The Union Ministry of Heavy Industries (MHI) has reduced the incentives for electric two-wheelers (E2Ws) under Faster Adoption and Manufacturing of Electric Vehicles (FAME)-II scheme in India with effect from the June 1, 2023.

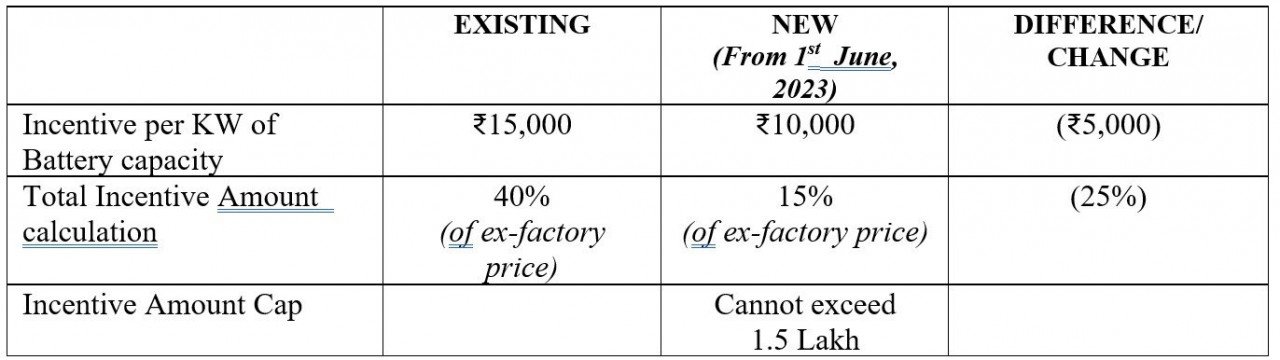

The notification, dated May 19, sets the subsidy available on E2Ws at ₹10,000 per kWh of the battery capacity, as against the existing ₹15,000 incentive for every kWh of the E2W's battery capacity. Further, the cap of the total incentives for the E2Ws has been lowered to 15 percent of their ex-factory prices (which cannot exceed ₹1.50 lakh), down from 40 percent at present.

Taken together, experts say these moves could cost premium E2Ws over 60 percent of their incentives, and E2W prices could rise in June, especially those of electric scooters. Some premium e-bikes might even see their prices rise to twice that of their petrol-fueled counterparts, they cautioned. On average, prices of E2Ws may rise between ₹15,000-30,000, depending on their battery capacity and vehicle pricing.

RELATED: MHI allocates ₹ 800 Cr. to Oil PSUs for setting up 7,432 Fast-charging EV stations

The industry seemed to welcome the move. Quoting the rise in government subsidy for E2W in 2019 and 2021, Tarun Mehta, Co-Founder of Ather Energy, commented on Twitter, "What goes up, must come down. The industry must stand on its own feet very soon".

Ather, in its Twitter ads, is persuading buyers to book its 450X premium e-scooter now and save up to ₹32,500, as prices are set to rise from June 1.

Vivekananda Hallekere, CEO of Bounce, applauded the revision. "I personally feel FAME subsidies being reduced is a great move. Current subsidy scheme isn't logical and the incentive is to be inefficient and pack as much as battery to claim highest subsidy. Waiting for the world without subsidy where innovation can happen", he wrote in Twitter.

India's E2Ws segment may undergo a significant re-calibration in terms of product line-up and packaging to prepare for the upcoming reduced or zero-incentive era for E2Ws.

Experts say the higher upfront costs might push companies to innovate and offer value-adds to their offerings to justify prices to buyers.

Reports say the FAME-II subsidy allocation for E2Ws – amounting to ₹2,000 crores – has been nearly exhausted, prompting the government to reduce incentives. The Center has transferred ₹1,500 crores of subsidy lying unutilized from the subsidy for electric three- and four-wheelers for use in the E2W segment, but analysis of E2W sales indicates that amount too could be exhausted by August this year.

RELATED: MHI introduces comprehensive testing parameters for safety of Batteries in EVs

In FY23, the E2W market registered sales of over 7,79,000 units, accounting for the largest chunk of EVs sold in the country.

E2W manufacturers are reported to have asked policymakers to further revise the subsidy structure under FAME-II to prolong the support till the end of March next year, when the scheme is scheduled to end.

It is yet to be seen how the E2W industry embraces the massive cuts to incentives meant for faster adoption of EVs.

Read More