No looking back: Energy transition in Europe, the UK

In many ways, this year was the tipping point for renewable energy. The world has woken up to the imperative of energy transition, and countries around the world have made progress on this front, albeit in different degrees. We take stock of their situation in this multi-part series.

EUROPE

Energy Storage

The momentum toward a clean energy economy has been accelerating globally since 2022. A similar trend was witnessed in Europe.

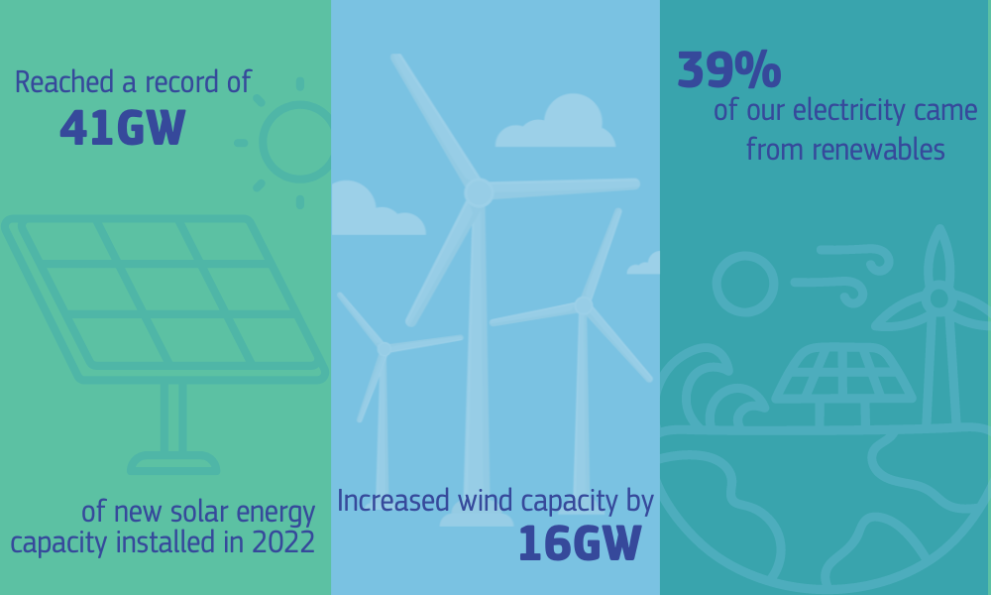

The share of renewable energy in the EU is estimated to reach around 69 percent by 2030 (from 39 percent in 2022). Acknowledging the crucial role played by energy storage in providing necessary system flexibility and stability, in March 2023, the European Commission published a series of recommendations and key actions to ensure greater deployment of energy storage in the region.

The Commission's recommendation estimates the demand for flexibility in the electricity system will increase significantly across all European countries by 2030, reaching 24 percent of total electricity demand, or 288 TWh.

Studies estimate the EU will require more than 200 GW of energy storage capacity by 2030 (from about 60 GW in 2022, mainly in the form of pumped-storage hydro power). As per International Energy Agency (IEA), grid-scale battery storage capacity is fast picking up globally, and the same is true for Europe as well.

Consultancy firm LCP Delta estimates that in 2022, some 1.9 GW of grid-scale battery storage was deployed across Europe. Of this ~85 percent was spread across just four nations: the UK, Ireland, Germany, and France. The consultancy further forecasts 3.7 GW capacity to come online in 2023, nearly 100% year-on-year growth (LCP Delta).

Additionally, the EU's landmark REPowerEU plan, passed in response to Russia's invasion of Ukraine and the subsequent disruption in energy markets, sets ambitious RE targets to reduce the continent's reliance on gas from Russia, further accelerating the region's transition to clean energy.

Though studies indicate that the US and China will remain the two largest energy storage markets, representing over half of global installations by the end of 2030, Europe, with its significant ramp-up in capacity fuelled by a new policy push, will see significant utility-scale storage additions from 2025 onwards.

BESS Deployment Trends in the European Union:

- According to a report published by consulting firm LCP Delta, 170 grid battery storage projects came online in 2022, accounting for 1.9 GW grid-scale battery energy storage deployment in the region.

- Great Britain, Germany, Greece, Ireland and Italy remain the five most attractive markets for battery storage in Europe.

- Studies indicate Greece remains an attractive market on account of its ambitious deployment target of 6 GW of battery storage by 2030 – the highest in Europe.

- Other countries in the region that have set ambitious target including Italy. It has set a target to install 3 GW of long-duration batteries by 2030.

- Studies indicate that 14 of the 24 EU countries do not have a national strategy or targets for energy storage deployment yet.

- More recently (June 2023), the European Commission approved a €1.1 billion scheme from the government of Hungary to support large-scale energy storage projects. Hungary is looking at installation of at least 800 MW/ 1,600 MWh of new energy storage projects through the scheme.

Notable Energy Storage Projects announced in 2023

- Harmony Energy brought its 196 MWh Pillswoods BESS project online in Yorkshire, Northern England in March this year. It is the largest BESS project in Europe (by MWh).

- Two 100 MWh projects in Belgium were commissioned. First one (50 MW/ 100 MWh) from developer Corsica Sole in December 2022. Another (25 MW/ 100 MWh) from Nippon Koie-Aquila Clean JV in March 2023.

- Enel is expected to begin construction of 1.6 GW of battery storage projects in Italy.

- Aura Power is working on a >1 GW pipeline in Italy.

- Matrix Renewables has partnered with others to develop 1.5 GW of projects.

- Eku Energy partnered with a local developer to create a 1 GW pipeline.

- TotalEnergies at its Antwerp refinery in Belgium launched a battery farm project for energy storage. The 25 MW/ 75 MWh capacity project will be operational in 2024.

E-mobility

The size of EV fleets grew across segments of road transport globally. In Europe, too, EV sales in 2023 surged due to a combination of factors such as policy support, developments in battery technology, EV charging infrastructure, and launch of new EV models.

As per the Global EV Outlook 2023 (IEA) more than 10 million electric cars were sold worldwide in 2022 and Europe remained the world's second largest market for electric cars after China, accounting for 25 percent of all electric car sales and 30 percent of the global stock. In Europe, the sales share of electric cars reached 21 percent in 2022, up from 18 percent in 2021.

Electric car adoption among European countries was led by Norway, Sweden, the Netherlands, Germany, the United Kingdom, and France. In volume terms, Germany is the biggest market in Europe with sales of 830,000 electric cars in 2022, followed by the United Kingdom with 370,000 and France with 330,000. However, it is important to note that electric car sales decreased in Italy, and decreased/ stagnated in Austria, Denmark and Finland.

As Europe has witnessed a surge in electric-car demand, the focus is now on electrification of other vehicle segments such as heavy-duty trucks and buses. Within Europe, the sales share for electric buses was highest in Finland (where electric buses made up two-thirds of sales in 2022), Norway and the Netherlands (where they made up nearly half of sales), and Denmark (nearly one-third of sales). Sales shares were also high in Sweden and Switzerland.

Further, Europe has pledged to achieve 100 percent ZEV bus and truck sales by 2040 and proposed stronger emissions standards for heavy-duty vehicles.

The sale of electric light commercial vehicles (e-LCVs) also continued to increase in the region, and grew substantially in the Nordic countries, with sales share in Norway reaching 25 percent, Iceland 16 percent and Sweden 13 percent.

Supportive policies encouraging EV adoption in Europe can be traced back to the Green Deal Industrial Plan which has four pillars related to progress on net zero-related projects: faster permitting, financial support, enhanced skills, and open trade. The plan also includes provision for the creation of a Critical Raw Materials Act, the proposal for which was issued in March 2023, with a focus on security of supply, extraction and environmental standards, as well as recycling.

In April 2023, the European Union adopted the 'Fit for 55' climate protection law with the intention of aligning current EU laws with its 2030 target of cutting greenhouse gas emissions by at least 55 percent in 2030 compared with 1990 levels. A key component of 'Fit for 55' is that it states all new cars or vans placed on the market in the EU from 2035, whether manufactured in the EU or imported, must be zero-emission vehicles.

Additionally, in EV-related policymaking, EV supply chains and battery manufacturing are increasingly being prioritized to build resilience through diversification. The Net Zero Industry Act, proposed by the EU in March 2023, aims for nearly 90 percent of the European Union's annual battery demand to be met by EU battery manufacturers, with a manufacturing capacity of at least 550 GWh in 2030.

In terms of charging stations, globally more than 600,000 public slow charging points were installed in 2022. Europe ranks second, with 460,000 total slow chargers in 2022, a 50 percent increase over the previous year. The Netherlands was the leading country in Europe with 117,000 charging stations, followed by around 74,000 in France and 64,000 in Germany.

Europe's overall fast charger stock numbered over 70,000 as of 2022, an increase of around 55 percent compared to 2021. The countries with the largest fast-charger stock are Germany (12,000+), France (9,700+) and Norway (9,000).

Further, EU countries have shown strong interest in developing public charging infrastructure across the region as indicated in the Alternative Fuels Infrastructure Regulation (AFIR), which will set electric charging coverage requirements across the trans-European network-transport (TEN-T). By end of 2023, the European Investment Bank and the European Commission will make over €1.5 billion available for alternative fuels infrastructure, including electric fast charging.

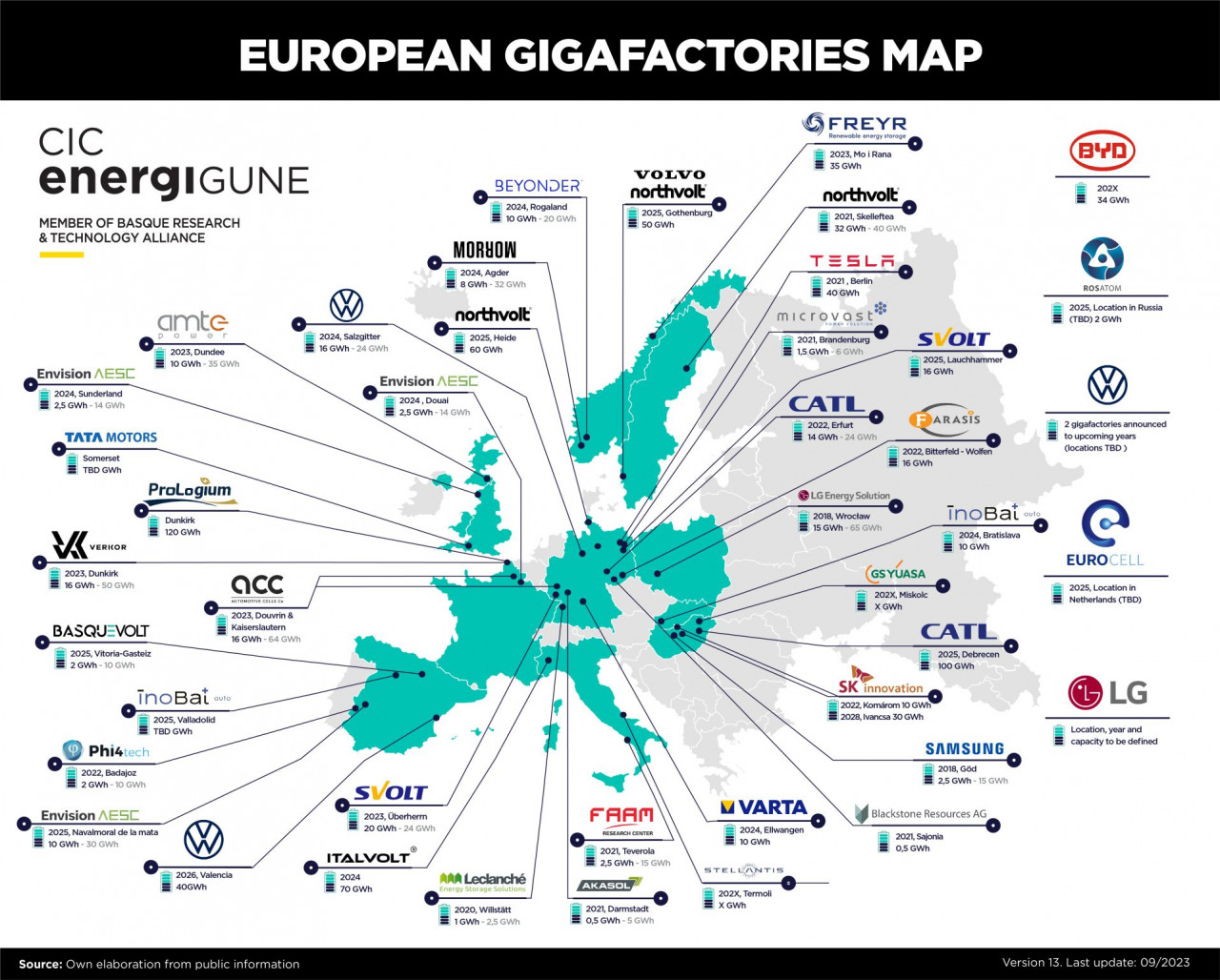

With European countries looking to develop battery supply chain, several new giga factories were announced across the region in 2023. Notable ones include:

- Taiwanese battery manufacturer ProLogium announced it will set up a solid-state battery gigafactory in Dunkirk, France. The 48 GWh facility will begin production in 2026.

- Swedish startup NorthVolt announced plans to set up a plant in Heide, Germany.

- Chinese battery supplier EVE Battery announced a plant in eastern Hungary.

- Tata Group announced a £4 billion giga factory in the UK. The 40 GWh facility is due to begin production in 2026.

- Nissan is scouting locations for two battery gigafactories in Europe and is trying to gain support from the UK government to expand its plant in Sunderland, run by AESC.

- Panasonic still has to announce a location for its battery gigafactory in Europe that was announced in 2020.

Green Hydrogen

The European Union has been rapidly implementing policies that will accelerate the production of and use of renewable hydrogen. In June 2023, the EU adopted two Delegated Acts that define renewable hydrogen in the EU. The first one covers renewable fuels of non-biological origin and sets the criteria for products that fall under the 'renewable hydrogen' category. The other one puts forward a detailed scheme to calculate the life-cycle emissions of renewable hydrogen and recycled carbon fuels to meet the greenhouse gas emission reduction threshold set in the directive.

The Green Deal, Fit for 55 policy package and its subsequent REPowerEU plan are some of the other policy measures through which the EU is accelerating the production and use of renewable hydrogen and hoping to emerge as a frontrunner in the global race towards a hydrogen economy.

The current hydrogen demand in Europe is about 8.7 million metric tons annually, as this is predominantly satisfied by grey hydrogen production (99.9%), greening the existing hydrogen value chains serves as an important steppingstone toward achieving the ambitious target of 10 million metric tons of renewable hydrogen production. And further 10 million metric tons renewable hydrogen import by 2030, totalling 20 million metric tons of renewable hydrogen use in 2030.

Last year, the European Commission also approved funding for the first two waves of hydrogen-related Important Projects of Common European Interest (IPCEI) in 2022. In September 2022 (following the first 'IPCEI 'Hy2Tech' in July 2022) the European Commission approved up to €5.2 billion of public support by 13 member states for the second 'IPCEI Hy2Use' in the hydrogen value chain.

Hy2Use focuses on projects that are not covered by Hy2Tech, namely hydrogen-related infrastructure and hydrogen applications in the industrial sector while Hy2Tech focuses on end-users in the mobility sector.

Like the first, the second IPCEI will support research and innovation, industrial deployment and construction of relevant infrastructure in the hydrogen value chain. IPCEI Hy2Use covers a wide part of the hydrogen value chain by supporting:

(i)The construction of hydrogen-related infrastructure, notably large-scale electrolyzers and transport infrastructure, for the production, storage, and transport of renewable and low-carbon hydrogen; and

(ii)The development of innovative and more sustainable technologies for the integration of hydrogen into the industrial processes of multiple sectors, especially those that are more challenging to decarbonize, such as steel, cement and glass.

In March 2023, the European Commission outlined new plans to stimulate and support investment in sustainable hydrogen production through a European Hydrogen Bank.

Notable hydrogen projects announced in 2023:

- HyDeal Ambition (Spain, France, Germany) – The project aims at producing 3.6 million tons of green hydrogen in 2030 with 95 GW of solar and 67 GW of electrolyzer capacity, in an integrated upstream, midstream, and downstream system spanning from Spain to France and Germany. It has been ranked by the International Renewable Energy Agency (IRENA) in a January 2022 report as the world's largest green hydrogen project.

- Iberdrola Hydrogen (UK) – The project is currently being built in Felixstowe, the UK's largest port, to supply green hydrogen to vehicles and machinery. The project's first phase, set to begin operations in 2026, will have capacity to produce 14,000 tons of hydrogen per year via electrolyzers.

- HyVal by bp – British Petroleum (bp) launched the green hydrogen cluster in the Valencia region (HyVal) in February 2023 at its Castellón refinery. The public-private collaborative initiative is intended to be based around the phased development of up to 2 GW of electrolysis capacity by 2030 for producing green hydrogen at bp's refinery.

- Plug's PEM Deal - Plug Power secured an order for 100 MW of proton exchange membrane (PEM) electrolyzers. The largest announced project in the oil and gas sector in Europe.

- Innovation Fund – In July 2023 the European Commission would award a combined €3.6 bn to 41 low-carbon technology projects — more than half of which are dedicated to green hydrogen production, its derivatives such as methanol and ammonia, or scaling up electrolyser and fuel-cell manufacturing. In combination with previous electrolyser projects that received grants via the Innovation Fund, this covers 11 percent of the 100 GW electrolyser production capacity targeted for 2030 in the proposed Net Zero Industry Act.

To see other articles in this series, click here.

Energy Storage

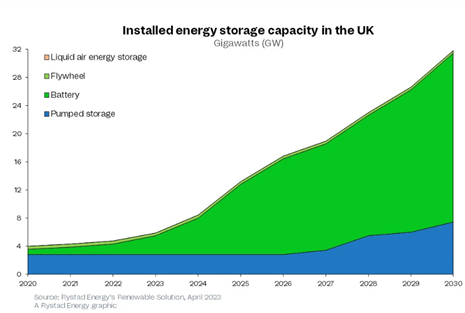

The UK has emerged among the top countries in terms of deployed energy storage.

The UK has 4.7GW of installed energy storage capacity (Rystad Energy) of which BESS account only for 2.1GW and most of the current capacity comes from pumped hydro storage.

Energy storage is a high priority for the UK government and a key component of its net-zero strategy. In keeping with that, the UK government has set ambitious energy storage requirement targets, eyeing 30 GW of capacity by 2030, which include batteries, flywheel, pumped hydro and liquid air energy storage.

Further, to boost energy storage project deployment, in 2020, a legislation was passed allowing local planning authorities to determine projects with a capacity of over 50MW in England and 350MW in Wales previously determined by the central government-- making the process long-drawn and more complex.

Further, the UK's Department of Business, Energy and Industrial Strategy (BEIS) gave permission to InterGen to build the country's largest battery energy storage facility to date at on the Thames Estuary in Essex. The £200 million project will see InterGen build a 320 MW / 640 MWh lithium-ion battery site, making it 10 times larger than the largest currently operational battery in the UK. The facility is expected to come online in 2024.

Few of key developers of UK energy storage projects include EDF, Pivot Power, Statera, and RES, providing services to National Grid, Distribution Network Operators (DNOs), as well as operating in the wholesale energy markets.

Notable BESS projects and players in the UK - 2023

- Intergen, based in Edinburgh, has two large-scale BESS projects totaling 820 MW, including the Gateway project. The InterGen project is a 320 MW / 640 MWh lithium-ion battery energy storage project at Gateway Energy Centre on the banks of the River Thames in Essex. The project is more than 10-times the size of the UK's largest operational battery project and is set to be one of the world's largest. It will provide fast-reacting power and system balancing to support the ongoing growth and integration of renewable energy sources and is a significant piece of system architecture critical to the UK's transition to net-zero. Facility will come online in 2024.

- UK company Alcemi has emerged as the market leader with 3.3 GW of capacity in the pipeline. The company is developing several projects ranging from 300MW to 1GW. Around 2 GW of its BESS projects are currently at the application stage, and another 1.3 GW are under the pre-application/concept stage. In 2022, the company partnered with Copenhagen Infrastructure Partners to build around 4 GW of energy storage projects in the UK.

- Zenobe, another UK-based company, takes second place in the UK's BESS project pipeline with over 1 GW of projects under different stages of development.

E-mobility

Electric vehicle adoption has been growing in the United Kingdom due to the strong consumer momentum and ambitious government target. Electric vehicle sales (battery; plug-in and hybrid) accounted for more than 50% of total UK vehicle sales during the first quarter of 2023, according to PwC's Electric Vehicle Sales Review for Q1 2023.

The research states that 264,046 EVs sold in Q1 2023. Of this, hybrid EVs were the most preferred choice for UK motorists, totaling 32% of all EVs sold, followed by battery at 15% and plug-in 6%. Hybrid EVs being the preferred choice in the UK above fully electric BEV models point to some areas that need to be addressed by the government such as UK charging infrastructure and range anxiety felt by current and potential EV motorists.

In another study, a third of respondents in six European countries – the UK, France, Switzerland, Belgium, Sweden and the Netherlands - reported that there were no charging stations for electric cars within 3 km of their homes (OECD's 2022 Environmental Policies and Individual Behaviour Change Survey).

Other studies suggests that range anxiety and other concerns about electric car use largely dissipate when a vehicle owner makes the switch to an electric car.

However, acknowledging the need to address the issue of range anxiety, the UK government is currently building a robust EV charging infrastructure with one of the most extensive network of rapid charger in Europe. In March 2022, the Department of Transportation released the "Electric Vehicle Infrastructure Strategy", backed by £1.6 billion funding, to boost on-street EV charging by 10-fold and eradicate concerns over 'range anxiety' across the UK.By 2030, the UK expects to reach 300,000 public electric vehicle charge points – equivalent to almost 5 times the number of fuel pumps on the UK roads at present.

In battery manufacturing, there will be demand for 10 UK-based giga factories (large, high volume battery manufacturing facilities) by 2040, each producing 20 GWh per year of batteries (UK Electric Vehicle and Battey Production Potential to 2040, by The Faraday Institution, June 2022). The UK established the first European battery factory in 2012 but there after it has slowed down in the race to secure the next generation of battery factories.

Currently there is only battery plant in the UK announced by Nissan and Envision AESC in 2021, after the plans of Britisvolt to build its first giga factory in the UK near the Port of Blyth in Northumberland failed due to insufficient funding.

While the rising energy cost and complex supply chains are making it difficult for battery manufacturers to operate in the UK, efforts are underway by the government to attract more gigafactories to the UK, develop a resilient, sustainable and efficient supply chain, build up skills capability and secure the future of the UK EV industry.

Notable giga factory announcements in the UK – 2023

- Tata Group's announced £4 billion ($5.2 billion) giga factory in the UK. The 40 GWh facility is due to begin production in 2026.

- Nissan is trying to gain support from the UK government to expand its plant in Sunderland, run by AESC.

- Among recent industry developments, UK PM Rishi Saunak in September this year announced that UK would be pushing back the phase-out of gas and diesel-powered vehicles from 2030 to 2035 citing reasons of grid readiness and cost to consumers and businesses. This decision was met with criticism by the industry as well as environmental groups in the UK. The industry contended this move will dissuade people from buying EVs and affect the EV charging sector as well as EV manufacturers.

Green Hydrogen

In August 2021, the UK Government launched 'Hydrogen Strategy' its first-ever vision to kick start a world-leading hydrogen economy. As a part of its Hydrogen Strategy, the UK Government announced that it will work with the industry to meet its ambition for 5 GW of low carbon hydrogen production capacity by 2030 as well as for powering transport and businesses, particularly heavy industry.

In April 2022, the government launched British Energy Security Strategy, and doubled its ambition from 5 GW to up to 10 GW of low carbon hydrogen production capacity by 2030, subject to affordability and value for money, with at least half of this coming from electrolytic hydrogen.

To support industry and the upfront cost of developing and building low carbon hydrogen production projects, the UK government opened the world's first national clean-hydrogen subsidy scheme in July 2022. The scheme uses a contracts-for-difference (CfD) style set-up to fund projects and is expected initially fund 1 GW of green hydrogen and 1 GW of blue hydrogen projects.

Key Government Initiatives in the UK

A £240 million Net Zero Hydrogen Fund to support the deployment of new low carbon hydrogen production plants, and a Hydrogen Business Model to provide producers with revenue support.

Low Carbon Hydrogen Standard, and a commitment to set up a certification scheme by 2025, to support future international trade.

£1 billion Net Zero Innovation Portfolio (NZIP), which supports the commercialisation of clean energy technologies in 10 priority areas, including hydrogen.

£170 million Industrial Decarbonisation Challenge Fund to invest in developing technologies such as CCUS and hydrogen fuel switching

Notable Green Hydrogen Projects Announced in the UK in 2023:

- Statera Energy announced plans for the development of a major green hydrogen electrolyzer project in Kintore, Aberdeenshire in Scotland. The 3 GWh electrolyzer project is targeting full production by 2030 and has been granted UK Government funding under Strand 1 of the Net Zero Hydrogen Fund.

- bp's HyGreen hydrogen project was shortlisted in Hydrogen Allocation Round 1 (HAR1) released by the UK government. Expected to begin production in 2026, the HyGreen Teesside project is said to be UK's largest green hydrogen facility. In its initial phase, the project aspires to a hydrogen production capacity of 80 MW, with a potential expansion to 500 MW by 2030.

- The hydrogen-powered transport project, Teesside hydrogen power projects were awarded £8 million government funding. The two projects will be based at the Tees Valley hydrogen transport hub, and one will develop hydrogen-powered supermarket delivery trucks and airport ground vehicles and another will set up publicly accessible hydrogen re-fuelling stations.

- Iberdrola to build a facility in Felixstowe, the UK's largest port, to supply green hydrogen to vehicles and machinery. The project's first phase, set to begin operations in 2026, will have the capacity to produce 14,000 tons of hydrogen per year via electrolyzers.

- In August 2023, the UK government shortlisted 17 green hydrogen projects for the negotiations stage of the HAR1 for the Hydrogen Business Model (HBM) subsidy, to be awarded in Q4 2023. The projects, which total 262 MW of capacity, have been invited to negotiations as well as a continued due diligence process to receive funding from the Net Zero Hydrogen fund.

To see other articles in this series, click here.