A dedicated session on green hydrogen ecosystem in the R1 Asia-Pacific region saw speakers discoursing on the current status, new prospects, and challenges of the emerging sector in three important markets, namely India, China, and Japan.

India Energy Storage Alliance's (IESA) flagship annual event – World Energy Storage Day 2022 – is off to a great start. The coveted clean energy virtual conference has brought the veterans, policymakers, researchers, and professionals from various sectors on a single platform to discuss on the state-of-affairs of the global energy storage, e-mobility and hydrogen industries holistically. Multiple sessions are being held region wise for all the three clean energy segment to offer focused discussions.

In his opening remarks on Green Hydrogen session for R1 Asia-Pacific region, Aditya Prasad Palavi, Consultant, Customized Energy Solutions (CES), gave a brief picture of the emerging hydrogen ecosystem in India, with specific attention to its demand base and immediate opportunities.

"Market for H2 is not fully developed in India yet, and the R&D, manufacturing and distribution infrastructures are in nascent stages. By 2030, India is looking at an opportunity of about 60 GW electrolysis capacity generating 15-20 million tons of green hydrogen annually, with largest production of green ammonia for exports", he said.

India is also expected to have electrolyzer manufacturing capacity of 25 GW by 2030, he added. "Partnerships and international collaborations are very important to achieve the targets, and will go a long way in establishing a vibrant green H2 ecosystem in the country", he opined.

In this regard, Aditya revealed that IESA will be releasing a document titled "Emerging Technology Review for Hydrogen" very soon. It will look into the holistic aspects of the hydrogen technology and ecosystem in the global markets, he added.

Speaking on the H2 and fuel-cell developments in Japan, Ohira Eiji, Director – Hydrogen & Fuel Cell, New Energy and Industrial Technology Development Organization (NEDO), said, "Hydrogen is a key technology for countries becoming carbon neutral, and Japan has been strongly promoting the clean energy source right from the beginning".

He brought attention to Japan's Green Innovation Fund, which is funding several H2 projects in the country relating to large-scale transportation, power generation, marine energy, steel production, and so on. Japan's 6th Strategic Energy Plan envisages a 1 percent Hydrogen/ Ammonia in 2030 energy mix, while the METI has already started discussions on support measures for H2 supply chain, he said.

"NEDO has been handling a step-by-step approach to H2 development in Japan, with residential fuel cell marketization in 2019, FCVs and HRS in 2014, and H2 in energy system in the current decade. We aspire for penetration at all levels including domestic or household market", he observed.

Japan targets 5.3 million residential fuel cell systems (EneFarm) by 2030, along with 1,200 H2 buses, 800,000 fuel-cell passenger cars, and 900 public hydrogen refueling stations.

China, on the other hand, is traditionally one of the mature market for hydrogen production and consumption in the Asia-Pacific region. As per Chinese H2 industry development mid to long term plan (2021-2035), the country has set a target of 100-200 thousand tons of annual green hydrogen production, along with over 80,000 accumulated FCEV implementation and more than 800 H2 refueling stations as early as 2025.

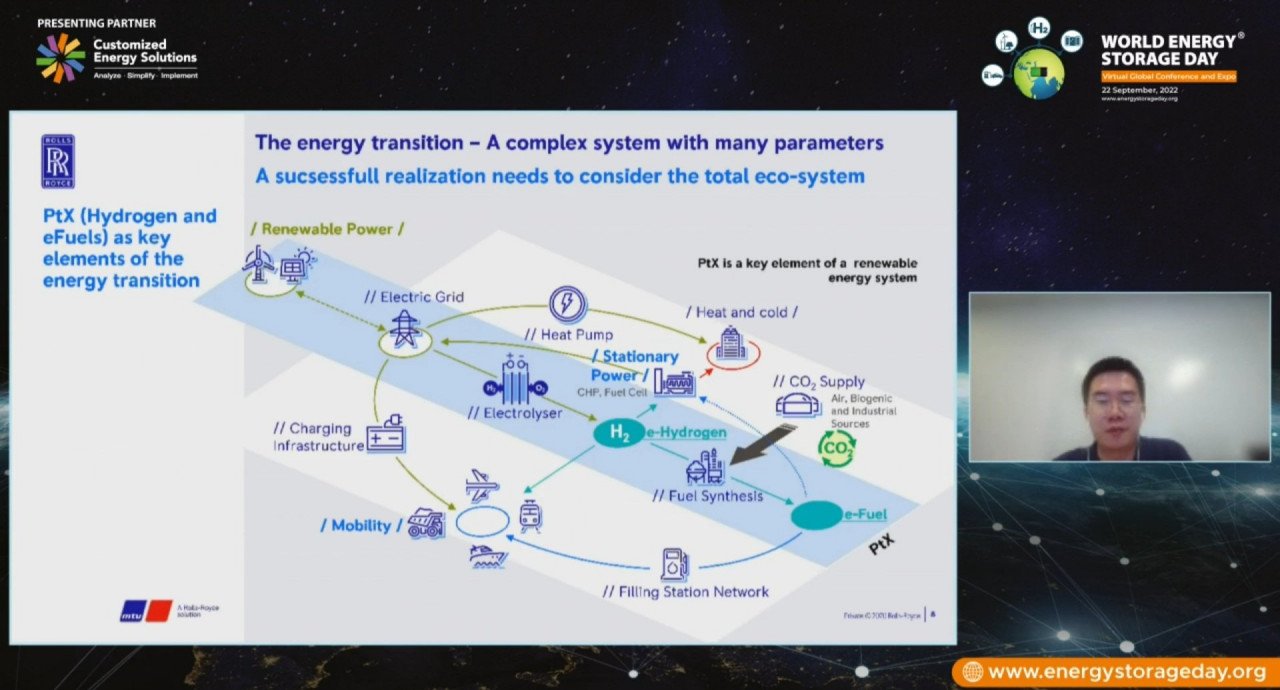

"China has come up with intensive hydrogen policies since 2020, as part of its 2030 carbon peak and 2060 carbon neutral roadmap, with hydrogen realized as an important means to decarbonization and energy transition", said Liu Chang Zhi, Senior Sustainable Product Engineer, Rolls-Royce Solutions (Suzhou) Co. Ltd., China (Rolls-Royce Power Systems). H2 is an integral part of national energy framework, he added.

Speaking on the emerging opportunities for green hydrogen in the country, he noted, "China produced 34 million tons of H2 in 2021, of which about 57 percent are produced using coal and another 22 percent using methane. The transition from grey to green hydrogen is becoming the priority, opening new avenues for renewable energy ecosystem". Liu said that Rolls-Royce's 'PtX' solutions consisting of hydrogen and e-fuels are of immense importance to this aspired energy transition.

Knut Linnerud, CEO, Greenstat Asia, in his presentation at the session, drew attention to his company's technology agnostic approach to hydrogen in markets in the region. He highlighted India's Green Hydrogen Policy, and spoke on Green Hydrogen India's operations and unique positioning to collaborate with wide range of partners and customers in emerging green H2 ecosystem.

"Penetration of Green Hydrogen is strategic for India to invest in developing its own parallel technologies and capabilities to production. A key challenge is on balancing taxation and incentivization to promote best technologies, so that help in quick commercialization and achieve mainstreaming in the energy system", he said.

Linnerud also added that commercial breakthrough in green H2 projects is a challenge, owing to high technology costs and slow market acceptance. "Existing grey hydrogen markets are also considerable in size, especially the industries that they cater to. To drive down the technology costs, the industry has to make pro-active steps", he added.

Read More