World Economic Forum's latest report titled "Enabling Measures: Roadmap for Low-Carbon Hydrogen Middle East and North Africa" dated 20th December has assessed the hydrogen readiness of the MENA region by identifying six 'high-potential' countries for the development of low-carbon hydrogen production ecosystem. The countries include Morocco, Egypt, Qatar, Oman, Saudi Arabia (KSA), and the United Arab Emirates (UAE).

The hydrogen readiness was assessed by evaluating the countries' hydrogen opportunity, ambitions and strategies against the six barrier framework under WEF 'Accelerating Clean Hydrogen Initiative' to capture the need for enabling measures to accelerate development.

Acknowledging MENA region's emerging position in the global hydrogen market, the report notes that the region's hydrogen and derivatives exports could represent 21 percent of the global export market by 2050. The region with a modest 4 percent of global GDP and 6 percent of the global population holds a substantial 13 percent of global hydrogen investments and 8 percent of projected global hydrogen production capacity by 2030.

'Low-carbon hydrogen', as mentioned in this report, includes blue hydrogen (produced with natural gas abated by CCUS), green hydrogen (produced through electrolysis), and pink hydrogen (produced through nuclear).

COP28: Countries agree on deal called 'the beginning of the end of fossil fuels'

Morocco

According to the WEF report, the dependency on fossil fuel imports have driven a strong development of renewable energy with 4.6 GW already installed. The low-carbon hydrogen strategy of producing up to 30 TWh (~ 0.9 Mtpa) of green hydrogen by 2030 includes scenarios for pipeline exports to Europe, shipping, aviation, decarbonizing Morocco's leading fertilizer sector and other new applications.

The country, seen as a gateway linking sub-Saharan Africa and Europe through electricity transmission interconnections and hydrogen pipeline transports along the Atlantic Coast, is emphasizing on low-carbon hydrogen not just for exports but also for boosting its local economy, with attention to high-value industry applications such as fertilizers, chemicals, and potentially steel production to diversify the economy.

The report mentions Masen and OCP as flagship players in Morocco in the hydrogen space. To attract private investments the soon to be announced Offre Maroc will further create an attractive hydrogen investment climate, it adds.

EIB study confirms €1 trillion Africa's Green Hydrogen potential by 2035

Egypt

The most populous country in the region with a population over 111 mn people, Egypt aspires to capture 8 percent of the global hydrogen trade by 2040, representing up to 10 Mtpa of renewable hydrogen. A staggering $83 bn of low-carbon hydrogen projects are being explored in the feasibility stage, a majority to be located in the Suez Canal Economic Zone.

Given the country's unique positioning global maritime trade passing through the Suez Canal, the report observes that Egypt could play a major role in the low-carbon hydrogen and ammonia fuels market for both the energy trade and maritime shipping specifically through sustainable fuel initiatives.

Egypt's green hydrogen outreach paying off in a big way

Oman

As of 2023, Oman is lauded by the report for having the most advanced regulatory framework, strategy, and project development policies for hydrogen in the MENA region. The country envisions to become the largest exporter of green hydrogen by 2030 with a production of up to 1.15 Mtpa, with 50,000 km² of land dedicated for hydrogen project development.

Project development in the country is coordinated by Hydrom, Oman's national leading entity responsible for strategy execution. The strategy focuses on exporting hydrogen to both Asia and Europe and also includes decarbonization strategies for existing demand representing 1.1 Mtpa, according to the WEF report.

Oman plans for liquid green hydrogen corridor with Netherlands

Saudi Arabia

The Kingdom of Saudi Arabia represents the largest economy of the Arab League, housing the largest oil and gas production facilities and a vast renewable energy potential. As such, the country is particularly well-positioned to play a key role in the low-carbon hydrogen economy, including export, decarbonization and new applications plays.

The report mentions the 4 GW NEOM Green Fuels Hydrogen project which has already reached FID, and the Northern blue hydrogen and ammonia projects from Saudi Aramco, which leverage key existing ports including Yanbu and Jubail. The country aims to produce 2.9 Mtpa of low-carbon hydrogen by 2030.

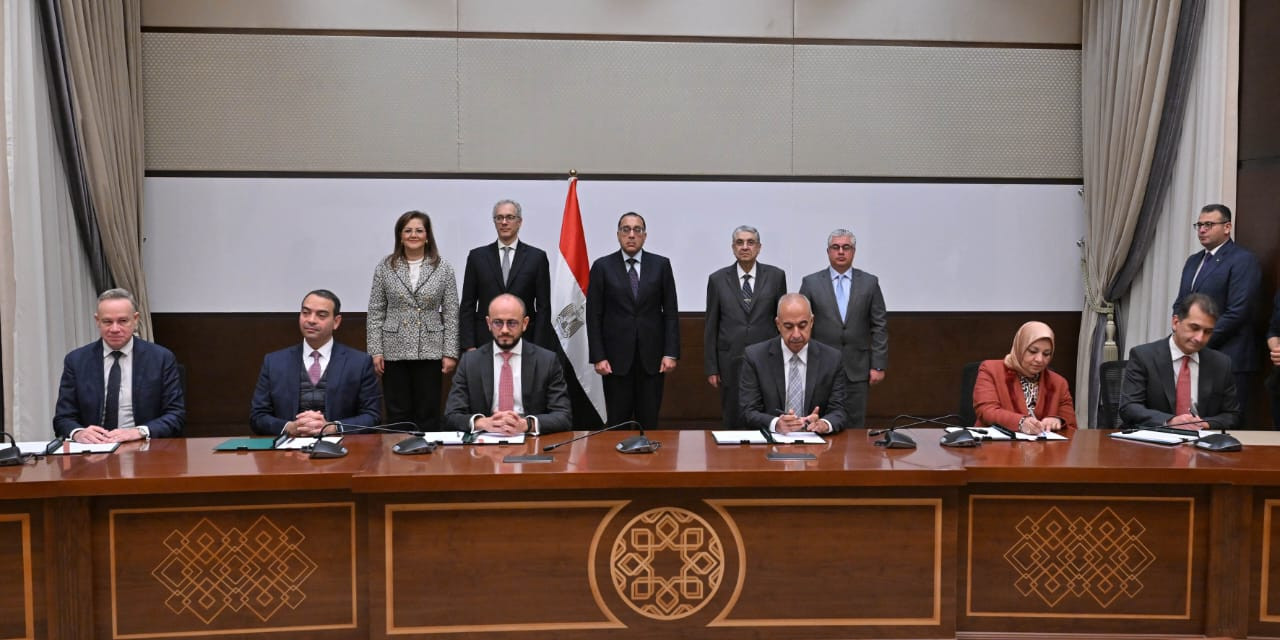

Saudi Arabia's Acwa Power, Egypt seal $4 billion green hydrogen deal

UAE

The country is capitalizing on a mature oil and gas ecosystem, strong renewables capacity, historic domestic industries, and existing export infrastructure to develop hydrogen ecosystem, claims WEF. Policy ambitions of producing 1.4 Mtpa by 2031 and 7.5 Mtpa by 2040 of low-carbon hydrogen include ammonia-based export plays to Europe and Asia, with new application strategies in hydrogen hubs, executed by major largely state-owned leaders such as ADNOC, Masdar, Mubadala and TAQA.

Low-emission hydrogen production set to more than triple by 2026: IEA report

Read More