In many ways, this year was the tipping point for renewable energy. The world has woken up to the imperative of energy transition, and countries around the world have made progress on this front, albeit in different degrees. We take stock of their situation in this multi-part series.

Energy Storage

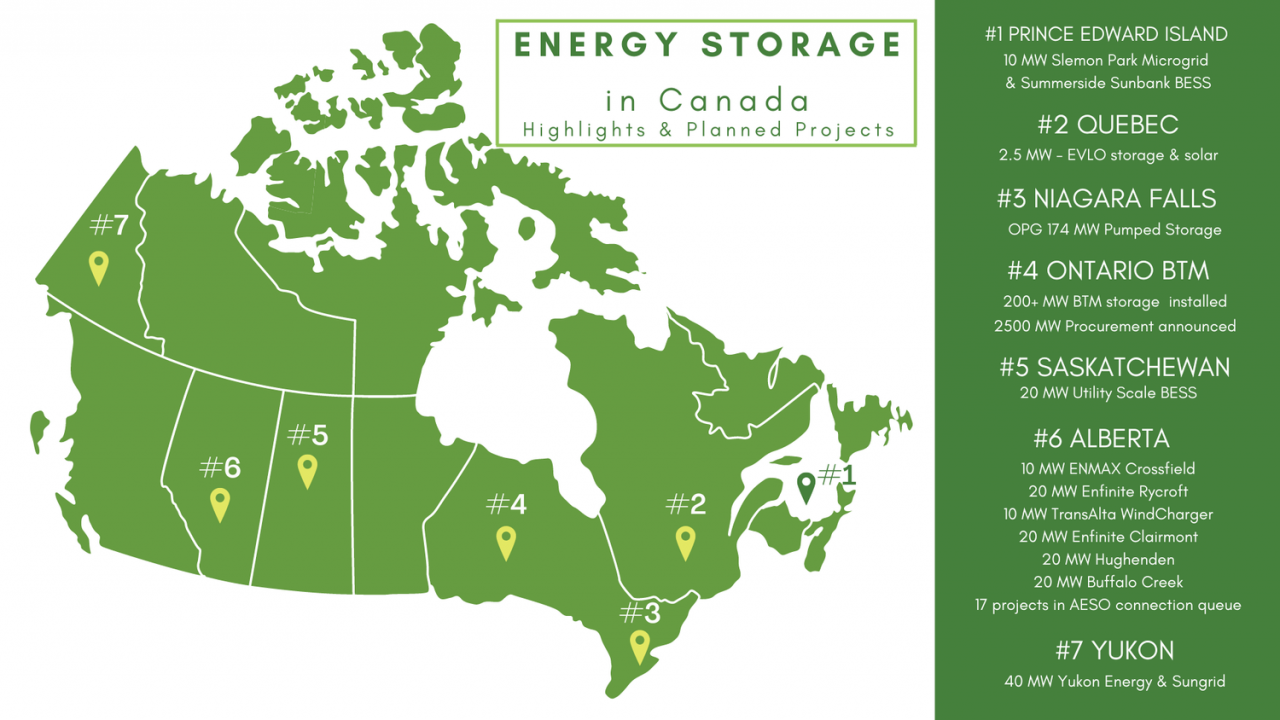

Canada's energy storage market has built up momentum, but there is still a long way to go. Estimates show the country will require at least 8-12 GW of energy storage to achieve its 2035 climate targets, against the current national energy storage capacity of under 1 GW.

Canada has undertaken several measure to attract clean energy investments. In November 2022, the country announced a 30 percent Clean Technology Investment Tax Credit. In 2023, the government introduced a 30 percent Clean Technology Manufacturing Credit and a 15 percent Clean Electricity ITC as well.

In July, the country became the first among the G20 nations to publicly declare a process for winding down subsidies to fossil fuels, in line with a pledge the grouping took in 2009.

All this is good news for companies in Canada, because the country's dependence on technological breakthrough is low: the Canadian Climate Institute estimates that 66 percent of the emission reductions required for its 2035 goals can be achieved by integrating existing technologies.

Experts opine the country needs to start focusing on long-duration energy storage assets, i.e. assets that can store large amount of electricity for hours or days and includes technologies such as pumped hydro, emerging battery storage, thermal storage and compressed air. Some of these projects are already up and running, while others are under development and expected to come online next year.

Province-wise updates

Canada has identified energy storage potential in all its provinces. Some major updates:

•In October, the Ontario state government announced one of largest competitive energy storage procurements in North America at 2.5 GW of capacity

•The 250 MW Oneida Energy Storage project in Ontario achieved financial closure in May this year

•The province of Alberta has 100 MW capacity already installed and has a prospective pipeline of more than 2,500 MW

•Fredericton-based NB Power has sought proposals for setting up of 50 MW energy storage capacity in the provinces of New Brunswick and Nova Scotia

Canada major energy storage projects

1. Sir Adam Beck Pump Generating Station

The Sir Adam Beck Pump Generating Station is a 175 MW pumped hydro station built in 1957 off the Niagara Falls in Ontario. The station uses electricity during off-peak hours to pump water into a 750-acre reservoir, which is released to produce power when demand is high. The only facility of its kind in Canada, the station displaces up to 600 MW of fossil fuel-based power generation for nearly eight hours.

In April 2016, the reservoir underwent a $60 million refurbishment that extended its operating life for 50 years.

2. Sunnynook Battery Energy Storage

Sunnynook is a 100 MW battery storage project and a 236 MW solar PV project in Alberta, Canada. The project is operated by Westbridge Energy Corp and expected to start operations in 2024.

3. Ontario Advanced Compressed Air Energy Storage Facility

The Ontario Advanced Compressed Air Energy Storage Facility is a 300-500 MW compressed air energy storage facility in Toronto, Ontario. The project is developed by Hydrostor, a leading global developer of such storage. The project is currently in conceptual design stage and likely to become operational in 2024.

4. Edmonton Hydrogen Plant

The Edmonton Hydrogen Plant is based in its namesake city in the province of Alberta. EHP will produce blue hydrogen using natural gas removed from Shell's Scotford facility through carbon capture technologies. The complex will include a hydrogen-fueled power plant and a liquid hydrogen facility.

The project will turn operational in 2024 and generate over 165,000 tonnes of hydrogen annually in its first phase, with possibility of capacity expansion depending on demand.

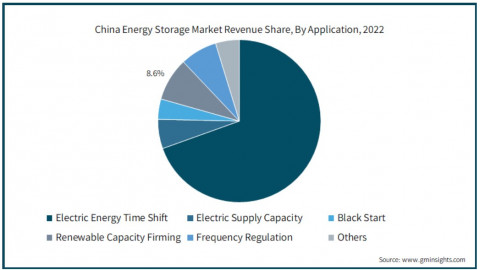

No looking back: Energy transition in China

E-mobility

Canadian policy calls for 100 percent Zero Emission Vehicles (ZEVs) by 2035 and at least 50 percent ZEVs by 2030, driven by the country's Zero Emission Vehicle Infrastructure Program (ZEVIP) program.

ZEVIP is a $680 million plan through which the Canadian government seeks to fund EV charging stations and hydrogen refueling stations across the country, thereby overcoming a key barrier to ZEV adoption — the shortage of 'refueling' infrastructure. The program will last until 2027. Additionally, car buyers can avail rebates of C$5,000 on battery EVs or plug-in hybrids having an electrical range of 50 km or more, while plug-in hybrids with electric range up 50 km or lower qualify for rebate of C$2,500.

Even EV and hybrid lessors can avail the incentives, although the full amount can only be availed by people leasing the vehicle for 48 months, with leases of up to 12 months duration or longer qualifying for pro-rata benefits.

Canada's EV market records sales of 120,000 vehicles a year, and the country has slightly more than 13,000 charging stations. Experts forecast the EV market will touch $7.13 billion in 2023, and double to $14.65 billion by 2028. Annual vehicle sales are expected to double to 250,000 vehicles by that year.

Canada aims to be a global hub for automotive and battery companies and has been seeking large anchor investments in the battery material processing and cell manufacturing space since 2022, as part of an attempt to shift to a net-zero economy while adding skilled jobs.

The attempts have paid dividends: Canada has attracted GM-POSCO Chemicals' Ultium CAM, a maker of key battery components, Volkswagen Group's battery company PowerCo, and a Stellantis-LG Energy combine, among others. However, the country faces competition from the US, where incentives under the Inflation Reduction Act have forced Canada to amend its own sweeteners. Earlier this quarter, the country had to enhance subsidies to a Stellantis-LG Energy Solution battery plant after the consortium halted construction and threatened to shift the factory to the US where it was receiving better terms.

Green Hydrogen

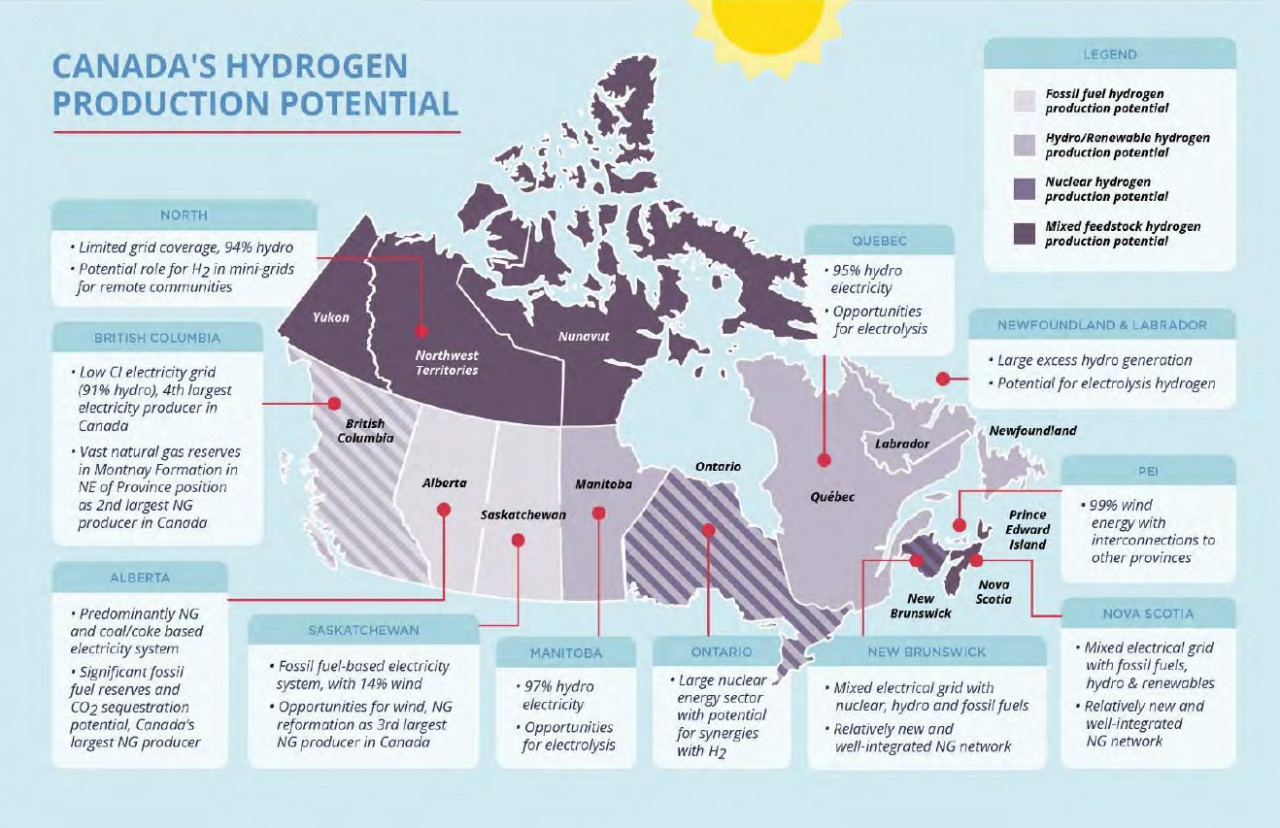

Canada has identified development of an at-scale, clean hydrogen economy as a strategic priority, and the government notes this will require a radical transformation of the country's energy system.

At the national level, the country is rich in feedstocks such as water, electricity, fossil fuels and biomass. The government aims to marry this with a skilled labour force and strategic energy assets to become a top global producer of clean hydrogen.

Government estimates show hydrogen could supply up to 30 percent of the country's end-use energy requirements by 2050, and integrating the fuel into Canada's economy abate up to 190 megatonnes of CO2-equivalent greenhouse gases that would otherwise be released through sectors such as transportation, power generation, heating and industry.

Canada estimates the global hydrogen market could reach over $11 trillion by 2050, and each region of the country could produce and deploy hydrogen for domestic and export use. The country has identified Europe, Asia, and the US as potential export markets.

Closer home, the country's Hydrogen Strategy expects to create a $50 billion domestic hydrogen sector and generate more than 350,000 high paying jobs.

Three key aspects of Canada's hydrogen strategy are 1) the development of signature projects, large-scale capacities that can be highlighted and promoter globally, 2) creation of a domestic market, that will support and build up the industry so that it can take advantage of overseas opportunities, and 3) ensuring low carbon intensity, to ensure production has the lowest environmental impact.

Canada can use its extensive natural gas pipeline network, combined with new storage and distribution assets, to move hydrogen from production to end-use locations.

Key hydrogen news to emerge from Canada are:

- Canada began using the Coradia iLint, the world's first passenger train to be powered by hydrogen, in the Charlevoix region of Quebec. The train, designed by French company Alstom, runs on electricity produced by mixing hydrogen with oxygen, creating moisture as a waste product.

- The government of Alberta announced $45 million in investments to two hydrogen funding competitions that aim to develop power new hydrogen technologies for use in production, transmission and distribution, storage, and in industries like heavy-duty transportation, industrial heat and chemicals.

- The province of Newfoundland and Labrador selected four companies to develop wind farms that will supply power for new green hydrogen plants. EverWind NL, Exploits Valley Renewable Energy Corp, ABO Wind and World Energy GH2 can apply to use government land for the wind farms, which could help Canada meet its pledge of suppling green hydrogen to Germany by 2025.

To see other articles in this series, click here.

No looking back: Energy transition in Japan, South Korea and the Philippines

Read More