No looking back: Energy transition in the USA

In many ways, this year was the tipping point for renewable energy. The world has woken up to the imperative of energy transition, and countries around the world have made progress on this front, albeit in different degrees. We take stock of their situation in this multi-part series.

Energy Storage

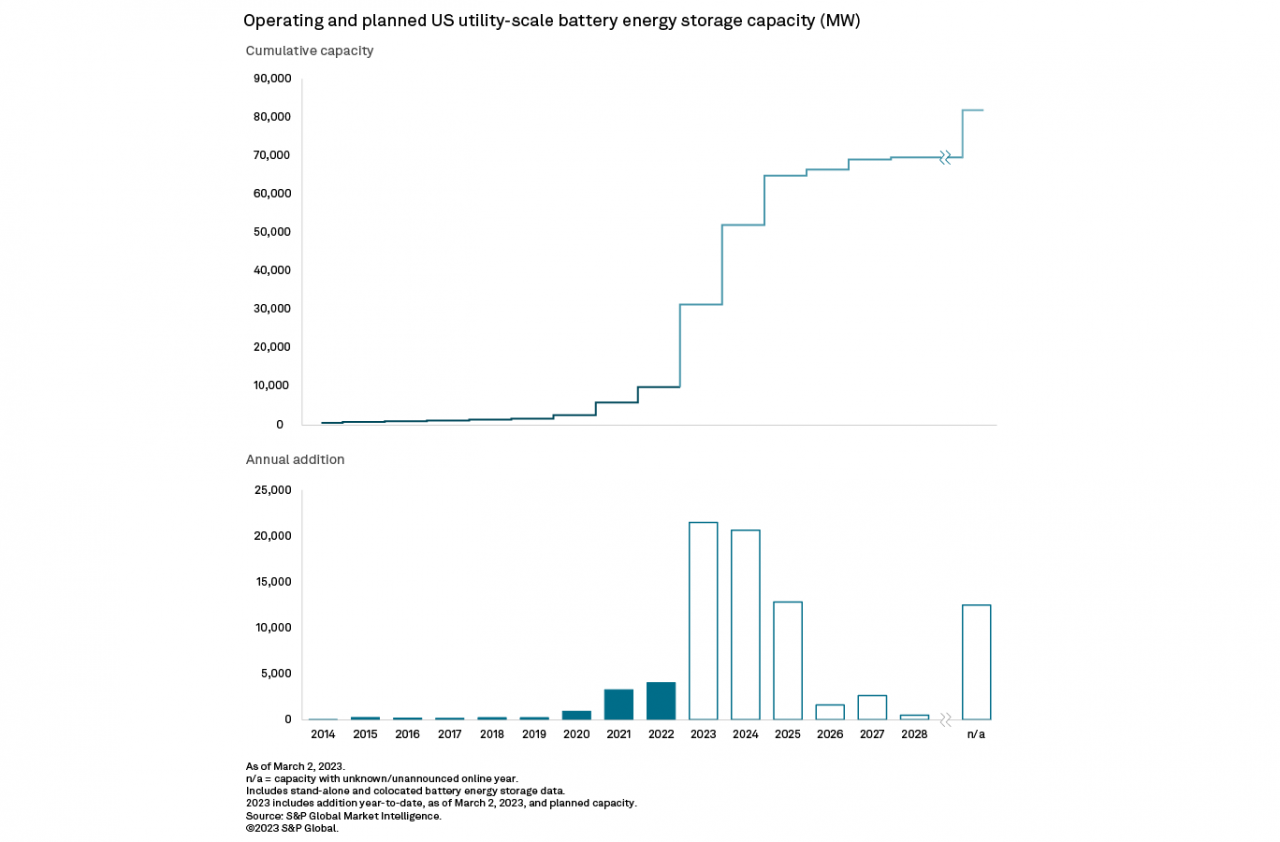

Last year was a record year for battery storage in the US. The country added 4.8 GW of capacity in 2022, equaling the amount of capacity added over the previous two years combined.

Total 2022 installations rose a massive 44 percent over 2021, driven largely by a seven percent increase in grid scale installations. Grid-scale capacity increased by 60 GW, representing 80 percent of the new capacity added during the year.

Residential installations, meanwhile, increased by 36 percent over the previous year.

Speaking on the country's progress, John Hensley, Vice President of Research & Analytics, American Clean Power Association (ACP), said, "Energy storage had its best year yet in 2022. Cumulative operating utility-scale storage capacity increased by 80 percent. While we saw a slight dip in installations toward the end of the year, the trend is clear: Energy storage is on a rapid growth curve and is already a key component of building a resilient grid that supports abundant clean energy."

Data from US Energy Storage Monitor report – released by the ACP and consultancy firm Wood Mackenzie – shows fourth quarter additions totaled 1,067 MW capacity, making it the fifth-highest quarter for total number of installations.

The US grid-scale segment installed 848 MW in the last quarter of 2022, down from the 1 GW installed in the second and third quarters, because of supply and interconnection constraints. Over 3 GW of capacity that was set to come online in Q4 was either delayed or cancelled, the report noted.

During the first quarter of 2023, the grid-scale segment installed 554 MW, bringing cumulative grid-scale US storage capacity to 10.4 GW. This was the lowest quarter since the second quarter of 2021, but over 1.8 GW of capacity that was scheduled to come online was delayed.

The residential segment added the most added in a first quarter, with capacity increasing by 155.4 MW.

The US's battery storage capacity is highly lopsided. California and Texas dominate the landscape, with a share of nearly 72 percent of the country's BESS capacity.

Florida, ranked third, operates 546 MW of capacity. That's mere quarter of Texas' capacity and just above a tenth of California's.

Overall, 41 US states have BESS in operation, but the top 10 account for 93 percent of the country's capacity. The bottom 31 operate a total of 700 MW capacity, representing just 7 percent of the country's overall capacity.

Some 710 MW of battery storage came online in the US in the first three months of the year, of which around 70% was in the ERCOT, Texas market, S&P Global said. Overall battery storage capacity in the US grew to 10.777 GW by the end of Q1 2023, amounting to a 52% year-on-year increase, the research firm said. The growth should have been even faster, however, with 2.448 GW of projects initially proposed to come online during the first quarter, compared to the 710 MW in actual commissionings, S&P added.

Major projects that should have come online but were pushed to Q2 include the 260 MW Sonoran Solar Energy and 150 MW Arroyo Energy Storage, from NextEra Energy Resources and Enel Green Power in Arizona and New Mexico, respectively.

Grid-scale capacity is forecast to more than double in 2023, driven by high storage demand and completion of projects that were delayed from 2022. For residential capacity, Wood Mackenzie forecasts an increase of 90 percent this year.

US energy storage capacity is forecast to reach almost 75 GW by 2027 and 95 GW by 2035, but dependence on imports for materials, components and the batteries themselves, is likely to persist, say analysts.

E-mobility

The US e-mobility market continued to expand, with the Inflation Reduction Act triggering a rush by companies to set up factories in the US.

Major EV and battery makers have announced a cumulative $52 billion in North American EV supply chains between August 2022 (when the IRA was passed by Congress) and March 2023. Nearly half the announced investments are for battery manufacturing, while battery components and EV manufacturing account for 20 percent each.

Tesla remains the largest EV maker in the US, with total sales of 336,892 in the first half of the year, up 30 percent over the same period of the previous year. Hyundai grabbed second spot, recording sales of 38,457 units. General Motors came third with 36,322 EV sales, followed by Volkswagen Group. Ford, which was second in sales behind only Tesla last year, fell to fifth place with sales of 25,709 vehicles.

America's EV market is going through a sluggish phase, as have slowed purchases and inventories have begun to pile up. Tesla launched a price war this year, but pure-play rivals Lucid and Rivian remain safe. Lucid raised $3 billion from investors in June and Rivian, backed by Amazon, announced it had $9 billion at the end of the second quarter, enough to see the company through till 2025. Rivian also raised full-year production estimates to 52,000 vehicles.

On the other hand, e-mobility company Proterra and e-pick-up truck maker Lordstown Motor filed for bankruptcy and e-truck manufacturer Nikola warned it might not be a going concern.

America's EV map next year could be markedly different from this year.

Tesla's NACS charging connector moved closer to its name, the North American Charging Standard. Carmakers such as Ford and General Motors announced plans to drop the CCS charging connector and switch to Tesla's NACS systems in the coming years, while several charging companies also decided to offer the point on their networks.

Meanwhile, seven carmakers — BMW, Mercedes, General Motors, Honda, Hyundai, Kia and Stellantis — joined hands to launch a US-wide charging network, thereby creating the first major network comparable to Tesla's in scale. Analysts maintain that given the shortage of charging points, the new network will be less of a rival and more of an ally. The network will offer both the CCS type charging connector, as well as Tesla's NACS type plug.

Green Hydrogen

Hydrogen is a light, storable, energy-dense gas that produces no direct emissions of pollutants or greenhouse gases. This makes it an ideal fuel for a world transitioning to Net Zero. The US has a National Clean Hydrogen Strategy and Roadmap, which it uses as a comprehensive national framework to facilitate the creation of large-scale production of clean hydrogen, as well as processing, delivery, storage, and use.

The roadmap estimates US clean hydrogen production totaling 10 million tonnes by 2030, doubling to 20 million tonnes by 2040 and touching 50 million tonnes by 2050. In addition, the transition to hydrogen as a fuel itself is expected to reduce economy-wide greenhouse gas emissions by 10 percent.

As per the roadmap, US federal agencies will focus deploying the fuel to address difficult-to-decarbonize segments of the economy, with priority focus being accorded to industrial sectors such as chemicals, steelmaking, and industrial heat, transportation segments such as medium- and heavy-duty vehicles, maritime, aviation, and rail, as well as the power sector: generation of electricity, energy storage, and stationary and backup power.

The aim is to reduce the cost of hydrogen production to $2 per kg by 2026 and $1 per kg by 2031.

The roadmap aligns well with the goals set by the US government, including a halving in US greenhouse gas emissions from 2005 levels by 2030, generation of 100 percent carbon pollution-free electricity by 2035 and achievement of Net Zero by 2050.

California

California is one of the largest markets for hydrogen-fueled cars in the US. Nevertheless, the overall market remains tiny. A total of 1,076 new hydrogen fuel cars were sold in the US during the second quarter of this year (April-June 2023). This is actually the highest ever, and only the third time that the sale figure has crossed the 1,000-figure mark. The next highest occurred during the first quarter of 2021, when sales touched 1,034 vehicles.

To see other articles in this series, click here.