indian students or researchers currently working in this area. We need a government or private program that is focused on bringing back all these scientists and researchers working with international companies that are open to returning to India and contributing to the development of this sector in the country.

Also, there could be many foreigners interested in coming and tapping into this opportunity.

So, we first need to focus on manpower and skilled resources, and then we need to make start utilizing industry-academic collaboration to stay on top of R&D requirements.

Q: Talking about the other side of the equation in battery manufacturing, how do you think the demand is shaping up in India for battery storage?

A: We are very confident that the demand in India is huge. Although right now, the demand for Li-ion batteries is perhaps a little under 5GWh so 50GWh seems like overkill in terms of manufacturing. But, as we are seeing different price points being matched for applications, the market is expected to grow very fast. We anticipate that by the time this 50 comes online buy 2027 the market demand at the minimum will be 80GWh or it could be possible even more than 100GWh.

We expect this manufacturing will serve only around 50 percent of the domestic demand the key part that is required right now is: confidence-building measures. Business leaders are currently a little skeptical about this proposition as they have seen in areas like coal or others where they made big plans, investments, but the actual demand did not follow so they are wondering: will that happen again?

This is where people need to realize that previously they invested into technologies towards the end-of-its-life internationally, whereas this is the sunrise sector and these technologies which will dominate the world at least for next 20-30 years if not more.

In terms of demand-generation activities, there is already a FAME-II policy by DHI wherein many State Transportation Enterprises are buying electric buses. EESL is looking at investing in setting up EV charging infrastructure. IESA is working with EESL to find the right charging location. Another important aspect is we need to educate the end-users so they do not keep waiting for cheaper batteries and cheaper EVs and impress on them that there are several applications where they can switch to electricity today and start saving money. We need to work on consumer education in helping them make the right decision, with these factors demand should pick up.

IESA is working on the stationary side agencies like Solar Energy Corporation of India (SECI). SECI had a huge role to play in the success story of the solar sector so they are also going to play a key role in identifying hybrid projects with solar, wind, and storage and those will drive applications on the stationary storage side.

India is already a vibrant market for UPS, inverter backup power applications, here I don't think any government intervention is required, the only thing necessary is enabling financing as the advanced technologies are far more energy-dense so they offer five to six times longer life, but they also have a higher capital cost for at least the next 3-4 years. If the financing is available, then they can hit the ground running.

This interview is an edited transcript of an original interview conducted by Netra Walawalkar, host of Emerging Tech Radio.