Decarbonization goals pave way for growth in energy storage

As electric mobility and renewable energy sectors see major expansion globally, the energy storage market is all set for robust growth.

Integration of large-scale renewable energy into the grid and the shift towards electric mobility have led to a growing interest in the energy storage sector globally.

As the share of intermittent renewable energy (energy generated from hydropower, solar, wind, geothermal, bioenergy, wave, and tidal) increases in our energy mix, the power grid will need more flexibility to respond effectively to the changes in supply and demand. Correspondingly, as the uptake of xEVs, plug-in hybrid, hybrid EVs, and FCEVs grows -- energy storage technologies will have an important role to play in developing the energy grids and transportation sector of the future.

Energy storage deployment scenario globally

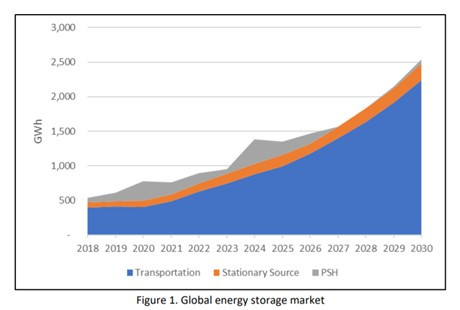

The global stationary storage and transportation energy storage, combined annual market is projected to increase fourfold by 2030 to more than 2,500 GWh, from a 2018 baseline, according to the Energy Storage Market Report, 2020 released by the Dept. of Energy.

[Note: In Figure 1, pumped hydro storage (PSH) is separated from the rest of the stationary storage as it is generally reported in GW instead of GWh, and its storage duration is often not available. For this diagram, it was estimated with a 21-hr storage duration based on a range of 18–24 hr.]

Of this, most of the growth will come from xEVs due to the push towards e-mobility globally driven by national decarbonization goals set up by countries and lucrative government incentives.

In terms of the stationary market, much of it is related to grid and commercial resilience. This sector is expected to witness a surge in demand as energy storage systems will be needed for providing ancillary services, peaking capacity, energy shifting at both the distribution and transmission level as more variable renewable energy gets added to the energy mix. Further, large-scale stationary energy storage applications in the commercial and industrial sector, for EV charging infrastructure, long-duration energy storage, UPS backup plus at data centres, as well as for telecom power backup and industrial and military use – these will serve as some of the major applications driving the growth of the stationery market.

Energy storage in transportation

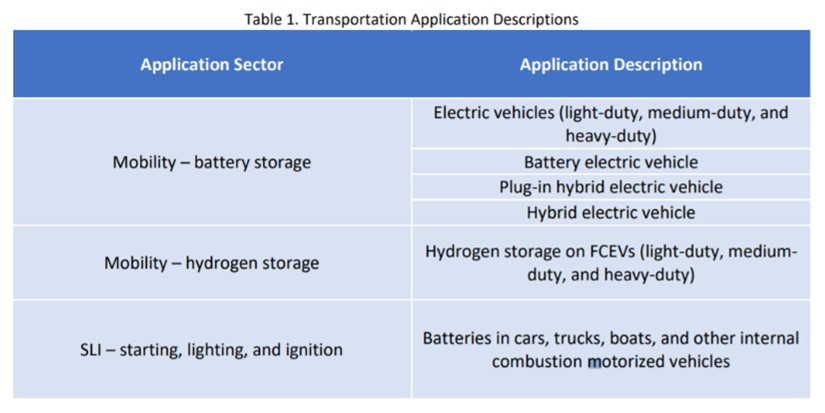

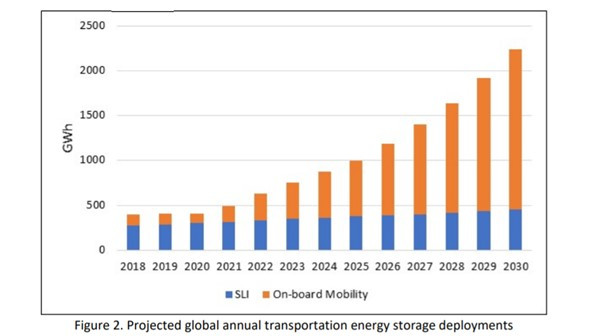

In the transportation sector, studies point that for SLI (starting, lighting, and ignition) applications lead–acid batteries currently dominate the transportation market exclusively as they are used in all types of vehicles — internal combustion engine vehicles, xEVs, and FCEVs. Whereas storage in battery electric vehicles and plug-in hybrid is dominated by lithium-ion batteries.

Mobility storage deployments, which include both onboard battery and hydrogen storage, currently remain a fraction of SLI. However, reports estimate on-board mobility will likely increase SLI deployments for the first time in 2023, with a considerable growth expected through 2030.

Although 2020 was a tough year for the auto sector with the global automobile market contracting 16 percent due to the COVID-19 pandemic, the momentum for the sale of electric cars continued. A record 3 million new electric cars were registered in 2020, registering a 41percent increase from the previous year.

As the strong drive towards electric cars continues, last year another notable shift in the EV car market took place with Europe surpassing China as heart of the global electric car market. Electric car registrations in Europe more than doubled to 1.4 million, while in China they increased 9 percent to 1.2 million [International Energy Agency's Global Electric Vehicle Outlook, 2021].

As of today, 90 percent of global electric car sales are concentrated in Europe, China, and the United States. IEA's report projects that the number of electric cars, vans, heavy trucks and buses on the road worldwide will reach 145 million by 2030. The global fleet has the potential to reach 230 million, if governments fast-track their efforts to reach international climate and energy goals outlined in the IEA's Sustainable Development Scenario.

Stationary storage market

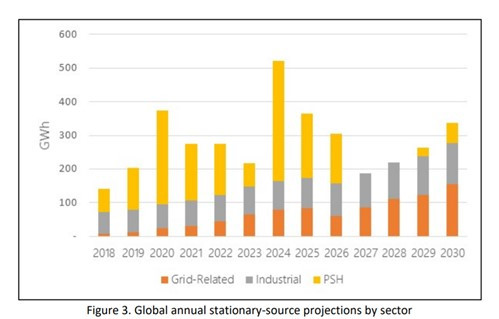

The global stationary market is estimated to grow from ~150 GWh/year. in 2018 to 380 GWh/year by 2030, with a peak at 535 GWh/year in 2024. [Energy Storage Grand Challenge: Energy Storage Market Report, December 2020.]

At present, the industrial deployments are far higher than the grid-related deployment of energy storage with an 8 percent CAGR. Forklifts or industrial motive storage make up a large segment of the industrial storage deployment, followed by UPS and telecom. As per reports, pumped-storage hydropower [PSH] is generally deployed as large-sized singular projects with long lead times, therefore the deployments do not follow a smooth curve.

As can be seen in Figure 3, the existing capacity in stationary energy storage is dominated by PSH. However, because of declining prices and advancements in battery technology, new projects are generally Li-ion batteries.

By 2030, grid-based applications are predicted to surpass industrial applications due to their significant growth at a CAGR of 27 percent, and the annual global deployment of stationary storage is projected to exceed 300GWh [Energy Storage Grand Challenge: Energy Storage Market Report, 2020.]

Currently, several countries are amid the development of PSH projects or actively exploring them. For example, China has announced more than 35GW PSH to be developed between 2021-26 through several multi-gigawatt projects. The United States is also exploring ways for growing PSH deployments.

The largest markets for stationary energy storage in 2030 are projected to be in North America (41.1 GWh), China (32.6 GWh), and Europe (31.2 GWh).

Excluding China, Japan (2.3 GWh) and South Korea (1.2 GWh) comprise a large part of the rest of the Asian market. Much of the expansive growth is 4-hour-duration hybrid configurations coupled with utilities, commercial and industrial (C&I), and residential renewables, generally photovoltaics [Energy Storage Grand Challenge: Energy Storage Market Report, 2020.]

At the 5th World Energy Storage, Day organized on September 22, leading voices of the storage and mobility industry discussed what policymakers are doing to develop the stationery market, the latest technology, primary drivers, and constraints to the market across the following four global regions:

R1: Australia & New Zealand, Singapore, Philippines, Indonesia, Japan, China, South Korea

R2: India, SAARC, Russia

R3: Europe, UK, Middle East & Africa

R4: United States, Latin America, and Canada

Key drivers of stationary storage market

- Rapid cost reductions: all storage technologies have shown significant cost reductions as they achieve manufacturing scale. Li-ion battery costs particularly have shown significant reduction with cell price reducing from ~$800/kWh in 2011 to ~$100/kWh by 2020.

- Growth in renewables: renewable energy penetration is driving policymakers to encourage storage. New ISO/RTO market products to address renewables: ramping, frequency response, flexible capacity.

- Policy incentives and decarbonization targets: driven by renewable integration, grid-resiliency states have provided mandates and incentives boosting energy storage system (ESS) deployment. Many policy incentives are provided for faster adoption (tax credits, pay-for-performance, dual-participation).

- Growing use of EVs: growth in EV sales have provided the economies of scale to technologies like Li-ion driving down the prices.

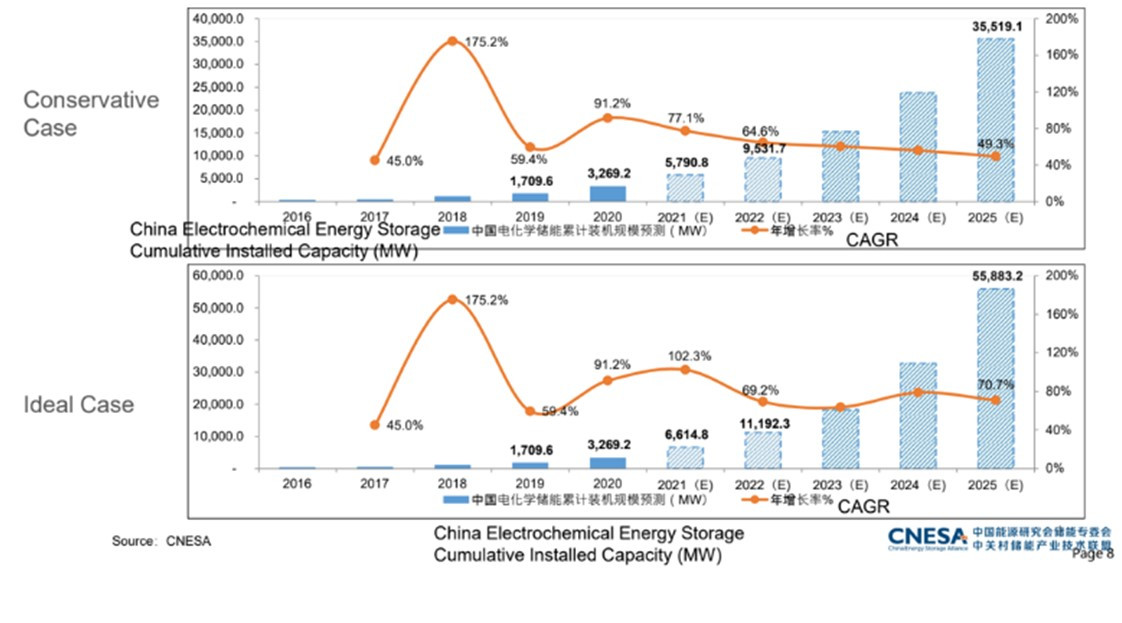

In Region 1, the panelists noted that due to the rapid increase in new energy penetration in China, by 2030, the country's new energy storage is expected to reach 150 GW.

In the near term, China's energy storage is forecasted to reach 35-56 GW in 2025.

In terms of developments in Region 2, specifically India, Ghanshyam Prasad, Joint Secretary- Ministry of Power, shared that India will be going forward with the first tranche of bidding in energy storage in October for 1000 MWh and in the future, the government will bring out other bid combinations.

Currently, the Indian Government is in the midst of drafting a National Electricity Policy. The key focus of which will be on 'energy transition' which will further focus on the storage systems and include BESS, hydro-pump storage, hydrogen, and all the types of storage.

"Some of the sops that were given to the RE sector will be given to the storage sector as well," Mr. Prasad said during his presentation.

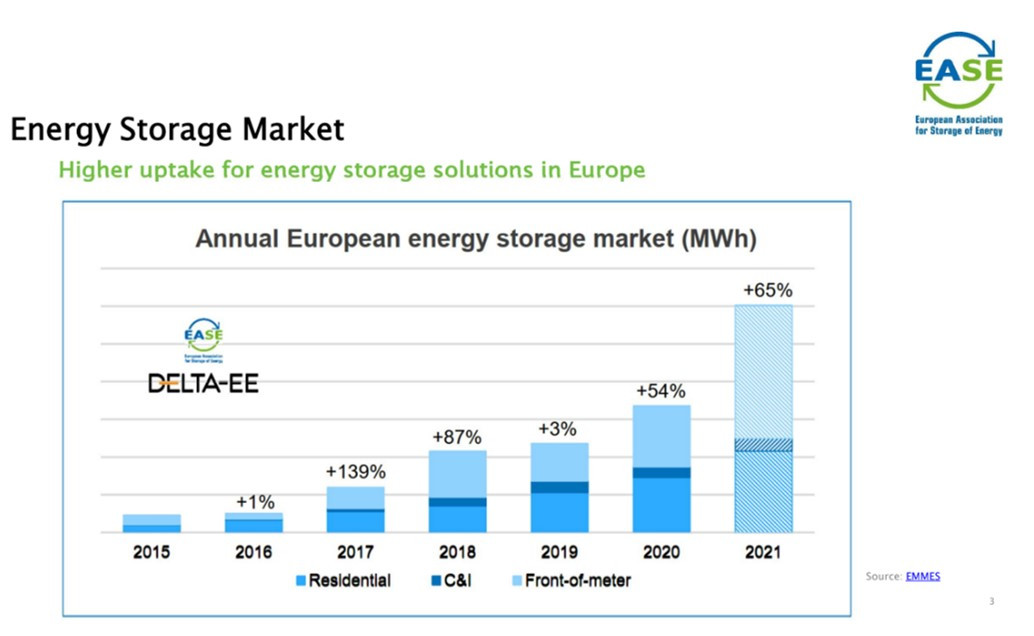

The panelists in Region 3, touched upon the higher uptake of energy storage solutions across Europe and the declining costs of renewable power and battery storage.

While the COVID-19 pandemic affected the EU storage market, not all countries were impacted equally. The behind-the-meter market (BTM) was particularly hit hard and commercial and industrial was hit harder, however, the front-of-the-meter uptake has remained relatively unaffected, with significant growth and new services entering the market.

"The regulation has a considerable effect on the energy storage sector," said Jacopo Tosoni, Policy Officer at EASE. "We [in EU] witnessed a significant growth despite COVID-19 pandemic that took the world by a storm. Customers for C&I applications have been conservative in 2021 as they focus on recovery, yet new businesses have made a case for energy storage across the sector."

In Region 4, speakers discussed the United States leading the path to energy storage deployments with the country surpassing 1GW of deployed energy storage capacity in 2020.

"We are now making regular procurement of multiple GW of energy storage in the USA. It is critical as it reflects that energy storage has developed as a key source for long-duration power backup across the country," said Jason Burwen, CEO of U.S. Energy Storage Association (ESA).

The panelists at the stationary storage session also discussed the existing constraints that need to be addressed to bolster the growth of the storage market. These constraints hinder the deployment of energy storage technologies, or in some way limit the deployment consideration.

Constraints to the stationary storage market

Regulatory Barriers – Public policy and market regulations have to be updated to promote the deployment of storage systems. Policies developed in many countries were developed before new forms of energy storage technologies were developed, and often do not recognize the flexibility that the energy storage system brings in the energy sector.

There is a need to update ancillary services market rules to support storage deployment. Further retail rules will also have to be updated especially as C&I and residential interests in energy storage system grows.

Lack of standardization – Diverse technical requirements, policies, and varied processes add to the complexity and therefore costs throughout the value chain. Standardization, therefore is important, particularly for promoting battery storage because of 'balance-of-charge' issues associated with the battery.

Lack of definition of energy storage – Policymakers in several countries is grappling with how to define energy storage. In some cases, this is because there is a lack of familiarity with the range of applications battery energy storage can be used for or because of a lack of understanding of how to assign value to their use and provide compensation to the providers.

In conclusion, the speakers in the stationary storage session agreed that policy and regulatory support, along with renewable energy transition and EV adoption, will drive the energy storage sector forward and potentially result in greater interaction between investors, energy firms, and project developers.