No looking back: Energy transition in Brazil and Latin America

In many ways, this year was the tipping point for renewable energy. The world has woken up to the imperative of energy transition, and countries around the world have made progress on this front, albeit in different degrees. We take stock of their situation in this multi-part series.

BRAZIL

Energy Storage

Brazil remains the largest energy market in Latin America, offering diverse opportunities across various subsectors. Notably, the Brazilian Energy Planning Agency's (EPE) Energy Expansion Plan (PDE) for 2021-2031 underscores the continued emphasis on renewable sources, constituting around 50 percent of Brazil's energy mix from 2021 to 2031.

In 2020, renewables already supplied 85 percent of the electricity sector's demand, with expectations to reach 88 percent by 2030. Additionally, nuclear energy is set to expand with the anticipated launch of the Angra 3 power plant in 2028.

Hydropower currently dominates Brazil's electricity generation, accounting for 63 percent of the matrix. Wind power is the second-largest energy source with 15 GW of installed capacity, and an additional 4.6 GW is contracted or under construction, scheduled for completion by 2023. The country has 601 wind farms equipped with 7,000 wind turbines.

Emerging long-term solar energy projects could rival wind investments, witnessing a 40.9 percent increase in utility-scale solar energy in 2021, along with an 84 percent rise in distributed solar generation.

Given the challenges posed by variable electricity generation, there is a growing focus on expanding storage capabilities and innovative approaches encompassing electricity, heating, cooling, and mobility. To fully leverage advanced battery technology, Brazil must assess and, in some cases, enhance its legal, technical, educational, and economic frameworks. These measures will facilitate the adoption of battery storage and electric mobility.

Brazil's energy storage market is relatively small, with around 250 MWh of installed capacity, primarily associated with rural electrification and solar panels. In 2023, the country anticipates a significant addition of new power generation capacity, totaling 10.3 GW, driven mainly by large-scale wind and solar projects, as reported by the National Electric Energy Agency (ANEEL). Over 90 percent of this capacity will be attributed to utility-scale solar and wind projects, with a substantial portion concentrated in States like Bahia, Rio Grande do Norte, and Minas Gerais.

São Paulo's transmission grid operator, Companhia de Transmissão de Energia Elétrica Paulista (ISA CTEEP), has also energized an energy storage system, enhancing renewable energy integration. This system can deliver 60 MWh of energy for two hours, benefiting around 2 million consumers during peak times. It is Brazil's largest battery storage project, a 33.5 MW/67 MWh facility, and has commenced operations with an integrated solution provided by Kehua Tech, representing a significant milestone in the country's energy landscape.

E-mobility

The Brazilian light electric vehicle market showed significant growth in March this year, with 5,989 units sold. This marks a 55.5 percent increase compared to March 2022 when 3,851 units were sold. The first quarter of 2023 saw 14,787 light electric vehicles sold, reflecting a 50 percent increase compared to the same period in 2022, which saw 9,844 units sold.

These EVs include hybrid electric vehicles (HEV), plug-in hybrid vehicles (PHEV), and battery electric vehicles (BEV), spanning cars, light commercial vehicles, SUVs, and utility vehicles.

The best-selling electric cars in Brazil during this period were the Toyota Corolla Cross (HEV) and the Toyota Corolla Altis (HEV). Following closely were the Volvo XC60 (PHEV) and the Volvo XC40 (PHEV).

The Renault Kwid Electric was launched in Brazil, under the brand name Dacia Spring. This 5-seater hatchback from Renault features specific design elements tailored to EVs.

BYD Brazil also announced the pre-launch of the all-wheel-drive compact SUV BYD TANG EV (known as TAN EV in Brazil), marking BYD's entry into the Brazilian electric passenger vehicle market.

Industry experts emphasize the need for a national electromobility policy in Brazil to align and coordinate public policies between the federal government and the State and municipal governments to promote the transition to EVs.

One of the challenges identified is the limited availability of charging points, which can deter EV adoption. To address this issue, companies like Volvo, GWM, Raízen, GreenYellow, Audi, Engie, and EDP, among others, are investing in expanding charging station networks across the country.

Additionally, Brazilian automaker WEG SA has partnered with Neoenergia SA, a power company, to supply EV charging stations. Neoenergia, owned by Iberdrola SA in Spain, not only operates its electric car fleet but also distributes charging stations to businesses and individuals.

Green Hydrogen

Brazil currently has approximately $30 billion worth of hydrogen projects, including both low-carbon and fossil source projects equipped with CO2 capture, according to government data. To advance towards greener hydrogen production, the emphasis is shifting towards renewable sources like wind and solar power.

The government is actively considering the establishment of a regulatory framework for green hydrogen initiatives. This includes the possibility of offering tax incentives to encourage the production of GH2.

A mapping initiative led by H2 Brazil, a collaboration between the German Agency for International Cooperation (GIZ) and the Brazilian Ministry of Mines and Energy, has identified a total of 42 green hydrogen production projects across Brazil. These projects vary in size and development stages. Presently, Brazil produces limited quantities of certified green hydrogen at a facility in Pernambuco State, located in the Northeast region of the country.

However, Brazil is also exploring the potential for significant green hydrogen production and export hubs. Feasibility studies are underway for these hubs in strategic locations such as Pecem port in Ceara state, Acu port in Rio de Janeiro State, and Rio Grande do Sul State.

LATIN AMERICA

Energy Storage

Latin America generates more than a quarter of its primary energy from renewables, twice the global average. From Costa Rica, where renewable energy sources account for 99 percent of its electricity matrix, to Brazil at 83 percent, countries small and large are increasingly powered by clean energy.

Many countries in the region rely on hydropower as the main source of power supply. But while the benefits of hydropower as a green energy source is valued, the flipside is the erratic supply during periods of drought brought on by unpredictable rainfall caused by climate change. Add to that the high cost of hydroelectric plants, including environmental repercussions, and it becomes important for Latin American countries to tap into other renewable sources like solar and wind, which are amply available in this region. Furthermore, as economic development, population growth, and electrification progress, power demand is poised to grow, increasing the need for enhanced grid services.

Electricity demand in the region is already projected to double by 2040, and the electrification of transport and heating to decarbonize these sectors will drive it up further still. Energy storage will be a crucial element in order to integrate all this variable RE and develop clean and reliable grids.

Though energy storage deployment in this region is still nascent, the World Economic Forum states that energy storage will affect the entire electricity value chain across Latin America as it replaces peaking plans, alters future transmission and distribution investments, reduces intermittency of renewables, restructures power markets and helps to digitize the electricity ecosystem.

Regulation pertaining to energy storage is in an early stage in Latin America. However, some countries have begun to restructure their regulations to cater to storage requirements.

Here are some notable energy storage projects and developments in Latin America:

1. AES Andes, a subsidiary of the US multinational AES Corporation, has completed the largest battery storage project in Latin America in Chile's Antofagasta region. This project boasts a capacity of 112 MW and incorporates lithium batteries with a five-hour duration, providing 560 MWh of energy storage. It is co-located with 180 MW of solar PV capacity.

2. AES Andes is also working on another solar-plus-storage project, Andes Solar IV, located in Antofagasta. It is currently 80 percent completed and is expected to have a 147 MW output Li-ion battery storage system with a five-hour duration (735 MWh) and 238 MW of solar PV capacity.

3. In Colombia, a 290 MW coal plant is being transformed into a renewable energy site, using a combination of solar PV and battery storage.

4. Investment firms PASH Global and ERIH Holdings have formed a joint venture to develop utility-scale solar and battery storage projects in Paraguay.

5. Developer On.Energy is deploying 39 MWh of battery energy storage systems (BESS) at airports across Latin America.

6. Puerto Rico is actively pursuing a goal of decarbonizing its electricity matrix by 2050. The Energy Bureau has issued requests for proposals (RFPs) for renewable energy and storage projects, with 'Tranche 1' launched in 2021 and 'Tranche 2 and Tranche 3' announced in 2022, showing a commitment to renewable energy and energy storage development.

It is important to note that while Latin America has significant lithium reserves, there are currently no Li-ion battery giga factories in the region. However, there are facilities producing Li-ion batteries in countries like Bolivia (Quantum Batteries), Argentina (UniLib), and Brazil (BYD). These facilities tend to be smaller-scale or linked to niche EV production, such as trucks or buses, rather than serving the general market. The lack of a substantial domestic passenger EV market in the region is one of the challenges in developing large-scale LIB giga factories.

Argentina has plans to expand its lithium refining capabilities and is expected to double its share of the global lithium refining market by 2027. Additionally, a battery manufacturing plant is set to launch in Argentina, potentially indicating future developments in the region's battery industry.

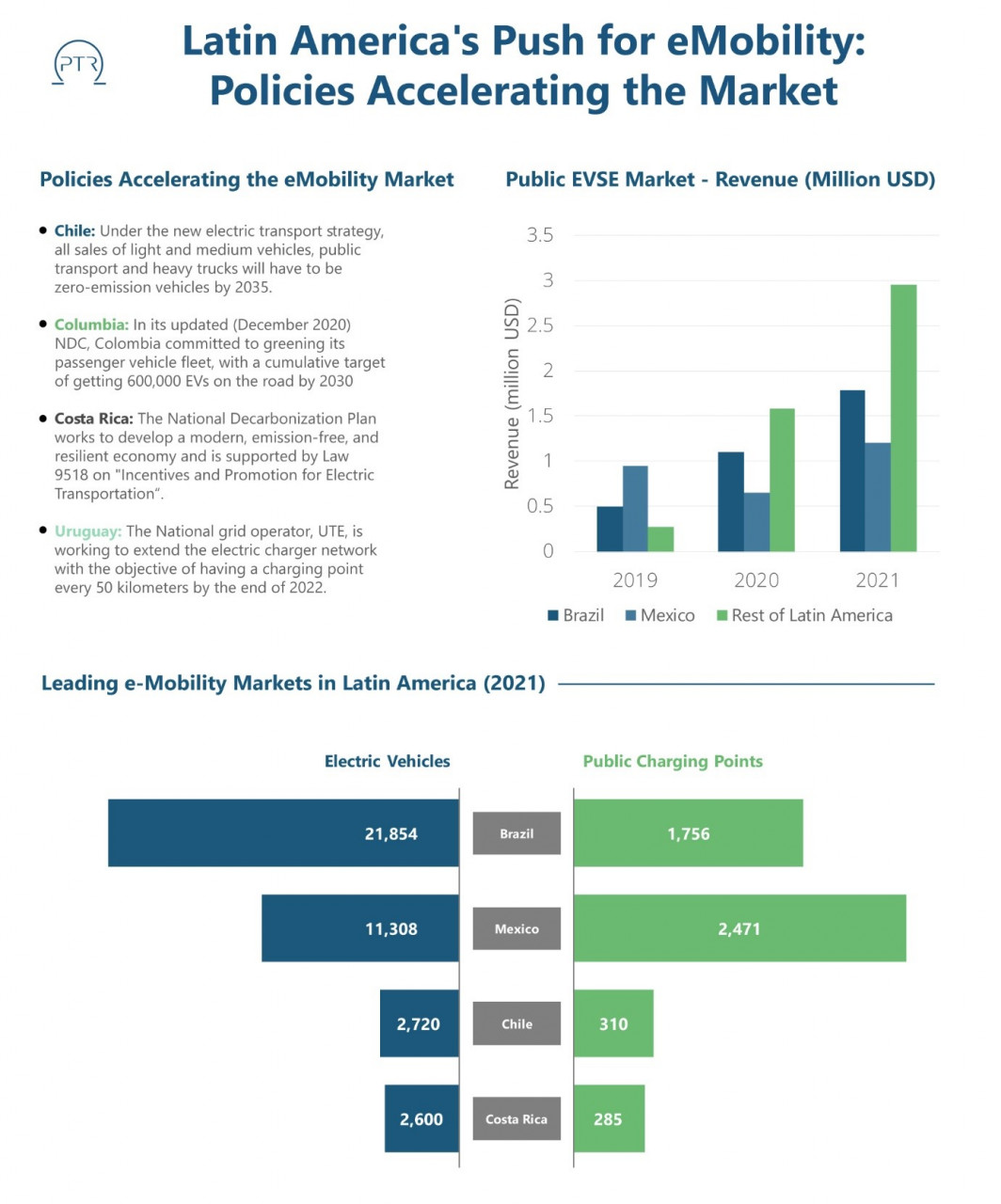

E-mobility

The E-mobility Program for Sustainable Cities in Latin America and the Caribbean (LAC) aims to enhance sustainable urban development in secondary cities across nine countries: Barbados, Chile, Colombia, Costa Rica, the Dominican Republic, Jamaica, Panama, Paraguay, and Uruguay. This program focuses on improving urban public transport and overall quality of life. By integrating e-mobility with sustainable urban transportation systems and climate resilience efforts, the program seeks to eliminate 7.5 million tons of carbon dioxide emissions. Additionally, its climate adaptation measures will provide direct benefits to 1.5 million individuals and indirect benefits to 9 million, accounting for nine percent of the total population in these countries.

The Inter-American Development Bank (IDB) is collaborating with the United Nations' Green Climate Fund (GCF) to establish the first regional fund dedicated to promoting electric mobility and green hydrogen adoption in LAC. As the transition to e-mobility gains momentum in public transportation systems across Latin America, it creates opportunities for various stakeholders, including investors, manufacturers, operators, and utility companies, to explore innovative business models.

In the South American Electric Vehicles Market, the top five companies, including Audi AG, Hyundai Motor Company, Nissan Motor Company Ltd, Toyota Motor Co, and Volkswagen AG, collectively occupy 58.70 percent of the market. Latin America has witnessed significant growth in electric buses, driven by public policies, declining technology costs, and innovative business models.

Over 10 transactions involving approximately 2,000 electric buses have been completed in cities like Santiago, Bogota, Medellin, and Mexico City since March. Bogota stands out as a leader in the e-mobility sector, boasting a contracted fleet of 1,485 e-buses, of which 351 are already in operation.

In 2021, EVs accounted for 0.7 percent of total car sales across the region. Brazil recorded the highest number of EV units sold, totaling 13,000, while Costa Rica led in terms of the percentage of cars sold with electric plugs, at 2.7 percent. Mexico, the sole EV manufacturer in the region, is also targeting exports to the United States, contributing to the growth of the EV market.

Green Hydrogen

Green hydrogen technology is rapidly advancing on a global scale, and Latin America is poised to become the third-largest region for green hydrogen projects by 2030, following Europe and Australia. The region is witnessing the emergence of various green hydrogen projects with the aim of expanding its production.

- Here are some noteworthy projects:

- Unigel, a Brazilian company, is set to inaugurate a $120 million plant in 2023. In its initial phase, the plant will produce 10,000 metric tons of green hydrogen annually, equivalent to 60 megawatts.

- Sener Ingeniería Mexico announced plans in August 2022 to establish a series of small plants, each with approximately 2.5 MW of green hydrogen production capacity.

- Chile has already begun to reap the benefits of its National Green Hydrogen Strategy, which was launched in 2020.

- Uruguay has established the Green Hydrogen Sector Fund, backed by $10 million in non-reimbursable government funding to support green hydrogen projects.

- In Costa Rica, efforts are underway to incorporate green hydrogen into the country's clean energy mix, which already relies on sources such as solar, wind, and hydropower for about 99 percent of its electricity generation.

The International Energy Agency anticipates that Latin America will become a prominent hub for clean hydrogen exports by 2030, with Chile identified as one of the countries with significant export potential and ongoing green hydrogen exports.

To view other articles in this series, click here.