Anode materials for li-ion batteries

For the effective development of a high energy density battery, the use of high capacity electrode materials (anode & cathode) is an essential factor.

As per one of the industry reports, the global anode material for the automotive lithium-ion (Li-ion) battery market is anticipated to generate a revenue of $1,348.6 million by 2030, increasing from $707.2 million in 2019, progressing at a 5.7 percent CAGR during the forecast period (2020-2030)

Anode material in Li-ion battery:

The anode materials are the negative electrode in lithium-ion (Li-ion) batteries and are paired with cathode materials in a li-ion cell. The anode materials in Li-ion cells act as the host where they reversibly allow li-ion intercalation/deintercalation during charge/discharge cycles. Anode materials make up 10-18 percent of the cost of materials for Li-ion batteries.

The anode in the battery deserves an equal say in the overall performance of a battery. For the effective development of a high energy density battery, the use of high capacity electrode materials (anode & cathode) is an essential factor.

General benchmarks for selection of suitable intercalation-based anode materials comprise:

- low first cycle irreversible loss

- high coulombic efficiency

- fast li-ion diffusion into and out of the anode

- high ionic and electronic conductivity

- minimum structural changes upon charge and discharge

- high specific capacity (mAh/g)

- the ability to form and maintain a stable SEI (Solid Electrolyte Interface) layer upon cycling.

Types of anode material:

- Anode materials fall into three types:

- carbon materials (graphite-based)

- metallic oxide materials and

- alloy materials

Lithium titanium oxide (LTO) leads the pack:

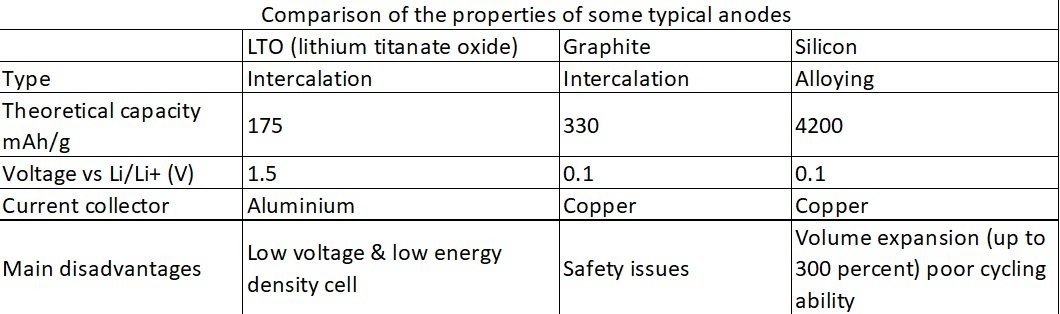

The most commonly used anode material is graphite. Lithium titanium oxide (LTO) is an alternative anode that is already commercialized. LTO is safer than graphite anode and more suitable for high power applications

Lithium Titanate/lithium titanium oxide (Li4Ti5O12, spinel, "LTO") is an electrode material with exceptional electrochemical stability. It is often used as the anode in lithium-ion batteries for applications that require a high rate, long cycle life, and high efficiency. LTO-based batteries are considered safer and have a wider operating temperature range.

Lithium titanate has emerged as a promising anode material for Li-ion batteries. The use of lithium titanate can improve the rate capability, cyclability, and safety features of Li-ion cells.

The advantages of Lithium Titanate Oxide (lithium titanium oxide) battery technology are significant and the whole LTO technology is a game-changer for the entire battery industry. The LTO is bringing a new dimension of possibilities for energy storage with several economic as well as ecological aspects.

New or latest R&D on the component:

India:

Scientists at the International Advanced Research Centre for Powder Metallurgy and New Materials (ARCI), an autonomous R&D Centre of the Department of Science and Technology, Govt. of India, in collaboration with the Department of Metallurgical and Materials Engineering, IIT Madras have developed a novel anode material for lithium-ion battery (LIB) for electric vehicles (EVs).

This high-performance and a sustainable anode made of a composite material of α-MoO3 and single-walled carbon nanostructures called carbon nanohorns (SWCNHs) showed high energy/power density, fast-charging capability, and long cycle life. The SWCNHs are carbon nanostructures composed of thousands of carbon nanocones and typically exist as spherical aggregates of 80–100 nm in diameter. The composite is considered low-cost and environmentally friendly due to its abundance and non-toxic elements present in the composite.

Canada:

Canada-based HPQ Silicon Resources, PyroGenesis Canada, and the Énergie Matériaux Télécommunications Centre (ETM) of the Institut National de Recherche Scientifique (INRS) have set up a research project focused on the development of silicon (Si)-based materials as active anode materials for lithium-ion batteries.

Europe:

As the next step towards large-scale production, Elkem is establishing Vianode as a new company and brand dedicated to develop and produce sustainable and high-quality active anode materials to meet the needs of the exponentially growing electric vehicle marketplace.

"Today, anode materials are one of the largest greenhouse gas emission contributors in battery cell production. Vianode intends to reduce emissions from this part of the battery materials value chain by more than 90 percent compared to conventional production", says Stian Madshus, Vice President and General Manager Europe at Vianode.

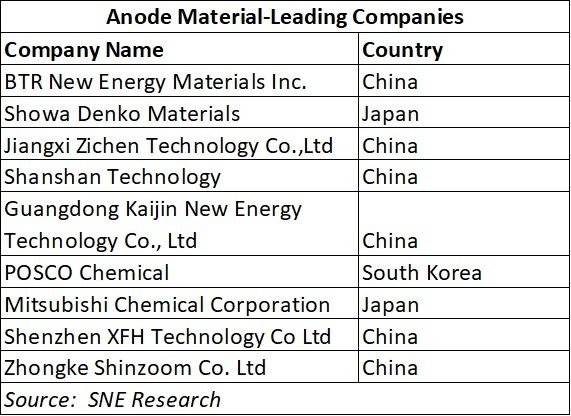

Leading global players:

The global anode material for the automotive lithium-ion battery market is fragmented in nature, with the presence of players such as:

To learn more about the Indian anode market development, ETN spoke to a few of the industry manufacturers who are leading in the segment:

- Mr. Anurag Choudhary - Managing Director & CEO, Himadri Speciality Chemical Ltd

- Mr. Sumit Garg, Business Head, Advanced Materials Business, Epsilon Carbon.

- Mitsubishi Chemical India Pvt. Ltd.

Mr. Anurag Choudhary - Managing Director & CEO, Himadri Speciality Chemical Ltd

Anode offerings for the industry:

Himadri manufactures high-quality synthetic variants of Meso Coke used as a feed material for the anode material & anode material in Li-ion battery. Himadri's anode material & Meso Coke is suitable for delivering anode material capacity of 355-360 mAH/g and a 1st cycle efficiency of more than 90 percent which contributes to facilitating a high-performance battery manufacturing ecosystem globally.

We have a commercial production capacity of 3,000 MT per annum. The synthetic graphite anode material is made from 2 types of coke: Pet Coke (petroleum-based) & Pitch/Meso Coke (coal tar-based). Lower extraction of oil would put pressure on pet coke production. Himadri's offering of anode material from Pitch / Meso Coke can ensure the sustainability of supplies for anode material in the long run as well.

Technology R&D for anode materials:

Himadri's indigenously developed technology, as well as in-house facility, enables flexibility to manufacture customized material to suit customer needs. We have been continuously developing the anode material from 2008 through careful research and have successfully developed anode material suitable to the present market needs. We have forward integration from coal tar to anode material along with control on quality at each stage. We are the first organization in India to develop this advanced carbon material and among the very few globally to do so.

Market share in the industry

We have over the last five years, exported our materials to the eastern part of the globe and are the only Indian producer with successful commercial supplies to cell manufacturers. With the increasing demand in the lithium and other battery segments, we are in discussions with cell manufacturers in India, Europe & US regions for further commercial supplies.

R&D strategy for enhancing anode materials

R&D is an important asset for us because, over the course of the last decade, it provided us knowledge and insights, which lead to improvements to existing processes where production efficiency was increased. We boast of state of an art manufacturing facility, NABL accredited laboratory as well a world-class global team of researchers and managers to develop our anode material.

We are also researching to further enhance the capacity of our anode materials by the inclusion of additives such as Silicon-Graphite, etc. which will further boost the life cycle and storage of battery being produced from them

Importance of high-performance anode materials in Li-ion batteries

Higher capacity and 1st cycle efficiency present in the anode material is an important factor to enable efficient li-ion battery being manufactured which is the key attribute of Himadri's anode material & Meso Coke. High-performance anode materials can deliver better density in Li-Ion batteries while increasing their cycle life along with arranging the volumetric density in the manufactured cell. The higher carbon percentage & minimum percentage of contaminants present in Himadri's anode material enables a better battery performance.

Development plans for the anode market:

Himadri is committed to supplying superior and uniform quality to its customers across the globe. We have major expansion plans which are underway in increasing our anode material production. We intend to produce 20,000 MT by 2022 and to produce 100,000 MT of anode material by 2028 in a phased manner. Through our well-chalked-out expansion plans, we aim to become a leading anode material player globally while consistently contributing to the Indian government's vision to reduce oil imports and support the cause of zero emission around the country and globe.

Himadri will also contribute to 'input localization' targeted in the PLI scheme recently announced by the govt. of India. Further on, with our experience on the anode material supplies and our continuous research in the product, we look to produce anode material that will not only suit the high-performance Li-ion Battery but also, set the bar higher on the performance of the anode material in the industry.

Mr. Sumit Garg, Business Head, Advanced Materials Business, Epsilon Carbon.

Anode offerings for the industry:

Epsilon Advanced Material aspires to be a leading manufacturer of advanced cell chemistry materials in the fast-growing LiB material space. Below flow chart explains our offerings to the market

We currently produce Bulk Mesocoke, which is a precursor to anode material, on a commercial scale of 2,500 TPA capacity. We sell this material to Anode makers based out of China, Japan, and Europe.

For synthetic graphite, we have a pilot facility. We also have a pilot facility for natural graphite. Going forward we will be offering multiple products to our customers as a full-fledged anode maker. We are already in the process of qualifying our synthetic graphite with globally top-tier cell companies. Our aim is by 2023 to start commercial supply commercial of synthetic anode

We have also entered into MoU with Finland based Graphite miner to set up a JV in Finland to process Natural Graphite flakes to Spherical Purified Graphite to be used as Anode material.

Globally we are the only company that has a full backward integration from raw coal tar to an Anode maker (in the LIB supply chain).

Technology R&D for anode materials:

We use coal tar as a raw material to make our anode materials. Coal tar has lower sulphur content, therefore lower SOX/NOX emissions. We have developed and use patented technology, which is developed in-house to process coal tar pitch into Bulk Mesocoke. Globally industry relies heavily on petroleum-based feedstock as raw material and we will be amongst the very few who have developed coal-based technology to produce consistent, high-quality materials. For the rest of the process of processing Bulk Mesocoke into Synthetic graphite, we use the tried & tested technology and equipment that is used by the most reputed global anode makers.

We position ourselves as a complete solution provider for the Anode material requirement of LiB batteries. With the technical expertise & know-how, we are well-positioned to provide Synthetic Graphite and Natural Graphite both by using thermal purification which is Zero discharge technology thereby making us produce material with a strong focus on ESG parameters.

Market share in the industry

Currently, China controls over 70 percent of global natural graphite supply & over 85 percent of synthetic graphite supply. Since the ecosystem for cell manufacturing in India is yet to develop, Epsilon would focus on the export market, primarily Europe and NA in the short term. However, in the long term, as the Indian market matures then we will allocate a part of our capacity to support Indian battery manufacturing.

Our long-term vision is to reach a scale of 100,000 MT synthetic anode volume and around 50,000 MT of Natural graphite anodes. Considering, an enormous amount of capacity being planned in Giga factories globally, we believe for markets other than China, we can capture a market share in the range of 8-10 percent

R&D strategy for enhancing anode materials

Our strategy is to continue to be at the forefront of strengthening our R&D capabilities and to develop cutting-edge materials that our customers may need. We will do this thru –

- Continue to invest in in-house R&D infrastructure and manpower

- Collaborating with research institutes/technology startup/govt. institutes globally.

Silicon in the last several years has generated high interest as one of the most promising anode doping materials for lithium-ion batteries due to its high theoretical lithium storage capacity. Epsilon is already conducting lab scale trials and expects to come up with its series of Silicon composite anode materials by 2022-23.

Importance of high-performance anode materials in Li-ion batteries

Epsilon produces various grades of synthetic graphite with properties, designed to meet our customer's specific requirements that are suitable for a long cycle, high power, and high energy batteries. These high-performance parameters make them suitable for widespread applications like portable electronic, electrical tools especially in Electric Vehicles (EVs).

An important factor in increasing the energy density of LIBs is the choice of efficient electrodes since energy density and cycle life strongly depend on the nature of the electrode material. Our anode materials align well with multiple types of electrodes.

Development plans for the anode market:

We plan to ramp up our precursor capacity to 15,000 MT by mid-2022 and then gradually to a capacity of 50,000 TPA of precursor capacity and 37,000 TPA of synthetic anode material by 2025. By 2030, we plan to have capacities of 100,000 MT of the synthetic anode and 50,000 MT of natural graphite. To achieve this scale, we plan to invest Rs. 5,000 – 6,000 crore till 2030 in the business.

Mitsubishi Chemical India Pvt. Ltd:

Anode offerings for the industry:

We offer formulated anode materials for rechargeable lithium-ion batteries.

Technology R&D for anode materials:

We are working on developing anode materials of high power, high safety, high voltage, and high durability characteristics.

Market share in the industry:

Mitsubishi Chemical has a high share in the natural graphite category, especially for the mobility segment.

R&D strategy for enhancing anode materials:

We are working on enhancing natural graphite anode material based on customer feedback and application requirements.

Importance of high-performance anode materials in Li-ion batteries:

The high-performance anode material will offer high energy density, high durability, fast-charge capability and contribute to Greenhouse gas (GHG) reduction by long battery life.

Development plans for the anode market:

The company has launched a new type of natural graphite MPG (Mitsubishi Power Graphite) which has good power performance and longer cycle capability.