Electric four-wheelers: Steering into the next phase of sustainable transportation

With the striving thrust from the government for boosting indigenous manufacturing through the Atmanirbhar Bharat initiative, the original equipment manufacturers (OEMs) and allied sectors are gearing up for the new opportunities in India's evolving e-mobility ecosystem.

The global automotive industry is on the edge of disruption. Four technology-driven trends — electrification, shared mobility, connectivity, and autonomous driving—are leading the automotive industry to this disruption. Out of these, Electrification is of significance and might considerably impact auto OEMs and auto component manufacturers. India has big plans for the emerging EV sector and its technologies. The country has great expectations of accomplishing a high level of penetration in e-mobility by 2030. EVs in India have opened ample business opportunities for automobile companies within the country and across the globe.

The e-4W market in India

India represents the fourth-largest automobile market in the world. The World Economic Forum and Ola Electric emphasized that the Indian automobile industry is one of the fastest-growing markets globally, but it still just makes up 0.5 percent of the global EV market. The EV market is expected to be a ₹50,000-crore opportunity in India by 2025 and it is expected to drive higher electrification of the vehicles in the medium term, in the wake of COVID-19.

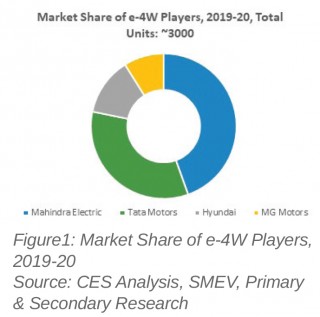

The EV market in India has gained significant momentum after the implementation of the FAME India scheme. In FY 2019-20, the industry sold ~3000 units. The market has gained traction from the customers with the launch of new high-performance vehicles in the market.

As per the Society of Manufacturers of Electric Vehicles (SMEV), the sales of e-4W have slumped to 3,400 from 3,600 units sold in FY19. The fall in the sales of electric cars is being credited to the lack of bulk purchases in FY20. However, electric cars have also started to see traction in the shared mobility segment, though the range of EVs and lack of charging spots continues to be a challenge.

The acceptability of electric cars in the premium segment in the second half of the year was a positive signal of a significant jump of a much higher volume of e-4Ws in FY 20-21, according to SMEV.

Policy framework: Giving impetus to growth of e-4W market:

The uptake of EVs in India is projected to yield diverse benefits for the country, such as lowering pollution levels, enhancing energy security with improved balance-of-trade levels, and meeting global climate-change commitments. The improved use of EVs could reduce CO2 emissions by 37 percent. To enable the higher and faster rate of adoption of EVs in the country, a clear policy directive is important. Indeed, some key policy decisions to this effect have been taken in recent years, e.g., the National Electric Mobility Mission Plan (NEMPP) 2020, launched in 2013 by the Department of Heavy Industry (DHI), as a roadmap for the faster manufacture and adoption of EVs in the country. Under this plan, the government of India targets to reach sales of six to seven million hybrid vehicles and EVs by 2020.

As part of the NEMMP, the faster adoption and manufacturing of (Hybrid) EVs in India (FAME India) Scheme was informed in April 2015, to encourage the manufacture of electric and hybrid vehicle technology. Initially launched for a period of two years, FAME-I, the first phase of the scheme, was extended to a period of four years, until March 31, 2019. A total of ₹5.29 billion was allocated and utilized under the scheme, a major portion of which was established for demand incentive (about ₹3.43 billion). To boost wider adoption, buyers were given demand incentives in the form of an upfront reduced purchase price.

Phase-II of the FAME Scheme was rolled out on April 1, 2019, to be executed for a period of three years, until March 31, 2022. FAME-II received an enormous outlay of `100 billion, compared to the meager funding of FAME-I, of which only 60 percent was utilized. Thus, the outlay for FAME-II is almost 19 times more than the fund utilization of FAME-I. This is a substantial budget jump for a sustained policy and can be accredited to the fact that the government views FAME-I as a way to set up the stage for enhanced EV mobility. FAME-II will then aim to increase EV adoption in the country. The budget provision also shows the government's commitment to the EV sector, which in turn can motivate companies, researchers, and buyers to assign resources for the sector.

The incentives under FAME are valid for EVs fitted with advanced chemistry batteries and those used as commercial vehicles for public transportation. Further, there are maximum price and minimum top-speed requirements, amongst several conditions that must be met to avail incentives. Some of these conditions for FAME-II are different from those for the first phase.

Recently, Union Minister for Road Transport & Highways, Nitin Gadkari, conveyed confidence that India will become a major manufacturing hub for EVs and the government is in process of extending all the support it possibly can to the industry. The Ministry of Finance has already revised the Good and Service Tax (GST) rates for the industry at 12 percent.

| State EV policy environment |

| Over ten States in India have final or draft EV policies that support the national e-mobility policies. The States with approved EV policies comprise Andhra Pradesh, Karnataka, Kerala, Madhya Pradesh, Maharashtra, New Delhi, Tamil Nadu, Telangana, Uttarakhand, and Uttar Pradesh. |

| Andhra Pradesh |

| • Aims to have 1,000,000 EVs on the road by 2024 • Complete reimbursement of road tax and registration fees on sale of EVs until 2024 • Replace public transport buses in four cities to e-buses by 2024 and across the State by 2030 • Establish one lakh (100,000) slow and fast charging stations by 2024 • Celebrate 'green days' to create awareness among public |

| Gujarat |

| • Aims to have 100,000 EVs on Gujarat's roads by 2022 • Investment of `50 lakh for installing charging infrastructure in the State • Investment of `800 crore for incentivizing the adoption of EVs in the State |

| Karnataka |

| • Aims to achieve 100 percent e-mobility in auto-rickshaws, cab aggregators, corporate fleets, and school buses/vans by 2030 • Local public transport bus fleets will introduce 1,000 EV buses • Providing incentives such as interest-free loans on the net State GST for EV manufacturing enterprises • Focus on a venture capital fund for e-mobility start-ups, and the creation of a secondary market for batteries • Set up 112 EV charging stations in Bengaluru |

| Kerala |

| • Aims to put one million EV units on the road by 2022 and 6,000 e-buses in public transport by 2025 • Incentives, such as State tax breaks, road-tax exemptions, toll-charge exemption, free permits for fleet drivers and free parking • Viability gap funding for e-buses and government fleets • Prioritizes EV component manufacturing • Create e-mobility demonstration hubs in a few potential areas such as tourist villages, technology hubs, and major cities' central business districts |

| Madhya Pradesh |

| • Rapid EV adoption and contribution to 25 percent of all new public transport vehicle registrations by 2026 • Shared e-rickshaws and electric auto-rickshaws incentives: free cost of permits, exempt from /reimbursement of road tax/vehicle registration fees for five years, 100 percent wavier on parking charges at any municipal corporation run parking facility for five years • Some cities to stop registering new internal combustion engine (ICE) autos • Ensure safe, reliable and affordable charging infrastructure, and promote renewable energy usage for charging |

| Maharashtra |

| • Increase the number of registered EVs to 500,000 over the policy period • Generate an investment of ₹25,000 crore ($3.4 million) in EV and component manufacturing and create jobs for 100,000 people • Exempt EVs from road tax and registration fees over five-year policy period • Enable fuel stations to set up charging points through governing regulations • Support for charging infra-structure by planning authorities and electricity supply agencies • Incentives for micro, small and medium enterprises and large manufacturing units • Modify building/property rules to help establish a robust public charging infrastructure in the State |

| Delhi |

| • Introduce 500,000 EVs in the city by 2024 • Create new jobs including driving, selling, financing and charging of EVs • Offer incentives on buying EVs • New scrapping incentive on exchanging conventionally powered vehicles with new EVs • A large network of charging station, first 200 charging stations by the end of 2021 • Long term goal is charging station at every 3km |

| Tamil Nadu |

| • Electrify 5 percent of buses every year by 2030, and substantially convert shared mobility fleets, institutional vehicles, and e-commerce delivery and logistics vehicles to EVs by 2030 • Convert all auto rickshaws in six major cities to EVs within a span of ten years • Establish a venture capital and business incubation service to encourage EV start-ups • Re-skilling allowance for employees working with EV manufacturing units • EV-related and charging infra-structure manufacturing units will receive 100 percent exemption on electricity tax through 2025 |

| Telangana |

| • 100 percent road tax and registration exemption for first 200,000 EVs; 5,000 units of e-4Ws and 20,000 electric auto-rickshaws • The companies investing in the development of infrastructure will be offered 20 percent fee subsidy, max up to `30 crore. • 25 percent discount on the power consumption by the charging stations • Around ₹1,425 crore will be spent toward incentives and 775 acres of land will be made available for EV manufacturers |

| Uttar Pradesh |

| • Roll out nearly 10 lakh (one million) EVs across all segment of vehicles by 2024 • Launch 1,000 e-buses and achieve 70 percent EV public transportation on identified green routes, in identified ten EV cities by 2030 • Phase out all conventional commercial fleets and logistics vehicles and achieve 50 percent EV mobility in goods transportation in identified ten EV cities by 2024 and all cities by 2030 • Establish a single-window system in place for all approvals required for EV and battery manufacturing units • Encourage new apartments, high-rise buildings, and technology parks to make provision for EV charging infrastructure • Aims to be a research and development hub for EVs by focusing on the next generation of battery management systems, from production to disposal • Work with universities and colleges to promote more research and development in e-mobility |

e-4W market amidst the COVID-19 pandemic

In the last few years, India has witnessed a series of measures taken by the government to support the shift to electric mobility. Despite favourable policy measures and increased thrust by the government along with the introduction of more products, the market acceptance of BEVs, particularly in the passenger vehicle segment, remains low due to the challenges of the higher upfront price of EVs, range anxiety, lack of charging infrastructure and low consumer awareness.As per industry data, the sales of electric cars in FY 2019 and 2020 was 3,600 and 3,400 units constituting a market share of 0.11 percent and 0.12 percent respectively.

Globally, customer acceptance is the key determinant for the pace of electrification. Besides the essential requirements of performance, quality, durability, convenience and the value proposition, the usage requirements determine the customer choice for various electrified technologies (xEVs). Globally, government support coupled with stricter regulations, especially fuel efficiency norms, is leading to a discernible shift to the entire range of electrified vehicles (xEVs) that includes strong hybrid electric (SHEV), plug-in hybrid electric (PHEV) and battery electric vehicles (BEV). The penetration of different xEVs varies in different countries. For Japan, the penetration of SHEVs is approximately 33 percent and growing year-on-year. In the EU, OEMs are deploying BEVs, PHEVs and SHEVs in order to achieve the upcoming fuel efficiency norms or CO2 emission targets.

Toyota has led the ranking and posted the best improvement in CO2 emissions in 2019 as compared to 2018. Even in 2020, Toyota was amongst a few large players that continue to reduce CO2 year-on-year thereby being comfortably placed to meet the upcoming stiff CO2 emissions targets. Even in the ASEAN region, in countries like Thailand, the growth of SHEV sales has been very strong owing to good consumer acceptance coupled with incentives and taxation policies being merit-based and technology-neutral.

e-4W sales in 2020 and future trends

Today, Toyota is the largest xEV manufacturer with 15 million units (including SHEVs, PHEVs, BEVs and FCEVs) sold globally until March 2020, resulting in 125 million tons of CO2 emission reduction and 47 million kilo-litres of savings in gasoline. Over the years, cumulatively we have sold over 5,300 hybrid vehicles in India of which over 4,800 units were Camry hybrid vehicles, which alone resulted in CO2 emission reduction of 14.1 million kilograms and fossil fuel savings of 5.9 million litres till date. Going forward our endeavour would be to provide all xEV technologies based on consumer acceptance and demand. With appropriate taxation and supportive policies, our commitment is to provide the best products that meet the needs of the customer and continuously contribute to meet the national objectives and the wellbeing of the environment.

Growth of e-mobility

Despite tremendous efforts from the Central and State governments to encourage electric mobility in the country through various interventions, which include FAME-II scheme, lower GST as well as several initiatives at State government-level like EV policies, the customer acceptance for electrified passenger vehicles remains low. The journey for creating widespread charging infrastructure has just started in our country and we have a fair distance to travel if the range anxiety of the consumer is to be adequately addressed.

For faster adoption, the existing challenges need to be addressed and one of the biggest issues is the current high prices of EVs. As per most forecasts by 2030, the BEV new car sales are likely to be in the range of 7-15 percent. At this level even by 2030, petrol/diesel cars will continue to constitute a vastly predominant portion of all the cars on the roads. This is not desirable for mass electrification to take place; it is essential to have local EV parts manufacturing eco-system on a large scale that is globally competitive in terms of price and quality.

Challenges in accelerating e-mobility

For India, key national goals include reducing imports, fossil fuel consumption, carbon emissions, pollution, enhancing local manufacturing and creating jobs. Alternate fuels and xEVs are key enablers for shifting away from dependence on fossil fuels. The challenge before us is to make certain that as we shift to BEVs, the savings in oil consumption are not nullified by the import of BEV parts and that contribution of manufacturing to GDP is not impacted as is the creation of jobs. For this, we need to ensure that a robust manufacturing ecosystem for EV parts is created along with measures to ensure greater consumer acceptance of BEVs. The customer's readiness to adopt any new technology is one of the biggest challenges and this is even more severe for EVs. Owing to lower consumer acceptance of EVs it is essential that all xEVs, which include SHEVs and PHEVs, are also supported proportionally by government policy. This will facilitate investment viability for local EV part manufacturing through the aggregation of demand of these parts, as all xEVs have common EV parts. Therefore, securing a significant tax rate gap between SHEVs and petrol vehicles in the short term and migrating to carbon-based taxation (GST) in the mid-term will be critical to bring down the prices of all xEVs substantially and will enable wider consumer acceptance, which in turn can catalyse the creation of a vibrant and self-reliant EV manufacturing eco-system in India. In addition, to resolve issues of range anxiety a ubiquitous and widespread charging infrastructure needs to be put in place.

Scope for indigenous manufacturing

Indigenous manufacturing is essential for realising the national objectives of reduction of imports, energy security, economic growth and creation of jobs for millions of young Indians. However, at present e-mobility is in a nascent phase in India and most of the EV power train parts are imported; the auto sector is also heavily dependent on import of electric and electronic parts as these are not domestically manufactured. Supportive policies that are technology-neutral, and supply-side incentives from the government can help facilitate the creation of the local manufacturing eco-system and self-reliance.

Toyota Kirloskar Motor in India has always focused on creating a strong local manufacturing ecosystem. Over our two decades of existence, we have heavily invested in creating world-class and scalable processes and

people across our value chain. At present, our flagship products have achieved over 85 percent of localization and our endeavor is to achieve greater heights. As pioneers of electrified technologies, our focus is to push for mass electrification, which can be created only by encouraging localization of electrified vehicle parts. We hope that with supportive technology-neutral government policies, including an adequately favourable taxation regime for all xEVs, we will be able to realise our objective of mass electrification with a focus on 'Make in India'.

PLI scheme for ACC battery

The production-linked incentive (PLI) scheme announced by the government for ten sectors will provide the required boost for the Atmanirbhar Bharat mission. The scheme can potentially help attract large-scale investments that can facilitate the introduction of latest technologies, processes and manufacturing at global scale thereby sharply enhancing local manufacturing capabilities, boosting exports, accelerating economic development and creating jobs.

Currently, the Indian automotive sector accounts for nearly 49 percent of manufacturing GDP and is very competitive. The government has earmarked a major share of the incentives for this sector which will go a long way in making India the global hub of automotive manufacturing and exports. Besides, the incentives for manufacturing of advance chemistry cells (ACC) will give a boost for creating a global scale domestic manufacturing eco-system for the most expensive part of an EV i.e., advance batteries. This will contribute significantly towards creating an ecosystem for the faster introduction of affordable EVs in the country.

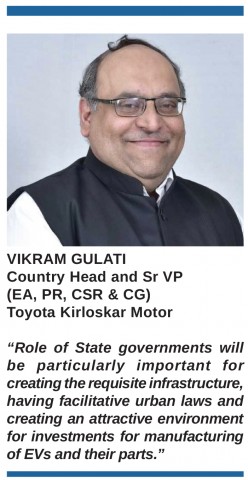

State EV policies

Various State governments have introduced EV policies with the aim of encouraging their adoption of EV, and to attract investments for manufacturing of EVs and their parts. These efforts of the State governments will greatly add to the measures being taken by the Central government. Role of State governments will be particularly important for creating the requisite infrastructure, having facilitative urban laws, and creating an attractive environment for investments for manufacturing of EVs and their parts. As in the case of Central government policies, we believe that States also need to adopt a technology-neutral approach with proportionate benefits for all xEVs, for mass electrification to take off.

E-4W market amidst the COVID-19 pandemic

EVs (BEVs) are imperative for India given the acute problem of pollution and ever-increasing import bill. Taking cognizance of this fact, the government of India has set a target of achieving 30 percent penetration in new car sales by 2030. In line with intent, the government has also come out with the policies and incentives (fiscal and non-fiscal) to support the development of an EV ecosystem in India. In addition, multiple OEMs have announced EV models in the coming years and multiple ecosystem players are coming forward to address the concerns of charging, financing, etc. Given all these actions, and reducing the cost trend of critical sub-systems like batteries, we think that EVs will become mainstream in the next decade in India.

Indian EV industry caters to two prominent segments: fleet and personal. In FY20, 67 percent of the total industry sales came from fleet segment which is witnessing subdued demand on account of work from home measures instituted by corporates, and reduction in business of mobility service providers owing to COVID-19. As a result, at the end of H1, fleet industry is down by 82 percent on a lower base of FY20.However, personal segment has seen a good uptake in volumes on the back of new product launches. At the end of H1, industry has sold 1774 units of EVs to personal segment customers as against mere 181 sold in H1 FY20. Personal segment of Indian passenger vehicle industry is 7-8 times larger than the fleet segment. Thus, even lower penetration in personal segment will be a huge upside for the nascent EV industry.

E-4W sales in 2020 and future trends

Tata Motors is one of the market leaders in the EV segment with 67 percent market share H1-FY21. We have proactively identified evolving needs of both fleet and personal consumers and have come of up with right product interventions which are propelling the growth of EV industry in India.

Growth of e-mobility

Although the EV industry has grown significantly in H1 of FY21, the growth is solely driven by personal segment. Fleet segment, which got impacted owing to work from home measures, continues to witness restrained demand. Product actions are always important for growth of the industry and with new EV product launches by various OEMs, we witnessed a lot of excitement in the market. The industry is also investing aggressively in technology and towards building the ecosystem. This, along with reducing battery costs will certainly boost the sector in coming times. Moreover, the demand for EVs will see a significant jump owing to upcoming emission norms such as CAFÉ, BS-VI Phase II and RDE.

Challenges in accelerating e-mobility

There are principally two challenges:

•First, EV battery cost continues to be a dominant aspect of vehicle electrification. As the conventional IC powertrains are replaced by Li-Ion battery, motor and reduction drive, the cost of the propulsion system goes up significantly. This means, despite FAME incentives, the on-road price of a typical B segment car is well beyond the expectations for a retail customer, eventually limiting its penetration. Optimizing costs of the electrical drive systems and providing a commensurate payback in terms of reduced operational costs are the major challenges for OEMs including Tata Motors.

•Another challenge is the absence of electric charging infrastructure for EVs in India. Customers are reluctant to take on an EV with the uncertainty of being able to re-charge the batteries.

State EV policies

EVs (BEVs) are imperative for India, given the acute problem of pollution and ever-increasing import bill. Taking cognizance of this, the government of India has set a target of achieving 30 percent penetration in new car sales by 2030. FAME I and FAME II schemes along with several other tax benefits, including reduced GST are acting as catalysts and are driving the adoption of e-mobility in personal and public transportation.

Way Forward

The EV segment in India has gathered momentum in recent years, but a mismatch in intent and action has resulted in limited on-ground adoption of EVs. However, the expected growth of the automobile sector (especially in the personal-mobility space), due to the ongoing COVID-19 pandemic and people's increased understanding of vehicular emissions, generates massive scope for the exponential growth of the EVs industry in India. Essential decisions and investments are necessary to facilitate this. As the government announces stimulus-based investments to alleviate the outcome of the pandemic, the EV sector must be made a beneficiary as well. For the EV sector, the government should work towards developing an ecosystem across the value chain. Now more than ever, policy actions with a long-term vision have become critical. It is important to enable a holistic growth for the EV sector and develop a strong EV value chain in the country. This will also support the government's objective of the country becoming self-reliant and enhancing domestic manufacturing. India is a large market for automobiles and with a paced transition to EVs, the country can enhance local manufacturing, lower oil dependence and consumption, and indeed enable a global clean transition.