Rivian Automotive raised full-year production estimates to 52,000 vehicles and proclaimed it was financially stable, bringing some cheer to the troubled US EV sector. Rivian, backed by Amazon, had just above $9 billion in cash as of the second quarter, which CEO R J Scaringe said was sufficient to tide till 2025. The company has been investing in production to catch up with Elon Musk-led Tesla, which launched a price war earlier this year.

China's Li Auto, founded in 2015, announced it will launch its first pure battery electric model, "MEGA" towards the end of this year. The luxury car maker said it expects the model to become the top-selling vehicle in China among vehicles priced above 500,000 yuan ($70,000) across all types of automotive fuels. CEO Li Xiang said the company is also aiming for the top spot as in the premium market, eyeing sales of 40,000 units a month.

Lithium miner Piedmont faced intense and angry scrutiny from North Carolina officials over its plans for an open-pit lithium mine in the US state. The project, if approved, would be one of only a handful lithium production sites in the US. Piedmont plans to supply the metal to Tesla for use in its EV batteries; the deal was first signed in 2021 but paused after Piedmont discovered the metal at a mine in co-owned in Quebec, Canada.

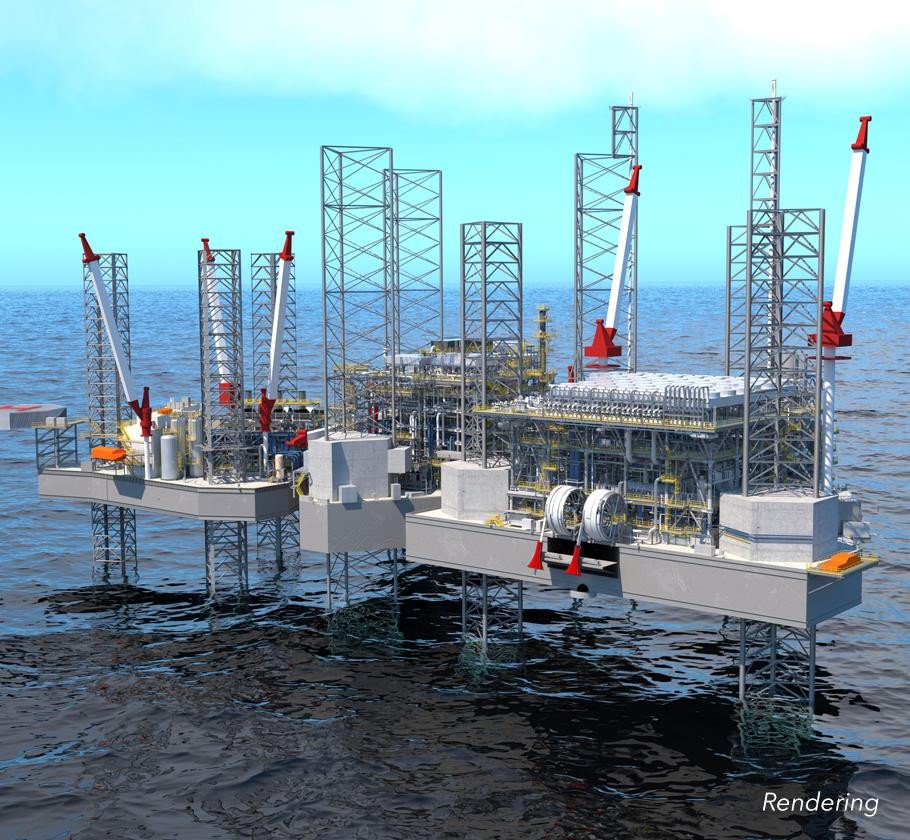

New Fortress Energy announced that the first of its three planned floating LNG plants in Mexico will start operations in September. The US company has tied up with Mexican state-owned utility CFE to build a $1.3 billion hub in Altamira for export of LNG. The second and third rigs are expected to come on stream in October. Once fully operations, the facility will have capacity of 1.4 million metric tons of LNG per year.

Is Exxon eyeing lithium? Reports of oil company in talks with Tesla, VW and Ford to supply the metal

Read More