Canada becomes first G20 nation to detail wind-up of fossil fuel subsidies

Canada has released an assessment framework for eliminating fossil fuel subsidies, becoming the first member of the G20 to deliver on the grouping's 2009 announcement to undertake such a process.

The framework announced by the government will cover existing tax structures as well as 129 non-tax schemes, but not affect multi-year subsidy agreements already in place. Canada's Environment Minister Steven Guilbeault told a press conference the government decision ensures that support to oil and gas industry only goes "to projects that decarbonize the sector and result in significant greenhouse gas emissions reductions."

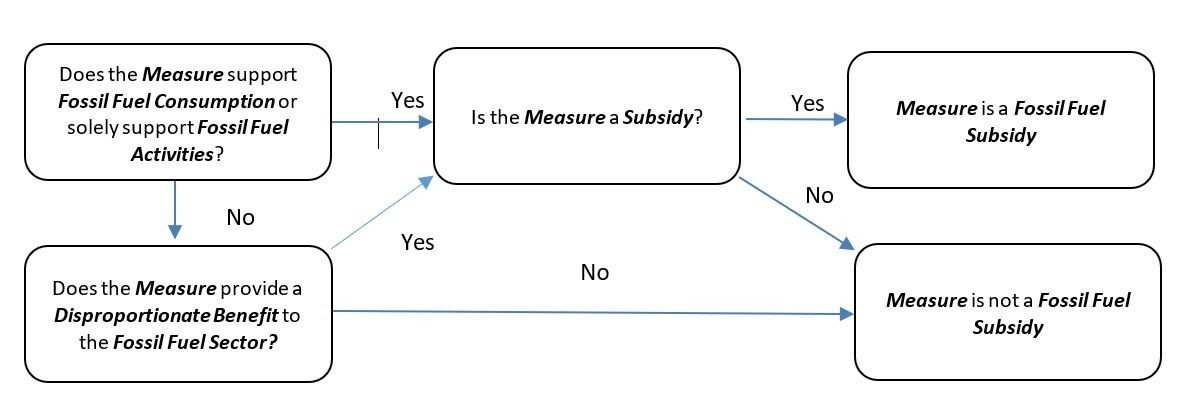

According to the rules, all measures will first go through a simple identification flowchart as shown below:

Following that, measure identified as fossil fuel subsidies will be considered "Inefficient Fossil Fuel Subsidies", unless they meet at least one of the following six criteria:

1.Subsidies that enable significant net GHG emission reductions in Canada or internationally In Alignment with Article 6 of the Paris Agreement

2.Subsidies that support Clean Energy, Clean Technology or Renewable Energy

3.Subsidies that provide an Essential Energy Service to a Remote Community

4.Subsidies that provide short-term support for Emergency Response

5.Subsidies that support Indigenous Economic Participation in Fossil Fuel Activities

6.Subsidies that support Abated production processes, or projects that have a credible plan to achieve net-zero emissions by 2030

Analysts welcomed the framework, but singled out support for fossil fuel projects that used carbon capture and storage (CCS) to reduce emissions as a disappointment. Industry, meanwhile, has been guardedly positive.

A consortium of Canada's six largest oil sands producers, dubbed the Pathways Alliance, said the organization was pleased to note the government partnership in the project. The alliance is planning to develop a $12.5 billion CCS hub in the state of Alberta.

Canada is the world's fourth-largest oil producer and expects CCS to play a significant role in decarbonizing the industry. Last year, the government had announced a tax credit for companies that deployed CCS in their plants.