Amid EV shift, Japanese could lose Thai auto market to China

Southeast Asia's largest automotive hub is gearing up for a China-Japan clash, market analysis shows. Chinese electric vehicle companies are heading into Thailand, and have so far announced plans to invest up to $1.7 billion in manufacturing plants in the country.

Their entry is backed by Thailand's government, which has targeted Chinese firms and rolled out incentives as it seeks to transition its carmaking facilities to produce EVs instead of conventional vehicles: Thailand manufactures around 2 million cars per year, and the government wants to convert at least 30 percent of the capacity to manufacture EVs by 2030.

The country is Southeast Asia's largest manufacturer and exporter of cars, and also the second-largest for sales behind Indonesia.

Japanese automakers have long held sway in the kingdom, with Toyota, Isuzu, Honda and Mitsubishi accounting for two of every three vehicles sold. But that dominance is being challenged by Chinese forays and analysts say brands from the Middle Kingdom could take at least 15 percentage points of market share from Japanese carmakers over the next 10 years by offering affordable EVs to buyers.

SMEV India suspends constitution, seeks revamp under new head

The Thailand Board of Investment (TBOI), responsible for attracting investors, says it is in talks with Chongqing Changan Automobile to invest $280 million to set up a right-hand drive EV factory – its first such outside China – while Guangzhou Automobile Group (GAC) is planning to invest more than $180 million to produce EVs in Thailand. Two other Chinese automakers – Geely and Chery Auto – are planning market entries, with Chery planning to enter the market early next year, according to TBOI.

These investments will bolster an already strong presence, that started with Great Wall Motor acquiring a factory from General Motors in 2020.

Great Wall is spending close to $650 million to make the plant a regional centre for manufacture of EVs and hybrid vehicles. The company has also announced local production of a popular compact model from next year, and announced plans to set up factories for electronics, powertrains and seating through group companies.

Other Chinese companies are expanding too. SAIC Motor is investing $15 million in a brownfield expansion of its existing EV parts and battery manufacturing plant.

Hozon New Energy is working towards locally producing its electric NETA V model from next year.

And BYD, the powerhouse that operates across the EV value chain, is investing $510 million to set up new plant that will manufacture 150,000 passenger cars a year from 2024, a portion of which will be exported to countries in Southeast Asia and Europe.

All this has translated to gains in market share in an expanding market.

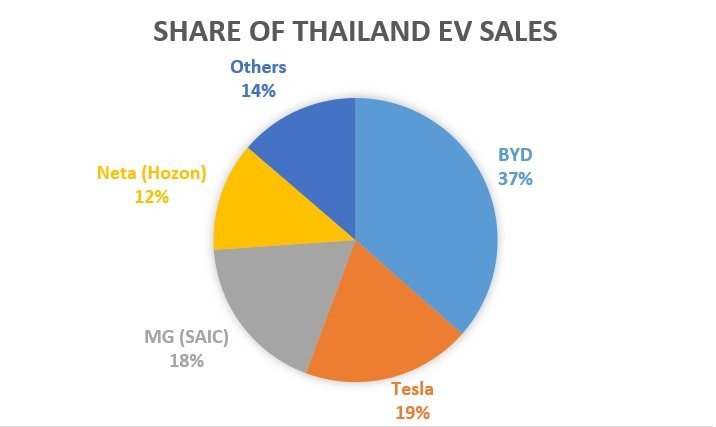

Last year, Thailand registered 850,000 new cars, but EVs accounted for only around 1 percent of the number, government data shows. Between January and April however, the proportion of EVs rose to more than six percent of sales, for a total of 18,500 units. And the Chinese have a huge headstart. BYD, SAIC Motor and Hozon are the top 3 EV automakers in the country, outperforming Tesla.

Western carmakers already are worried about Chinese EV prowess, with both American and European car chiefs sounding alarm bells. The Japanese should be too.