FM bypasses EVs in Budget; abolishes duty on critical minerals to support domestic refining

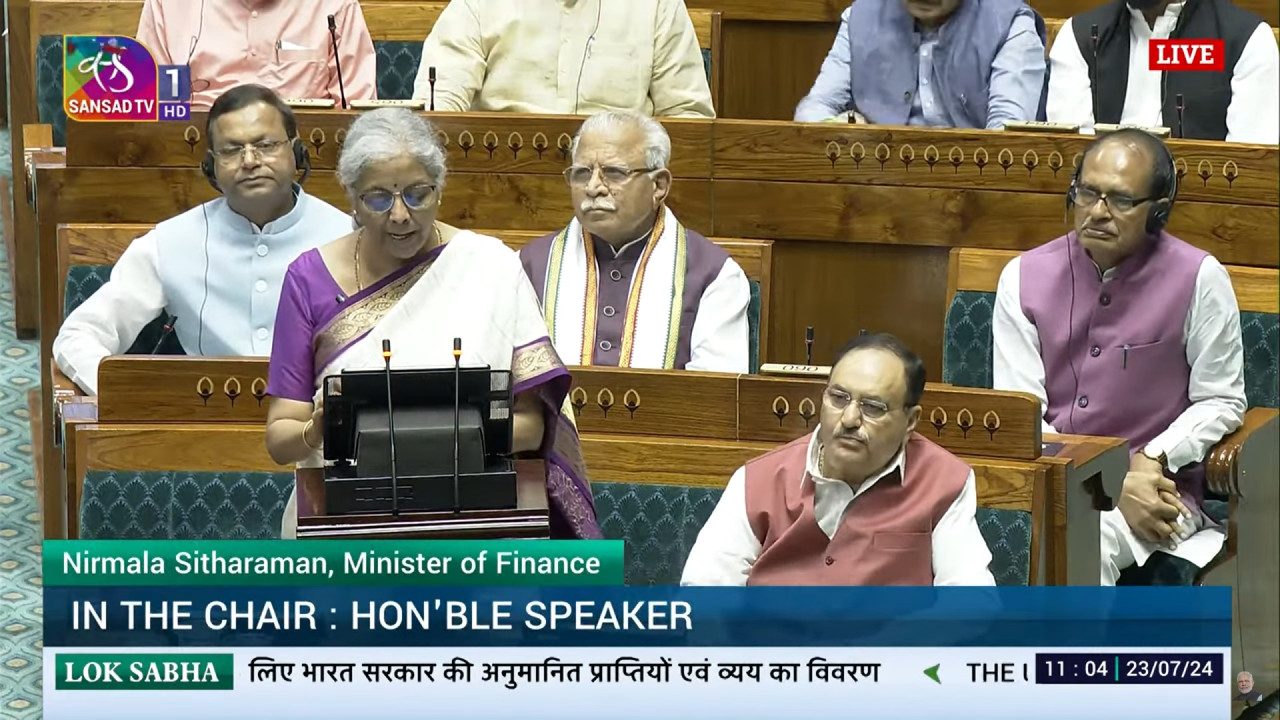

Union Finance Minister Nirmala Sitharaman delivered a mixed bag for the country's auto and electric mobility industry, by avoiding specific, new measures for either the traditional sector or the newer, electric players.

The sole cheer came from exemption of customs duty on critical minerals such as lithium, copper and cobalt and rare earths to promote domestic processing and refining of such minerals and improve availability for the country's battery manufacturers. These minerals used to attract customs duty between 2.5 percent and 7.5 percent.

In her speech, the FM proposed that 25 critical minerals be exempted from custom duties, saying, "This will provide a major fillip to the processing and refining of such minerals and help secure their availability for these strategic and important sectors."

The FM also exempted raw materials used in manufacturing such as ferro-nickel and blister copper from basic customs duty (BCD). Ferrous scrap and nickel cathode will continue to attract nil BCD as before.

Allocations for schemes such as FAME (to promote EV offtake among consumers) remained unchanged from the interim Budget. Consequently, the picture that emerged after the Union Budget was:

- FAME scheme allocation for FY25 stood at ₹2,670 crore (no change from interim Budget)

- Electric Mobility Promotion Scheme, launched in April, had allocation of ₹500 crore (no change from interim Budget)

- Auto performance-linked incentives (PLI) scheme allocation for FY25 stood at ₹3,500 crore (no change from interim Budget)

- Advanced Chemistry Cell (ACC) PLI scheme allocation was ₹250 crore (no change from interim Budget)

- Customs duty abolished on lithium, copper, cobalt to promote domestic processing and refining capabilities

- Ferro-nickel and blister copper exempt from basic customs duty (BCD). Ferrous scrap and nickel cathode to attract nil BCD as before

Dr. Rahul Walawalkar, President of India Energy Storage Alliance (IESA) and President and Managing Director of Customized Energy Solutions India Pvt Ltd welcomed the abolishing of customs duty, calling it "A great move towards making India the global hub for processing of critical minerals that are essential for advanced energy storage, e-mobility, solar and green hydrogen manufacturing domestically as well as for export".

Pointing out that customs duty exemption for critical minerals would support the country's lithium-ion battery manufacturing sector as well as associated supply chain, Dr Walawalkar called it "a great move in the direction towards making India the global hub for critical minerals."