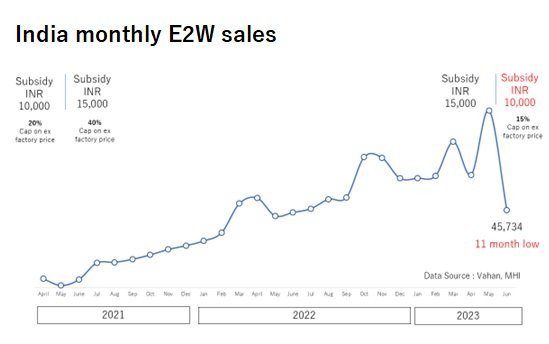

Electric 2-wheeler (E2W) sales for June came as an unexpected shock, even though everyone was watching with trepidation to see how the price sensitive E2W consumer would react to the reduction in subsidy from June 1. The government had slashed subsidy 50 percent to ₹10,000/Kwh from ₹15,000/Kwh, and consumers reacted by sending sales down a similar percentage.

E2W sales for the month of June tanked 50 percent from the previous month to just under 46,000 units.

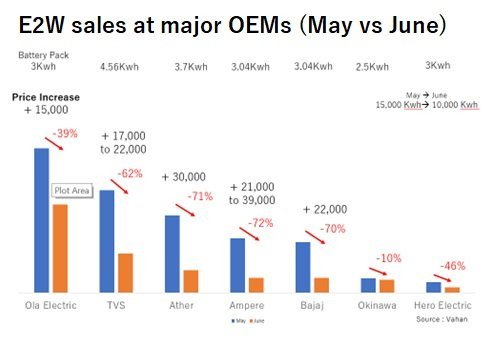

As the above sales numbers show, consumers have been put away by the decline in subsidy. In fact, a comparison of the sales of various E2W manufacturers or OEMs shows that the greater their price hikes, the bigger their sales decline, reinforcing the notorious price sensitivity of the Indian E2W buyer.

Electric vehicles are more cost effective than conventional vehicles, or ICEs (internal combustion engines) over the long- and medium-term. But while these benefits are understood, their higher purchase cost has deterred prospective consumers from making the shift. Thus, we need to focus on reducing the high upfront costs to make EVs palatable to buyers.

E2W companies have taken the initiative here, introducing multiple ownership models, exchange programs, assured buybacks, private leases, and deals with financial institutions to make buying and owning an E2W easier.

The Case for Subsidies

Within India, there are strong and opposing views on subsidies. One school of thought says they are necessary, while the other advocates industry achieve self-sufficiency without subsidies.

Let's simple this simple question: is buying and owning an E2W as simple and straightforward as buying a petrol vehicle?

On that front, a lot still needs to be done. Let's take charging, for example. The number of publicly-available chargers has gone up to around 11,000 charging points across 6,500 charging stations as of 2023. In March this year, MHI sanctioned ₹800 crore to oil marketing companies (Indian Oil, Bharat Petroleum, Hindustan Petroleum) to set up another 7,000-odd charging points, with installation expected to be completed by March 2024.

In comparison, the country has almost 49,000 petrol pumps as of March 31, 2023.

Plus, because charging an E2W takes more time than filling petrol in the tank, owners would rather plug their vehicle overnight at home. But owners wishing to do so face challenges in obtaining necessary approvals from group housing societies to install charging points in the society parking area. Among the concerns raised by opponents are common society meters, loss of basement parking, etc.

Two-wheelers are the mainstay of India family travel, so E2Ws will be pivotal in providing India's middle-class households with low-cost environment-friendly transportation. The experience of other countries shows that sustaining sales momentum after withdrawal of subsidies is challenging.

A shift to electric mobility is essential for India – think of our high petroleum imports, and the adverse impact on trade balance and foreign exchange, to speak nothing of the impact on our environment – and only a holistic approach will help us make the transition. We need to balance factors like supply chain localization, charging infrastructure, financing, etc to support our EV adoption goal.

The adoption of EVs also contributes to a wide range of sustainability goals, including better air quality, reduced noise pollution, enhanced energy security, and reduced greenhouse gas emissions, among others.

Weaning consumers away from subsidies should be gradual and closely aligned with consumer mindset and the readiness of the overall E2W ecosystem to absorb the loss.

With just nine months remaining for the FAME-II scheme to expire, the June results are either an early warning sign from extremely price-sensitive buyers willing to desert the market, or as a moment of hesitation before convinced customers take the plunge.

Data for the coming months will reveal which it is, so this third quarter is crucial.

-- Gurusharan Dhillon,

Director, E-mobility Services,

Customized Energy Solutions

Read More