At the recently held 'National Dialogue on Emerging Trends in E-Mobility' organized by the Council on Energy, Environment and Water (CEEW) at New Delhi, Amitabh Kant, G20 Sherpa of India, has spoken on the desired roadmap for India's transition to electric mobility.

"India should target making two and three-wheelers sales 100% electric in the next five years. This will not only help reduce air pollution but also ensure that we become a global manufacturing champion for electric two-wheelers and three-wheelers. Public mobility is the backbone of a civilised society. Focus should also be on e-buses", he said, at the event.

He further added, "To accelerate the e-mobility transition, financing will be key. There is a need for mechanisms such as first-loss guarantees, credit enhancement and blended finance, to enable private-capital to flow at scale. We must target to install five million fast chargers, and push for battery swapping and PLIs for localised manufacturing. Also, I want to congratulate CEEW for this path-breaking e-mobility dashboard that will encourage healthy competition between states."

He released CEEW Centre for Energy Finance's (CEEW-CEF) independent report 'Greening India's Automotive Sector' at the event. The report, supported by Bloomberg Philanthropies, showed that more EVs were sold in the country in the first six months of FY 2022-23 than in the previous full financial year. EVs constituted 6 per cent of all new auto sales in September 2022, up from only 1 percent in January 2021.

CEEW-CEF also launched its 'Electric Mobility Dashboard', a free, online tool that captures and dynamically updates, on a fortnightly basis, EV volumes at a national, state and RTO level.

RELATED: IESA initiates India Electric Mobility Council (IEMC) to support EV ecosystem

Dr Arunabha Ghosh, CEO, CEEW, commented, "India's EV segment has been a bright spot for the auto sector and growing from strength to strength. We are well-positioned to emerge as a global manufacturing hub for electric two- and three-wheelers. Announcing an official EV transition target for India's auto sector could provide further impetus to the sector's growth, both nationally as well as sub-nationally. In fact, states must also give incentives to vehicle categories more suited for electrification".

He added that the successful greening of India's auto sector could be a shining example of a transition that generates jobs and spurs economic growth in a just and sustainable manner.

The CEEW-CEF study has found that states with EV policies incorporating consumer incentives saw doubled market growth compared to states without such incentives. Larger incentives are also linked to more visible market growth. States with higher incentives such as Assam, Goa and Gujarat registered a near twenty-time growth in the six-month period after the notification of their incentive policies. On the other hand, states with lower incentives saw their markets grow by only 4.5 times.

Twenty-one Indian states have notified their own EV policies, with 15 of these providing incentives in the form of subsidies to buyers. Uttar Pradesh and Tamil Nadu are the most recent states to announce EV policies.

Moreover, FAME II has been impactful in driving E2W volumes, with 56 per cent of their unit target achieved, according to the report. However, E3W including e-rickshaws and commercial electric four-wheelers lag considerably behind, both having achieved just 12 percent of their respective FAME II unit targets. Despite a blip in trends due to the incidents of E2Ws catching fire, timely policy reaction helped EV sales recover soon after.

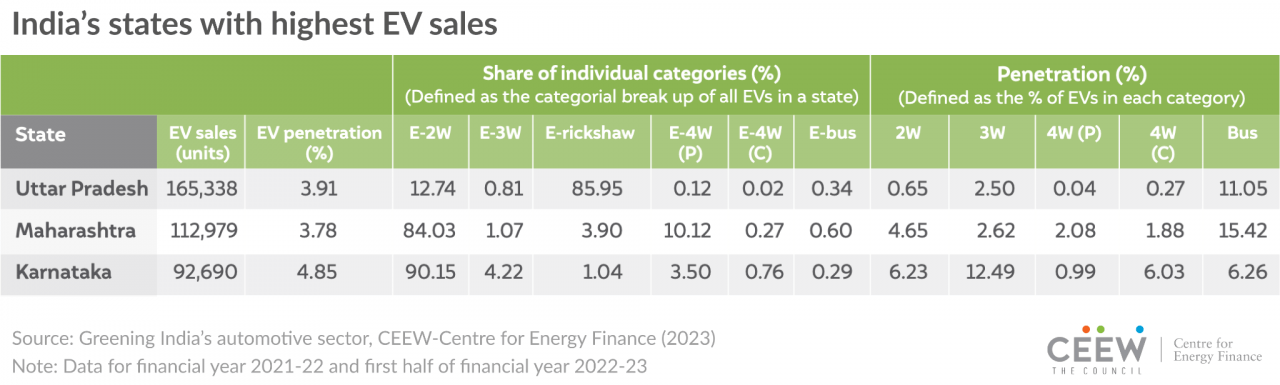

The CEEW-CEF study has also noted that Uttar Pradesh leads as the state with the highest EV sales (1.65 lakh) in the country in FY 2021-22 and the first six months of FY 2022-23. It has an EV penetration of nearly 4 per cent, followed by Maharashtra with 1.12 lakh EV sales.

However, Delhi has India's highest EV penetration (8.30 per cent), followed by Assam (5.91 per cent). Among RTOs, Pune leads in absolute sales with 21,665 EVs sold through FY 2021-22 and the first six months of FY 2022-23, but Delhi's Burari taxi unit is India's greenest RTO with an EV penetration of 46.4 per cent.

Further, the study claims that E2Ws and e-rickshaws jointly lead the EV segment in India, forming 93.5 per cent of the total market. Nearly 3 lakh E2Ws and 1.7 lakh e-rickshaws were sold in the first six months of FY 2022-23 alone, the highest ever recorded for both.

However, despite such high numbers, the penetration of EVs among all two-wheelers remains low at only 4 per cent. States like Maharashtra, Karnataka, Tamil Nadu, and Rajasthan can attribute their success in EV sales to the E2W category. E-rickshaws form the majority of EV sales in Uttar Pradesh and Tripura where they offer last-mile connectivity.

RELATED: Indian EV Charger market to grow at 46.5 percent CAGR in 2022-2030: IESA

"So far, most of the EV volumes in India have been driven by e2Ws and e-rickshaws. Policy support, including at the state level, has played an instrumental role. Our report found that states with their own consumer incentives for EVs over and above FAME II subsidies recorded volume growth more than 2X that of states without such policies. With FAME II expected to draw to a close at the end of FY2024, it is all the more important for those states that have not yet notified EV policies incorporating consumer incentives to do so at the earliest", said Gagan Sidhu, Director, CEEW-CEF.

The CEEW-CEF study recommends an official EV transition target for India's automotive sector to provide appropriate direction at all levels. Seeing the market growth associated with consumer incentives, states that have not already introduced such EV policies must consider doing so to catalyze their local markets.

Finally, the report mentions that the vast majority of E3Ws are sold without recourse to any FAME II subsidy. Policymakers may consider higher per-unit incentives to spur the volume growth of approved E3W models.

MG Motor to launch 'Comet' smart, city-focussed Electric car in India

Read More