Global challenges and opportunities for Li-ion battery recycling

As the number of used Li-ion batteries swells globally, most countries will have to establish supply chains for battery recycling and a sound regulatory framework to keep processes environmentally sustainable in the future writes Dr. Tanmay Sarkar, Senior Consultant R&D at Customized Energy Solutions.

The number of spent Lithium-ion batteries (LIBs) are bound to increase with the growing popularity of electric vehicles (EVs). Other than EVs, LIBs are increasingly being used in stationary storage applications such as back-up power for telecom sectors, data centers, renewable energy integrations, and other applications. Several reports have predicted that globally the number of spent LIBs will be around 2 million tons per year by 2030.

In general, LIBs are not as toxic as lead-acid or nickel-cadmium batteries, but LIBs have certain chemicals that must be prevented from being exposed to open atmosphere or being disposed in a landfill. As the use of LIB increase, the demand for its raw materials will also grow. Hence, recycling of LIB materials could have a positive impact from environmental and economic perspective.

Portable batteries used in consumer electronics and the power tools are currently the

main source of LIBs for recycling industry. However, due to usage history, battery chemistry, and applications, the volume of end-of-life (E-O-L) LIBs will have

different distribution as compared to its nascent stage in the market. Additionally, batteries that are at E-O-L may not automatically become available for recycling. There could be many reasons for this such as batteries are being stored and hoarded, sometimes batteries are disposed elsewhere but not recycled or they are reused for other applications. Even though there are enough of batteries, collection of these spent batteries is one of the biggest challenge for LIB recycling industry.

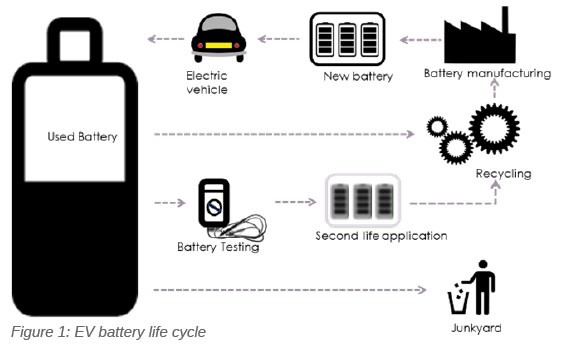

There are various challenges associated with EV battery recycling like difficulty in identifying battery chemistry,difficulty in estimating battery State of Health (SoH), lack of automated battery dismantling processes and others. Figure 1 shows the schematic of EV battery life cycle.

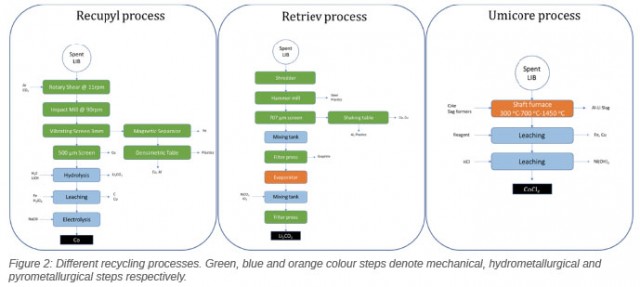

LIB recycling industry uses mechanical, hydrometallurgical or pyrometallurgical process. Mechanical process involves dismantling of the battery and separation of different components. Hydrometallurgical process includes leaching, precipitation, refining and other processes, and it takes place at a room temperature. Consumption of acid/alkaline solution is one of the major challenges associated in the current hydrometallurgical based recycling processes. Pyrometallurgical process is easy to scale up and acid/alkaline-free process and it takes place at high temperature. High energy consumption and emission of gas are the major challenges for pyrometallurgical based recycling processes. Many of the today's recycling processes involve both hydro and pyrometallurgical processes along with physical separation (mechanical process). Figure 2 shows the process flow involved in different modern-day LIB recycling processes.Several LIB recycling companies exists globally. Among Asian countries, South Korea, Japan and China are leading in LIB recycling activities. Companies like Sungeel Hitech, South Korea's largest battery recycler and urban mining company and Anhua Taisen Recycling Technology Co, a leading China-based recycling firm, use hydrometallurgical process to extract critical battery elements. Whereas, company like Nippon Recycling Centre Corp, Japan uses pyrometallurgical recycling technology for extraction of nickel and cobalt. Many European countries are also involved in LIB recycling. Recycling company Accurec is based in Germany and it uses mechanical pre-treatment, pyro and hydrometallurgy to recover battery cathode materials, with over 60 percent efficiency. Belgium-based Umicore is a world-leader in urban mining and LIB recycling company using combined pyro-hydrometallurgy technology for cobalt and nickel extraction from LIB and nickel metal hydride (NiMH) batteries. In the US, California-based company Retriev Technologies is leading in recycling of batteries, including LIBs. In India, companies like, Attero Recycling, Tes-Amm India Pvt. Ltd., SungEEL HiMetal, Ecoreco and others are processing LIB and their recycling capacity in the range of 1000 - 5000 metric tonne per annum.

In commercial LIBs, graphite or lithium-titanium oxide (LTO) is used as anode, while lithium iron phosphate (LFP) lithium-nickel-manganese-cobalt oxide (NMC), lithium-nickel-cobalt-aluminum oxide (NCA) and lithium-manganese oxide (LMO) is used as cathode. Aluminum and copper are used as cathode and anode current collector respectively which hold the electrode materials and also help in electron flow at outer circuit. With different recycling processes, each of elements, lithium, copper, aluminum, cobalt, nickel and manganese can be extracted in different forms. The degree of recovery of different elements vary with recycling process, chemical compositions of battery, and economy involved with the recycling process.

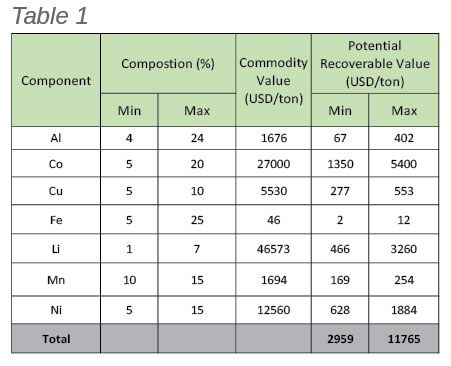

Table 1 summarises potential recoverable value (USD/ton) of different elements present in LIBs. To set up a LIB recycling facility in the range of 15,000-25,000 ton per year (feed rate), capital cost can vary 1000-3000 USD/ton depending on the elements (Li, Ni, Mn, Co )

that will be recovered with the degree of purity.

Globally, there are various rules and regulations present in many countries for E-O-L battery collection and recycling. In the US, as per the federal universal waste regulation of United States Environmental Protection Agency (USEPA), battery is considered under one of the universal waste categories. There is no producer responsibility legislation in Canada. Although, British Columbia, Quebec, Manitoba and Ontario have own regulations to recycle all types of primary and secondary batteries. The European Commission has legislated a Battery Directive in 2006 which regulates collection, recycling, treatment and disposal of batteries and restricts mercury and cadmium content in batteries as well. In Japan, Extended Producer Responsibility (EPR) rules apply only for rechargeable batteries.

In India, with the growing presence of LIBs in the country, Ministry of Environment, Forest and Climate Change (MoEFCC) is expected to release Battery Waste Management Rules 2020 in the near future. The rule will cover all type of batteries including LIBs unlike the older policy Batteries (Management and Handling) Rules, 2001 which covered only lead-acid batteries. Under the present draft policy, battery collection responsibility will go to the manufactures and the dealers whereas registered recyclers will be responsible for safe transport of the E-O-L batteries.

A proper regulatory framework for battery management can help in handling and segregation of different types of batteries and establish a supply chain for recycling industries culminating in an environmentally friendly recycling process.