Outlook 2023: Paving the road to zero emission | Green Hydrogen

GREEN HYDROGEN OUTLOOK

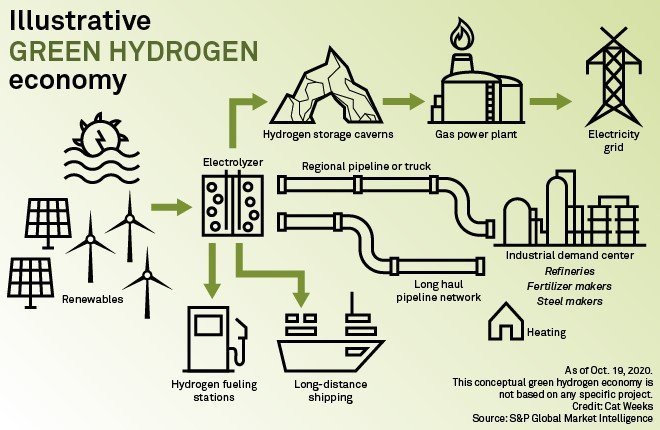

Apart from various battery chemistries being explored, newer materials being researched, and the mushrooming of mega-sized battery manufacturing facilities; green H2 has become the current favorite around the world as the fuel technology to look out for.

Energy outlook reports state that the hydrogen production market that has been valued at $130 billion, is expected to grow about 9.2 percent every year up to 2030. Although, green H2 is the ultimately desired outcome, current hydrogen production is mostly fossil-fuel based. With use cases increasing across sectors and regular advancements in H2 technology, it is slated to be one of the promising fuels in the energy transition.

According to analysts at GlobalData, investments in low-carbon hydrogen have shown an increase from 600 to over 1,700 in the last two years itself. Beginning of this year, over 90 percent of both active and pipeline hydrogen projects were green, as a result of the increasing manufacturers' electrolysis capacity and the number of EPC contractors participating in bigger green projects.

If development in the H2 sector continues at this pace, with improved renewable energy inputs, it will create a momentum that will accelerate cost reduction across the entire hydrogen value chain, the analysts say. It has also been noted that close to 400 hydrogen-related deals were made last year, showing a significant increase from the preceding years and indicating an upward trend in the hydrogen market development.

GlobalData also reported that since last year, over 111.9 Mtpa hydrogen capacity was announced in many countries, including US, Denmark, Egypt, Canada, and Portugal. In Canada, Green Hydrogen International (GHI) announced two important green hydrogen projects that are expected to begin production in 2030.

With the focus being on producing low-carbon hydrogen, electrolysis is being considered as a key technology to produce green H2. Reports show that main companies using this process for production include Hydrogenics, Nel ASA, ThyssenKrupp, ITM Power, HydrogenPro, Enapter, and Plug Power.

Expert inputs show that the UK and Germany are set to play a crucial role in achieving a milestone for the hydrogen market in Europe. The planned projects indicate a surge in total installed capacity of hydrogen projects across Europe from ~236MW in 2022 to more than 2GW in 2023.

Policy decisions

- The governments of various countries are showing an avid interest in supporting the development of H2 production, through policies and programs that provide subsidies and tax rebates.

- Government subsidy schemes are slated to start this year in the US, EU, UK, and Germany. Countries like Canada, India, and Portugal, are also keenly looking at implementing policy support.

- Some key policy decisions:

- The US hydrogen tax credits — unveiled in last year's Inflation Reduction Act — aim to pay producers up to $3 per kilogram of green H2 for the first 10 years of a project's lifetime.

- Contracts for Difference (CfD) subsidy programs from the EU and UK are also due to begin this year, along with Germany's H2Global scheme, which will provide financial support for clean hydrogen (and its derivatives) imported from outside the EU. A special firm owned by the German government - Hydrogen Intermediary Network Company (HintCo) - will buy green H2 or its derivatives from international producers, and sell it to European customers.

- Scotland announced in December last year its $112 million Green Hydrogen Fund, calling for H2 project proposals early this year. The goal is to install 5GW of clean H2 by 2030 and 25GW by 2045.

- Canada has announced a hydrogen tax credit of as much as 40 percent for H2 production, to be launched in 2023 and run till 2030.

- In January this year, the Indian government approved an initial outlay of ₹197.44 billion ($2.4bn) for its 'National Green Hydrogen Mission', which aims to make India a global hub for the production, utilization, and export of renewable H2 and its derivatives. About ₹174.9 billion ($2.11bn) of the funds will go towards production of green H2 and for domestic manufacturing of electrolyzers. The government also plans to mandate the use of green H2 in industrial sectors such as steel, oil refining, fertilizer, and cement production.

- Oman will announce the winners of its first green hydrogen tender this year in March, and its second in December.

- Early this year Portugal unveiled details of its first national green hydrogen tender — offering 10-year contracts to renewable H2 producers, with the H2 then being sold on to natural-gas suppliers for blending into gas networks.

- Norway is considering introducing a CfD scheme this year.

RELATED: US DoE 'Pathways to Commercial Liftoff' reports on Clean Hydrogen, LDES launched

It is expected that the schemes announced will attract considerable investments this year, and many projects might even begin construction by the end of the year.

Statkraft to power FFI's Holmaneset 300 MW Green Hydrogen, Ammonia project

For Outlook 2023 articles on Energy Storage and E-mobility sectors, click here.