Electric three-wheelers: Leading the electrification race in India

Three-wheelers hold a unique position in the Indian public transport system. Apart from consumer demand, other factors driving e-3Ws sales include supportive policies by the Central and State governments, lower operational cost, and emergence of viable business models.

If we look at EV sales in India, you will notice, electrification of vehicles has chiefly taken place in the two-wheeler and three-wheeler segment.

A total of 380,000 EVs were sold in India between 2019-20 (India Electric Vehicles Overview Report 2020-27 - Customized Energy Solution) and a bulk of these i.e., 224,800 comprised e-3Ws, followed by 152,000 e-2Ws and 3,000 e-4Ws.

"In India's paradigm shift towards EVs, e-3W will play a vital role as it addresses the crucial segment of last- and first-mile commute and even deliveries," said Mahesh Babu, MD & CEO at Mahindra Electric Mobility Ltd. Mahindra Electric is a market leader in the e-3W market for FY 2019-20, as per IESA's Ranking of Energy Storage and EV companies for 2020.

Mr. Babu highlighted India requires a "multi-modal approach to electric mobility" and e-3Ws will lead the country's EV adoption race.

E-3W market in India

Three wheelers hold a unique position in the Indian public transport system. The low-cost mode of transport offers not only greater affordability but also maneuverability on congested Indian streets, making it a popular choice among commuters. Besides the growing consumer demand, other critical factors driving the sales of e-3Ws include ambitious policy announcements by the Central and State governments, lower operational cost for the drivers and emergence of viable business models (such as battery swapping).

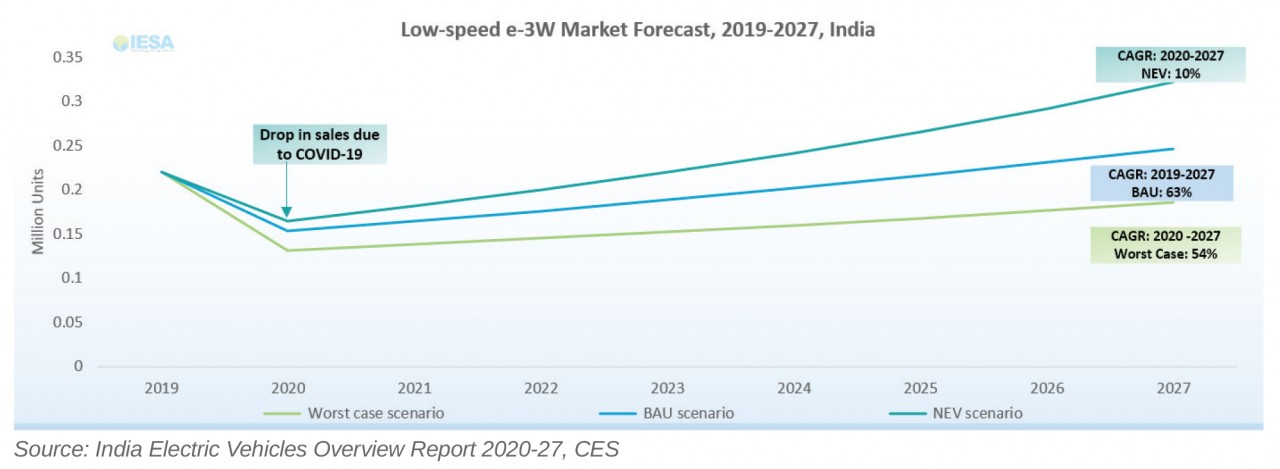

The e-3W market in India has two variants: e-rickshaws and e-autos. Currently, low-speed (up to 25 kmph and motor size below 2kW) e-rickshaws powered by conventional lead-acid batteries dominate the market. Several small, unorganized players operate in this segment accounting for nearly 60-80 percent of the market share.

As per the International Centre for Automotive Technology (ICAT) there are 600+ registered players operating in this segment, and together, these players sell approximately 10,000 - 12,000 units of ICAT approved e-rickshaws per month. In addition to the registered OEMs, a sizeable gray market for e-rickshaws has also evolved in the country, particularly in the States of Bihar and West Bengal, and NCR-Delhi (India EV Overview Report 2020-27, CES). However, since 2018, the share of gray market has slowly started to decline owing to the government's push for ICAT-certified model.

Some of the major players in the e-rickshaw segment include Mahindra Electric, Kinetic Green Energy & Power Solutions, Champion Polyplast (Saarthi), YC Electric Vehicles (Yatri), Saera Electric Auto (Mayuri), Goenka Electric, Thukral Electric Bikes, GK Erickshaw, and others.

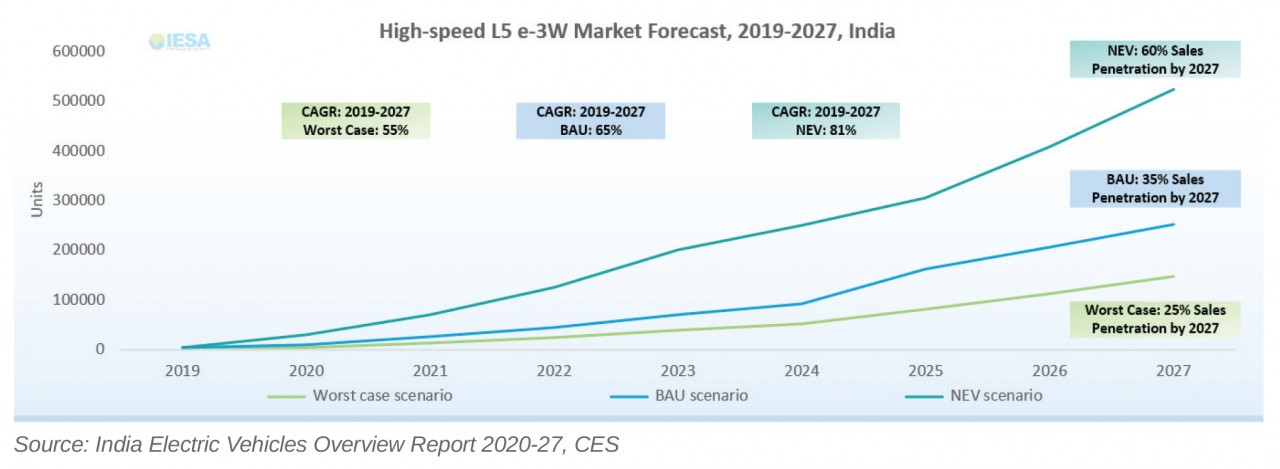

The e-auto segment, on the other hand, is at a nascent stage in India and more organized compared to the e-rickshaw segment. E-autos are high speed e-3Ws (25 kmph and above with motor size greater than 2kW) and currently operate at B2B and in the cargo segment due to requirement of high-performance vehicles therein.

As per the India EV Overview report, the industry sold ~4,800 units of e-autos in FY 2019-20. In recent years, e-auto segment has witnessed entry of several new players and big brands. Some of the major OEMs operating in e-auto segment include Mahindra Electric, Gayam Motors, Piaggio, Kinetic Green Energy, Champion Polyplast (Saarthi), Vidhyut EVs, and others.

CES analysis indicates that 90 percent of the e-3Ws units currently sold are passenger vehicles and the rest 10 percent are sold as goods vehicles (e-carts).

"E-autos are yet to witness widescale adoption," noted Shamsher Dewan, Vice President, of credit rating agency, ICRA. "E-3Ws (lead-acid battery based) account for the lion's share of EVs sold in the country. However, this is primarily in the e-rickshaw segment."

Mr. Dewan believes as major 3W OEMs start to develop electric variants of their 3Ws, offering superior specifications and range compared to the e-rickshaws, the adoption in the cargo segment is likely to pick up pace.

Factors driving the e-3W growth in India

(i) Supportive policy framework –

Over the recent years the national government has created a momentum for EV adoption through several policy measures. Starting with the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme framed to promote and incentivize the production of hybrid and EVs in India. As per reports, of the 280,000 EVs that availed purchase subsidies through FAME – Phase I (April 2015-March 2019), only 1 percent were availed for e-3Ws.

However, in FAME – Phase II, the government focus shifted to electrification of the public and shared transportation and this has given a big boost to the e-3W market.

FAME-II aims to support approximately 100,000 e-2Ws, 500,000 e-3Ws, 55,000 e-4Ws (passenger cars) and 7,000 e-buses. However, there are a few qualifying specifications that need to be met in terms of speed, battery capacity, and technology to avail the FAME – II subsidies.

According to Mr. Babu, policies like FAME II are helping to take e-mobility to the masses. "The success of India's e-mobility program cannot be achieved without a strong policy on manufacturing, Mr Babu explained. The Ministry of Heavy Industries and Public Enterprises had released a Phased Manufacturing Program (PMP) under the FAME II scheme for boosting local manufacturing of EV components including battery packs, power electronics and electric motors. PMP encourages industry to invest and develop the supply chain in India and lays down a clear timeline for the localization of all the components. Parallelly, government has also made it very clear that they are not interested in subsidizing the imports and from 2020, custom duty will be increased rapidly.

"Mahindra has been investing consistently towards developing EV components in-house and will continue to strive hard to move the world to electric. Mahindra Treo range is currently completely made-in-India (except the cells)," he added.

Thirdly, the Cabinet in November finally approved production-linked incentives (PLI) in 10 key sectors including Advanced Chemistry Cell (ACC) battery, under the Atmanirbhar Bharat (self-reliant India) vision. In the long-term, this move is expected to benefit EV uptake as it reduces upfront capital costs, as batteries (a key component of EV cost) will be manufactured locally.

Apart from the Central government, State governments like Delhi, Kerala, Karnataka, and Maharashtra have taken step-change measures for paving the way for e-3W market.

For example, Delhi has extended purchase incentive of `30,000/e-3W to registered owner. It has also made available hire purchase scheme, 5 percent interest subvention and scrapping and de-registration incentive of `7,500 per vehicle. Karnataka government has offered 5,000 free permits for e-3Ws.

Other examples include, Bihar State EV policy (draft-stage) that has set an ambitious target of converting all paddle-rickshaws to e-rickshaws by 2022, among other targets.

(ii) Lucrative operational economics –

A recent analysis by the World Resource Institute on the economic viability of e-3Ws revealed that at an average of 100 km per day usage, the total cost of ownership (TCO) per km of e-rickshaws (`1.30/km) and e-autos (`2.10/km) is lower than the corresponding ICE variant (CNG-3W, petrol-3W, and diesel-3W).

Combined with the additional FAME-II subsidy of `37,000 for e-rickshaws and `66,523 for e-autos, the TCO per km of e-rickshaws (`0.99/km) and e-autos (`1.82/km) becomes even more economical.

Therefore, over time it is believed e-3Ws offer significant savings in terms of operating costs.

Mr. Dewan from ICRA underscores that the higher capital cost associated with e-3Ws would be recovered over a short period in the form of savings in operating costs.

"Just as the adoption of CNG-based 3Ws increased in cities due to the favorable operating economics, the adoption of e-3Ws would also increase, especially with the government bringing down the capital cost for buyers through subsidies," he added.

(iii) Battery swapping option –

Battery swapping refers to a process when a discharged battery is replaced with a fully charged one akin to refueling of ICE vehicles. Lithium-ion batteries account for a significant upfront cost of EVs, and therefore, battery swapping model is considered a game-changer (especially in e-2W and e-3W segment) as it can help drastically reduce the upfront cost of EVs.

Recently, the government allowed the sale of EVs without the batteries. E-3Ws are expected to greatly benefit from this move as it will make it more viable.

Though the caveat here is, battery swapping will lower the upfront cost of the e-3W by about 40 percent, but its operating cost will be relatively higher compared to e-3Ws that come with battery. In this case, studies indicate (WRI- India, Ross Center) e-3Ws with assured high utilization rates are a more profitable prospect for businesses, as they become cheaper to operate per-kilometer with increased utilization. Therefore, this model may prove to be useful for e-3Ws deployed by e-commerce/retail giants like Amazon, Flipkart, and others, who have recently announced adding e-rickshaws to their delivery fleet.

Barriers to e-3W adoption

(i) High upfront cost & financing challenges – Formal financing options for e-3Ws have not evolved for EVs as they have for ICE vehicles. CES analysis highlights that users can buy an ICE vehicle with zero down payment in the market typically at an interest rate of 8 percent whereas in case of EVs, one has to spend nearly 30 percent cost of the vehicle as down payment with an interest rates as high as 20 percent.

Further, national banks are offering interest rate in the range of 9-9.5 percent whereas NBFCs are going as high as 15-20 percent, and few private lenders are charging even higher rates (<20 percent).

Moreover, the e-3W after-sale market has not evolved as much as ICE-vehicles due to which financial institutions are not able to assess the value of the asset in case of a default.

(ii) Limits of battery swapping – While battery swapping could give a boost to e-3W market, the downside to it is that incentives are not applicable for models equipped with swapping options under FAME-II scheme.

As for battery swapping stations, industry is seeking uniformity on the GST front, as on vehicle, GST applicable is 5 percent whereas on charging, which is a service, GST applicable is 18 percent.

While battery swapping model does look promising, currently the industry is looking for more clarity on how the incentives will be given on purchase of a vehicle without battery.

(iii) Low localization levels in EV manufacturing – While several policy announcements such as PMP, and more recently ACC battery manufacturing, have been made with the aim to auger EV component and battery manufacturing in India. The prevailing ground-reality is that localization continues to be low in EVs. To be able to avail FAME II subsidies manufacturers have to locally source at least 50 percent EV parts and a large number of manufacturers are yet to make all the EV components and technologies in-house.

However, companies like Mahindra and Kinetic Green Energy have started localizing their EV component. "We are currently working towards making our EV components and technology in-house," said Mr. Babu commenting on localization efforts by Mahindra Electric.

"Mahindra Treo range of e-3W is completely made-in-India at our Bengaluru plant (except for the cell) and with a new upcoming plant in Chakan we will be manufacturing EV components for high-power EVs," he added.

Kinetic Green Energy's 'Kinetic Safar Smart' the company's Li-ion powered e-auto is also a nearly 100 percent 'Made-in-India' product (except the cells) developed with a strong local supply chain.

(iv) Registration of EVs in State – Registration of vehicles at the State level is another key challenge faced by several OEMs. Currently, vehicle permits are being given for e-3Ws but registration of EVs has not been a straightforward process, and therefore, there is need to streamline registration process for EVs at the State level.

Collective path for EV adoption

With the right policies in place and partnership of private players working to make EV components and technology in-house, India can meet the target of having 30 percent sale share of EVs on Indian road by 2030.

CES analysis indicates there is a huge potential for growth in the e-rickshaw segment in the next five years as new markets open in Raipur, Indore, Bhopal, Orissa, and other regions. Moreover, the South and North East markets are also expected to open in the upcoming years.

For example, Amazon has already announced to include 10,000 e-3Ws and e-4Ws in its fleet,

Flipkart is looking to convert 40 percent of its fleet, Ola is aiming for 1 million EVs by 2022-23.

Looking at the EV sales in the recent years, it is safe to say, EV revolution in India will be

led by e-2Ws, e-3Ws and fleets. E-3W market in the coming years will not only allow for cleaner forms of first- and last-mile mobility, but also create new employment opportunities and help in the economic upliftment of e-3W drivers, especially women, as we witness their increased participation. The growing penetration of e-3W indicates that 100 percent electrification in three-wheeler segment could well be a possibility by 2030.

ETN spoke to MD & CEO of Mahindra Electric Mobility, the market leader in e-3Ws category.

Evolution of e-3W market in India

In India's paradigm shift towards EVs, e-3W will play a crucial role as it addresses the crucial segment of last/first mile commute and even deliveries. There are two types of e-3W on sale right now e-rickshaws and e-autos. The e-rickshaws market is mainly concentrated in Eastern and Northern part of India and the industry volumes is estimated to be around 7,000 units/month in the passenger segment. The segment is highly unregulated and 85 percent of the e-rickshaws plying currently are powered by lead-acid batteries. The e-auto will compete in small 3W segment and is one of the largest segments in the passenger category with volumes of ~30,000 units/month. The Central and various State governments are promoting e-3W space with fiscal and non-fiscal benefits and this has seen an increase in uptake of e-3Ws especially in tier-1 and tier-2 cities. We see e-3Ws as a source of employment as well as cleaner means of last mile mobility. The e-3W segment has also opened a huge customer base of women drivers in the country.

Key developments in the past year

In the last one year, we have seen an increase in uptake of Li-ion powered e-3Ws, and government policies have certainly helped to make e-3W more affordable and accessible. Given the ease of driving an e-3W, we have seen more women drivers opting for an electric three-wheeler.

Policy and regulatory framework

The government policies especially FAME II is a long-term, well thought out policy to promote manufacturing, adoption, and acceptance of EVs in India. We can say, policies like FAME II are helping us take e-mobility to the masses. The success of India's e-mobility program cannot be achieved without a strong policy on manufacturing. Under FAME II, Ministry of Heavy Industries and Public Enterprises had released a Phased Manufacturing Program (PMP), which has helped in boosting local manufacturing of EV components including battery packs, power electronics and electric motors. Mahindra has been investing consistently towards developing EV components in-house and will continue to strive hard to move the world to electric.

PLI scheme for ACC Batteries

The Production-linked Incentive (PLI) initiative by the government is a game-changer and puts India on the global map to develop and manufacture EV technology. The policy supports both OEMs and component manufacturers and will help the industry not only become globally competitive but also Atmanirbhar (self-reliant). It will help the EV industry to reduce its dependence on imports and become a net exporter of EV components and platforms.