Battery Swapping can aid India's EV growth story

For India's EV growth to continue in the coming years, the country needs a robust charging infrastructure, wide range of products for buyers to choose, lower battery costs, and a higher driving range per charge. Battery swapping helps us solve most of these challenges in a systematic way, write Dev Ashish Aneja - AVP & Sector Lead, and Abhishek Bansal - Investment Specialist, Automobile and Electric Mobility Sector, Invest India*.

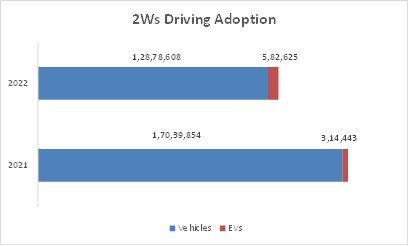

EV sales are breaking new records month after month and year after year, both globally and in India as well. Global EV sales have grown by 61 percent this year, while the sales in India have already crossed 582,000 this year until the month of August. This is about 46 percent higher than EV sales recorded in FY 2021-22.

There is a massive room for growth in the Indian EV market. As on date, we have about 1.5 million EVs on roads, out of a total parc of 300 million vehicles, thereby making a total EV penetration of just 0.5 percent. In fact, the total number of EVs sold in India last year was 314,000. This number has already reached 582,000 (85 percent YOY growth) in the first eight months of 2022.

E2Ws are driving the Indian EV story. We have already seen a 488 percent YOY sales growth in this segment until August'22. States like Delhi are taking charge, with an EV penetration of over 11 percent already.

Talking about E3W sales, we are already seeing an EV penetration of over 60 percent. In fact, we have crossed the magical threshold of 50 percent EV penetration month-on-month since the start of this financial year.

Primarily central government schemes such as FAME are driving this growth, coupled with State EV policies. As of today, over 576,000 vehicles have been sold under FAME, and over 19 States already have a dedicated EV policy.

Battery Swapping

For this EV growth to continue, India needs a robust EV Infrastructure, wide range of EV products, lower battery costs, and a higher driving range per charge. Battery swapping helps us solve most of these challenges in a systematic way.

The battery swapping ecosystem is nascent, and there are immense opportunities for introducing solutions to tackle the existing challenges. An attempt has been made through NITI Aayog's Draft Battery Swapping Policy which proposes on reducing tax rate differential of batteries and EVSE, backs fiscal incentives, prioritizes metro cities for swapping network and advocating for interoperability.

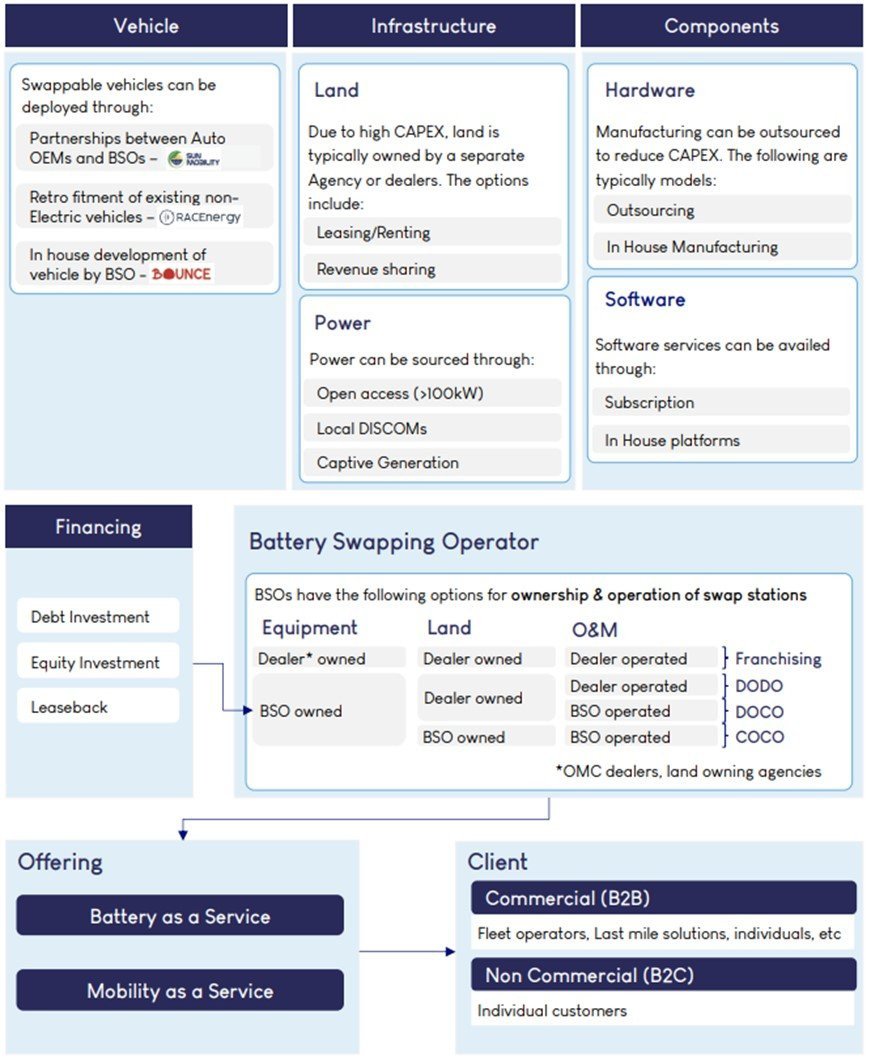

Setting up a battery swapping business in India requires interaction with different central government and state government bodies. Some of the key compliances have been covered in the report. It's a capex intensive business, however viability is getting better with each passing day.

With the PLI ACC scheme getting notified, we are staring at cell level localization in India leading to cheaper batteries in the next 3-5 years.

Key Stakeholders involved in Battery Swap Business models:

- Energy Operator

- Real Estate Owner

- Third Party Swapping Outlet Operator

- OEM (Original Equipment Manufacturer)

- Power Company

Gogoro in Taiwan has already proved to the rest of the world that battery swapping for light vehicles can be a huge success. EO needs to ensure a high density of swapping outlets across the city, with a swap outlet to be present every 1 –2 kms. While some companies have opted for existing fuel pumps, others are opting for 'kirana stores' like local shops to set up their swapping stations, wherein shop owners keep 2-3 batteries that can be readily swapped.

Lastly and most importantly, India's EV ambitions are based on the successful transition of two-wheelers and three-wheelers into electric vehicles. These vehicle form factors are ideal for swapping.

Further, over 80 percent of EVs in these segments are sold in the B2B space, further strengthening the swapping business model. Game of swapping has just begun, and it has a massive potential in a country such as India which is a world leader in light vehicle form factors.

RELATED ARTICLES:

# IESW 2022: Charging infra and battery swapping for EVs draw attention

# Making EVs mainstream – Can battery swapping change India's EV ecosystem?

*Dev Ashish Aneja is serving as AVP & Sector Lead at Invest India. Abhishek Bansal is an Investment Specialist associated with Automobile and Electric Mobility Sector of Invest India, the National Investment Promotion and Facilitation Agency of Government of India. Views expressed are personal.