Battery Nation in the making

The government push for battery cell manufacturing in India on a larger scale had begun a while ago, but it is with the introduction of the PLI schemes for ACC and electric vehicles that the possibility seemed nearer. This year's budget furthered the aspirations by announcing allocations for the growth of RE, grid integration, e-mobility, and charging, among other things. The spotlight now is on energy storage and the important role it will play in realizing the nation's plans of initiating the green energy transition.

Research reports point out that India will need a minimum of 10 GWh of cells by 2022 and 50 GWh by 2025. This could be a result of a surge in demand for EVs expected in the coming years, something that is eagerly anticipated for e-mobility to take off in a big way. The energy storage sector excited with the prospect welcomes the government mandates as the probable link between EVs and mass adoption. In that aspect, the subsidies announced through the PLI could well give a boost to local manufacturing and intensify demand across India.

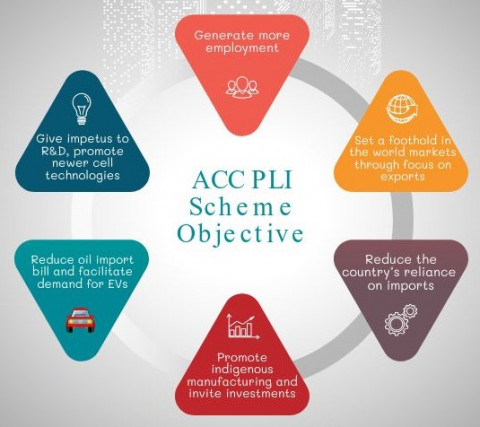

Widely welcomed by industry leaders, the PLI schemes are considered a concrete step towards achieving self-reliance, achieving a manufacturing capacity of 50GWh of ACC and 5GWh of 'niche' ACC, with an outlay of ₹18,000 crore; and enhancing the manufacturing capabilities of Advanced Automotive Products (ATT), with an outlay of ₹25,938 crore.

In an overwhelming response to the schemes, the government has received a total of 10 bids with a capacity of 130 GWh -- over twice the manufacturing capacity to be awarded – under the 'National Programme on Advanced Chemistry Cell (ACC) Battery Storage'. An encouraging response was also received for the PLI scheme for the automobile and auto components sector, with almost 95 companies approved from around 115 applications received.

Prospect of progress

The PLIs have opened up the space for the industry to bolster business opportunities, and companies – whether selected or not - will continue to invest in the space in whatever capacity they can at the moment. Optimism is less about facts and more about prospects. So, whatever the figures are pointing at, it is the possibilities of progress that will matter most.

As efforts toward energy transition accelerate, domestic battery manufacturing will be critical in ensuring energy security for the country. Building a manufacturing base that will not only cater to the domestic EV and grid storage markets but also turn into a global hub for batteries, requires stringent commitment.

"It is going to be very challenging, no doubt, but also very exciting. We are looking forward to it, at the same time next 18 to 24 months are going to be extremely crucial and we need to put a very solid foundation for this industry. We need to put a lot of effort into scaling up the skill development and training efforts, particularly around the manufacturing processes where there is very little work right now happening in India. We have to have a very strict learning curve," says Dr. Rahul Walawalkar, Founder & President – of India Energy Storage Alliance (IESA).

He believes that while government subsidies will help tremendously - especially in the initial years of setting up Giga factories, to become a global hub and to be competitive in the international market, India has the next five years as available time, "within which we have to get our act together".

Addressing Challenges

Like any other growing industry, battery manufacturing also comes with its share of challenges. Some of the uphill tasks are going to be:

- Development of a strong and sustainable raw material supply chain

- Decision on a choice of chemistry that will suit Indian climate conditions

- Setting up battery standards to ensure performance and safety

Establishing a domestic supply chain for lithium-based batteries, in an environment that relied on Li-ion imports for a long, is not going to be easy. To begin with, maybe not 100 percent, a large chunk of the value chain for battery manufacturing can be captured locally. Plans to scale up battery production need to be ably supported by careful planning and sound supply chain strategies.

Dr. Rahul Tongia, Senior Fellow at the Centre for Social and Economic Progress (CSEP), feels: "We also need to innovate on materials and supply chain issues, starting with materials security and concerns over toxicity all the way to end of life recycling and disposal. Of course, we must 'Make in India', but how we kick-start the process (to go from low-volume|high-cost to high-volume|low-cost) is tricky. We cannot rely solely on production incentives eventually."

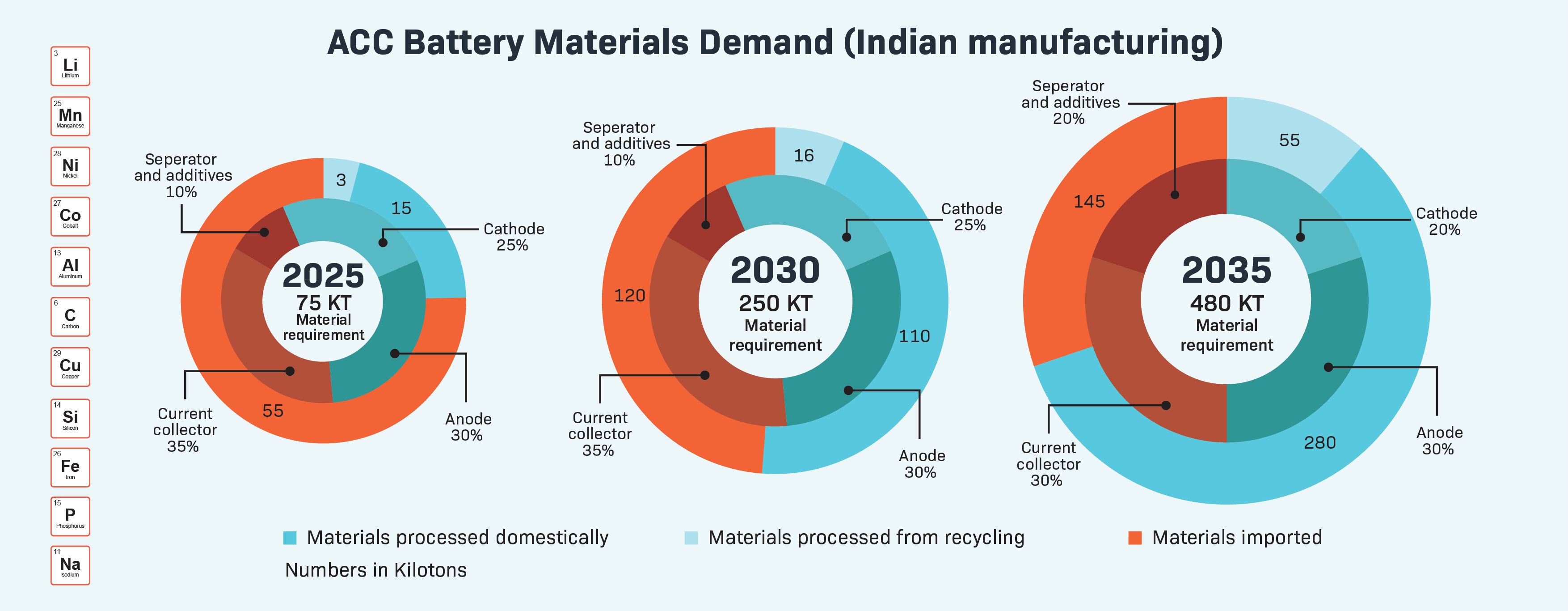

Filling the materials gap

In developing a raw material ecosystem, we might be a few years behind. Ideally, the process should have started much before the battery production plans were afoot. The raw material suppliers could have used that time for the material qualification process so that by the time the Giga factories are up in a couple of years, they could have been at par in scaling up. But it is still not too late to start, believes Vikram Handa, MD of Epsilon Carbon and also Chair of the India Battery Supply Chain Council: "There are a lot of material development companies that are doing very well, and new technologies are coming out. Giga-scale manufacturing will create a demand in the market, so funding and resources will be committed to this. But there's a lot more to do because the segment is very big; hopefully, more players will enter and more investments will come into this space."

Talking about the Indian companies who applied for the PLI scheme, Mr. Handa said: "Whether they won or not, all of those companies are bullish on investments in India and the Indian market needs this. A lot of them are also in the process of qualifying material. I think India can become a very big export hub for battery materials in the future, the demand is going to be a lot in India and globally."

Beyond the supply chain risk – there is also a need for technology tie-up and infrastructure setup. There is a need for continuous R&D investments to be future-ready.

Rakesh Malhotra, Founder – Livguard Energy Technologies, believes that the current technology of Li-ion base inherently puts India at supply chain risks. "Current technology is largely import dependant – with India neither having the mines nor the processing capability leaves it at risk of global supply shocks. The country should look at investing in mines with friendly nations like Australia, and invest in India for downstream refining."

"To avoid import dependence, akin to crude oil Import, India needs to invest in capability and R&D to work on newer technologies that are emerging, which are fit for the market and also allow for supply chain reliability," Mr. Malhotra added.

So far, there are no direct incentives available for setting up any supply chain activities in India. The direct push will probably come when the Giga factories in India start procurement and try to achieve the required domestic value addition to get the incentive. The stringent 3- to 5-year timeline will prove to be crucial, and all stakeholders including the auto OEMs, the Giga factories, and the raw material suppliers need to work in an aligned partnership, boosting each other's progress.

R&D for better performance

Here also is the opportunity for R&D investments in battery innovations that could address some of the raw material concerns, as well as the more critical safety issues. In the wake of recently reported EV fire incidents from around the country, it is important that maintaining battery standards in terms of performance and safety are given focus. If there is one thing, in the scheme of EV adoption, that is most unpredictable – is the decision of the end-user. And safety plays an important role, in that decision-making.

India is facing one of the most significant manufacturing opportunities of the decade; one that it just cannot risk losing. If that happens, like in solar we might become dependent on imports for yet another value chain segment. But optimism should be die-hard; it should prevail through all challenges, embracing growth opportunities and disregarding speculation.

Numbers game we can play some other time, right now let's celebrate the onset of a battery nation in the making.