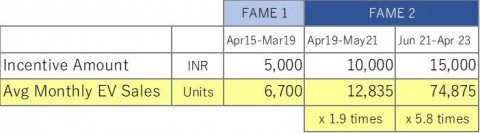

Following up on the subsidy reduction announcement by the government of India, the India Electric Mobility Council (IEMC) looks back at the substantial progress of the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, and gleans insights into the journey so far.

With just 10 months remaining for the FAME-II Scheme to end, the government's announcement of a reduction in subsidy benefits for two-wheeled EVs (₹10,000/kWh from ₹15,000/kWh, and revision of cap on vehicle cost to 15 percent from 40 percent) from June 1, 2023, will significantly impact e-2W prices.

The scheme's first phase began on April 1, 2015, and was extended till March 31, 2019. The second phase commenced on April 1, 2019, for a period of three years, which was further extended for a period of two years up to March 31, 2024.The MHI has now reduced the demand incentive from ₹15,000/kWh back to ₹10,000/kWh, and cut incentive cap to 15 percent, bringing back the incentive amount to the same level as it was till May 2021.

Price is one of the important factors for influencing customer decision in favour of an EV. ICE vehicles have had a head start of more than a century in optimizing production at scale and in building an ecosystem, allowing customers to buy and operate vehicles affordably and conveniently.

Therefore, policy makers introduced various EV incentives to compensate for ecosystem readiness, which can be clustered into three broad categories:

1. Sales price incentives (tax reduction or lump sum)

2. Ownership incentives (mostly reduction of motor vehicle tax)

3. Operations incentives (lower energy prices, reduced tolls, exclusive parking)

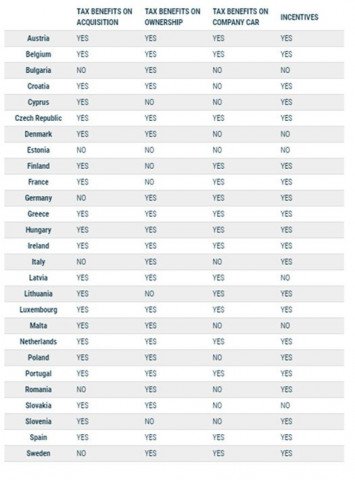

Incentives in the form of subsidies and tax rebates, to promote e-mobility, is a practice being adopted globally. The European Union is the global frontrunner in the adoption of EVs; its member countries are responsible for more than a quarter of the world's EV production. Purchase incentives for EVs are currently available in 21 EU member States.

RELATED: E-Mobility | Review 2022: A look at the year that was

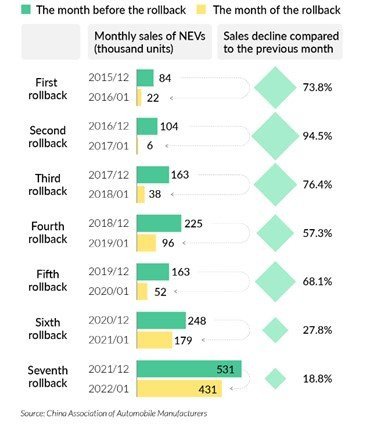

On the other hand, there is China, which in 2023, officially ended its 13-year-long policy of subsidizing purchases of new energy vehicles (NEVs, pure and hybrid EVs and fuel-cell EVs). Car buyers till Dec 31, 2023, could receive a one-off subsidy for buying an NEV, as long as it conformed to certain eligibility criteria. The NEV subsidy plan was set to end in 2020, but authorities began cutting the subsidies far earlier.

The end of subsidies means that the sale of NEVs then depends exclusively on market factors. Concerningly, EV sales have dropped with consumers waiting to sit on the side-lines.

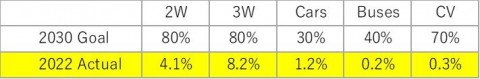

The Economic Survey 2022–23 says that by 2030, the Indian market for EVs will sell one million units per year and directly and indirectly create five million jobs. By that time, the government plans to have EV sales penetration of 40 percent for buses, 30 percent for private cars, 70 percent for commercial vehicles, and 80 percent for two- and three-wheelers.

The future of mobility for India is at a critical point and operationalizing mass transition to e-mobility in a country of 1.3 billion people is not an easy task. A shift towards e-mobility is essential for India, considering the country's high petroleum imports, and its adverse impact on the trade balance, valuable foreign exchange, and the environment.

A holistic approach, balancing factors like supply chain localization, charging infrastructure, policy, financing, etc., will help enhance the enabling ecosystem and support our EV adoption goal.

India remains largely dependent on imported lithium-ion (Li-ion) cells owing to limited local manufacturing. Cells are the most critical part the of e-mobility value chain, and a significant cost reduction is envisaged with large-scale, domestically manufactured batteries.

To fulfil forecasted demand for LiBs, government has set an ambitious target for battery manufacturing. It aims at setting up a cumulative 50 GWh of capacity for advanced chemistry cells (ACC) by 2024. However, local battery manufacturing ecosystem is scheduled to start production around 2025-2026, and in the interim it is important to maintain price parity of batteries, till local commercial supply is stabilized.

A total of ₹1000 crore has been allocated under FAME-II for provision of EV charging stations, however our availability of EV charging stations is comparably lower than leading EV adoption markets (1 public EV charger per 154 vehicles, as compared with 1 public EV charger for 6 to 20 vehicles globally).

Development of e-mobility ecosystem in India may follow a different growth trajectory as compared with global EV markets. As reflected in our 2030 goal, the transition is expected to be driven by private two-wheelers and public three-wheelers, making battery swapping a significant business model for India as it reduces upfront EV costs and increases commercial run time.

The EV Battery Swapping policy needs to be finalized on priority, addressing crucial concerns like GST rate and simplification of the homologation process. Close to 77 percent of all vehicles are financed through banks and non-banking financial corporations (NBFCs), though this share varies across different segments.

Banks and NBFCs are currently apprehensive in financing EVs due to product risk, in addition to credit risk and the lack of a second-hand market for EVs. There is a need to encourage banks and financing institutions to develop customized offerings to encourage EV adoption.

With the government directive reducing or reverting to pre-June 2021 levels, it is with careful trepidation that we wait and watch how EV OEMs and EV customers respond to this change, and how market aligns itself to meet our 2030 mobility goals.

With just 10 days to go for the reduced FAME-II subsidy to take effect, the question that arises is: Are EVs on a self-sustainable momentum, with incentives only working as sweeteners to encourage purchase, or do the sops hold the sway in EV-adoption?

And the answer perhaps, as Bob Dylan famously sang, is 'blowing in the wind'.

*The India Electric Mobility Council (IEMC) is an initiative by IESA that is intended to explore opportunities for India to exploit the potential of R&D and manufacturing of E-Mobility technologies and the adoption of clean transport. IEMC is working with government and various stakeholders to address the barriers and focus on the aspects related to safety & standards, charging infrastructure development, battery swapping, V2G mechanism for India.

[Contributed by Gurusharan Dhillon, Director - eMobility Services, Customized Energy Solutions (CES)].

FAME-II subsidy for E2Ws slashed; prices to go up, push for OEMs to innovate

Read More