Daily Shorts: Bridgepoint buys energy investment firm, Indonesia's PLN looks to shift from coal

Asset fund manager Bridgepoint announced an agreement to buy energy investor Energy Capital Partners for $1.05 billion, and said the deal would be accretive to profit from day of closing. ECP invests across energy transition, electrification and de-carbonization infrastructure, including power generation, renewables and storage. Bridgepoint, which mainly invests in private equity and private debt, handles more than $40 billion across Europe, the US, and China.

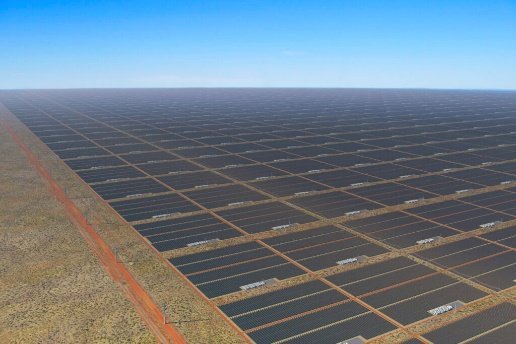

Indonesian state utility PLN announced plans to add 32 GW of renewable energy capacity, its CEO said. The company also plans to invest in grids to connect to more renewable power sources, as part of efforts to reduce reliance on coal. Indonesia depends on coal to generate half of its power, while renewables contribute 14 percent to its energy mix. Under its 2021-2030 expansion plan, renewables will account for 51 percent of capacity additions.

Colombia deferred its first-ever auction of offshore wind farms sites, without intimating a new date for bidding. The Latin American country depends on oil for a major chunk of its income, but President Gustavo Petro has been pushing for a domestic transition to renewable energy sources. In a statement, authorities said some 90 percent of documents for the tender had been created, but did not say why the process was delayed. Earlier this month, a US offshore tender in the Gulf of Mexico due lukewarm response.

Poland's Orlen Group announced a decision to join and operate the Polaris carbon storage project in the Barents Sea, owned by Horisont Energi. Under the deal, an Orlen subsidiary will acquire up to 50 percent in the Polaris licence and become operator of the project around December, the companies said. Polaris has capacity to store up to 100 million tonnes of CO2, and the first carbon injections could start in late 2028 or early 2029.