Battery swapping stations: Can they improve grid flexibility?

The role of battery swapping in potentially bringing down EV ownership costs is well-known. However, swapping stations could also act as an essential source of grid flexibility, which will become crucial with an increasing share of renewable energy and EVs. Dhruv Warrior, Research Analyst at the Council on Energy, Environment, and Water (CEEW), elucidates the various aspects of battery swapping and its relevance in the coming years.

On February 1, 2022, the Finance Minister of India made several landmark announcements related to the energy transition, building on the Prime Minister's 'Panchamrit' or five-point agenda to tackle climate change.

Among these announcements was a proposed battery swapping policy that has excited many in the industry. Aligning policy and private sector strategy on battery swapping is vital. There is also a need for updating legislation addressing the various challenges inherent to scaling up battery swapping.

What is battery swapping?

Battery swapping is a form of vehicle refuelling through a detachable battery. When the battery's charge gets depleted, the driver can go to a battery swapping station and replace the battery within minutes. Hence, the driver doesn't need to own the expensive battery but instead is provided the battery-as-a-service (BaaS). The success of this business model could prove to be a significant catalyst in the EV revolution since it can bring down the EV ownership cost.

Battery swapping for grid flexibility

The argument for battery swapping generally boils down to a potential lowering of EV costs and access to fast refuelling without the need for fast chargers. But with the increasing share of renewable energy and EVs, battery swapping stations can also play a key role in helping utilities balance their grids.

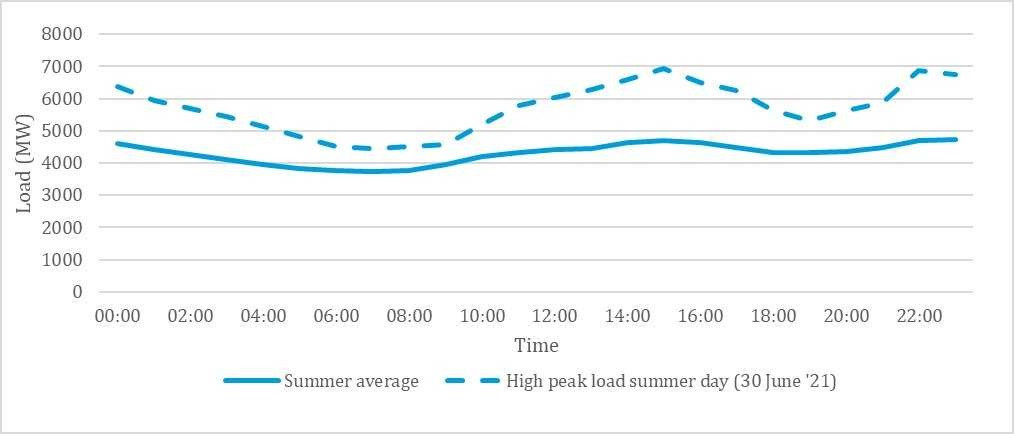

To understand where battery swapping could play a role, we should first understand where the trouble lies with current charging methods when it comes to loading on the grid. We use the case study of Delhi to explain the problem.

In Figure 1, we see the characteristic dynamic demand of the Delhi grid, with afternoon and evening peaks. At these times, the transmission and distribution (T&D) infrastructure of the grid is at its limit, and the utility is forced to procure excess electricity from the short-term electricity markets at a high cost. As the number of EVs charging increases, it is likely to increase the variability of this load. Typically, EVs are charged at night, and in the case of Delhi, their power demand coincides with pre-existing peak hours.

Managed charging systems

Utilities can try to control their EV charging load through passive or active managed charging. When managing to charge passively, utilities use incentives such as variable time-of-day (ToD) tariffs to nudge the charging behaviour. In an active managed to charge, utilities manage to charge through the direct control of chargers on their network. Consumers would see their charging slowed or switched off as required by the utility, in return for participation incentives or cheaper EV charging tariffs. Unfortunately, while necessary, managed-to-charge systems have limits to their effectiveness.

Actively managed charging requires installing smart charging equipment. Such installations will be challenging to implement at scale for e-2W and e-3W drivers who currently charge from standard wall plug-points. Managed charging programs may also require active user involvement in keeping track of time-of-day rates and demand response events. This active participation could be challenging for less technically-savvy consumers.

Battery swapping could be ideal to fill these gaps, particularly in India where e-2W and e-3W make up the majority of the potential EV customers. Battery swapping providers have the potential to act as aggregators, where the charging load of a large number of e-2W and e-3W can be managed. The process of smart charging would be considerably simpler for EV drivers. Further, battery swapping could increase the range of load shifting available during managed charging.

Flexibility with battery swapping

Currently, the amount of flexibility available during charging depends on the schedule and charger availability for an individual consumer. Swapping stations should be able to determine flexibility for all the batteries being charged. Such a business model would be more straightforward than aggregator models consisting of multiple, non-co-located smart chargers since a smart battery station would need to consist of only a single commercial connection to the grid.

If battery swapping is expanded to e-4W and e-buses, it could reduce the load from fast chargers while providing similar refuelling speeds. Battery swapping stations could reduce the charging load by broadening the charging window of these swapped batteries.

Through this mechanism, battery swapping stations could provide much-needed flexibility to utilities while concurrently providing value to EV consumers. The station could also act as energy storage on the grid and provide power back to it. Gogoro Inc. and Taipower installed the world's first V2G battery-swapping station in Taiwan in October 2021.

Mainstreaming grid-integrated battery swapping

Battery swapping as a technology has been through false starts. It will be vital for policy-makers and the private sector to align on the deployment of the technology. When considering the deployment of grid-integrated battery swapping, a few challenges need to be tackled.

Lack of data is the first roadblock. Smart charging is a nascent technology in India, while battery swapping is still in the proof-of-concept stage. Further, globally, it is only concentrated in specific geographies, and access to smart charging implementation data is scarce. The government should earmark funding for grid-integrated pilots as part of the battery swapping policy. Such pilots will give utilities and industry players more precise data on the potential flexibility afforded by battery swapping stations, as well as the technical and commercial constraints.

Secondly, for battery swapping to provide grid flexibility, it must be deployed at scale. A major hindrance to such deployment is the lack of standardization of swappable battery technologies. Each company has its proprietary technology and may be unwilling to make modifications for standardization. The government must step in to mandate certain basic standards for these swappable batteries. Effective standards will only arrive through a consultative process that brings together all of the major players in manufacturing (EV and battery) and swapping station operators.

Finally, battery swapping must be affordable for consumers. Here, the revenue from grid services could add a much-needed competitive advantage to the battery swapping model in India. Battery swapping companies can pass on some of the value accrued from cheaper tariffs and managed to charge incentives to customers as part of their BaaS model.

Flexible electric grids require adequate demand-side management and grid-connected energy storage. Smart battery swapping stations could provide both of these services to the grid while providing value to EV drivers. The flexibility could be provided without compromising on the USPs of battery swapping: fast refuelling and affordable EVs. To ensure the success of battery swapping and increase grid resilience, various stakeholders like EV manufacturers, utilities, and policymakers need to work closely to develop a smart battery swapping ecosystem.