Cathode - the energy source of a lithium-ion battery

The cathode is the energy source of a lithium-ion battery. Building strong supply chains, such as cathode and anode plants, and securing supply of critical raw materials will be crucial for the rise of giga factories.

When it comes to ICE vehicles, the central driving force of the vehicle is the engine but in EVs, batteries are the heart of the vehicle. One of the key components that lie at the core of the EV battery is the cathode.

The cathode is often referred to as the energy source of a lithium-ion battery.

In a cathode, lithium and oxygen meet to form lithium oxide. When the battery is being charged the Li-ion is pulled out of the cathode and travels to the anode and when the battery is being used (or discharged) the Li-ion returns to the cathode and electricity is produced during this process. Due to the charge-discharge process, Li-ion batteries are reusable and therefore also termed as secondary-cell batteries or rechargeable batteries.

Types of cathode materials

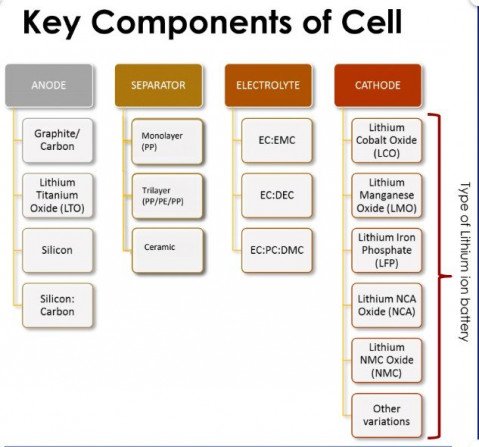

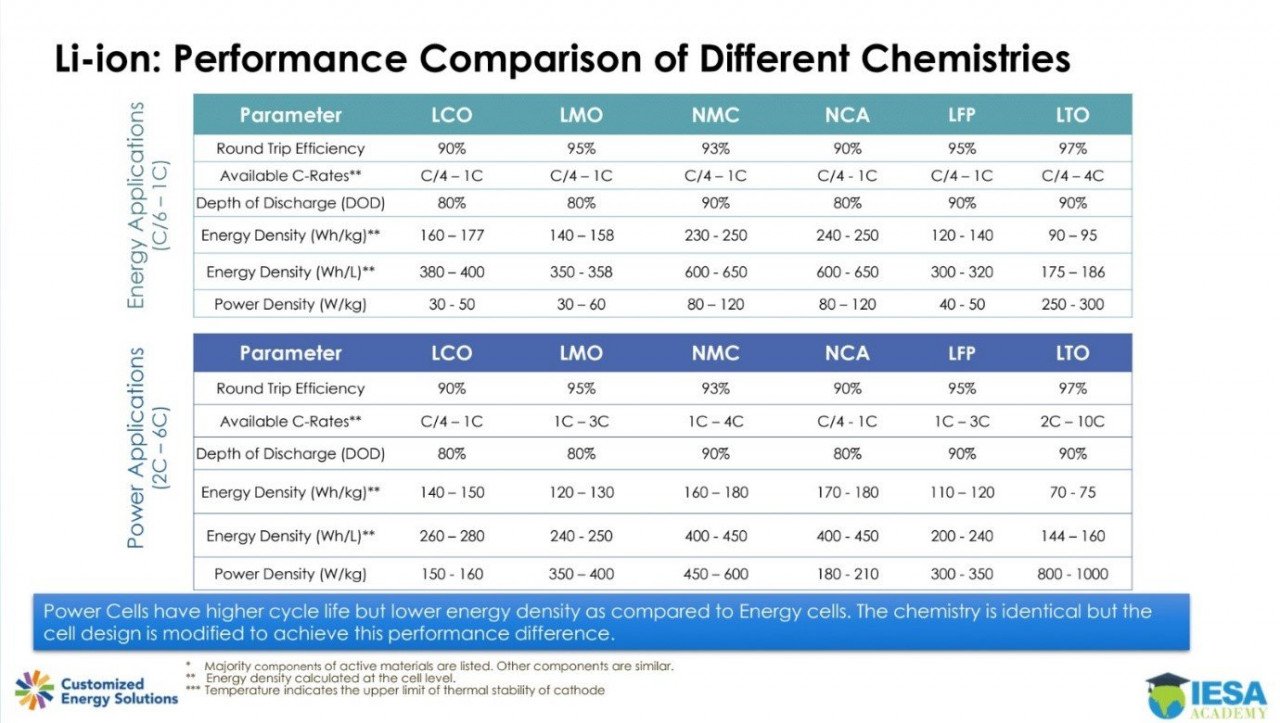

Cathode materials in a Li-ion battery are critical as they determine the characteristics of a battery such as its capacity and output.

The battery's capacity and voltage are determined based on what type of active material is used in the cathode. Lithium, oxygen, and other metals can meet to form various combinations. Further, various cathode materials with different characteristics can be formed depending on the type of metal and proportion used. Therefore, there are several materials for the cathode. The main factor influencing the choice of material are cycle life, energy density, cost and availability of materials, power to energy ratio, safety, and temperature of operation.

Among the numerous combinations of cathode materials, five combinations have been determined to produce the best performance as a battery. Regardless of the battery chemistry, lithium is required in all cathode materials.

These five different types of cathode materials are lithium cobalt oxide (LCO), lithium iron phosphate (LFP), lithium manganese oxide (LMO), lithium nickel manganese cobalt (NMC), and lithium, nickel, cobalt, aluminum (NCA).

- LCO – It is a cathode material composed of lithium, cobalt, and oxygen. On account of its low energy density, it is not often used for batteries in electric vehicles but is widely used in Li-ion batteries for portable electronics like smartphones. This chemistry gives good performance and is relatively safe, but due to the high cobalt content, it is also expensive and therefore, not used in EV applications.

- LFP – It is a cathode material composed of lithium, iron, phosphoric acid, and oxygen. Given that it uses iron, it is low-cost and safer than other cathode chemistries, but LFP is also heavy and has lower energy capacity. They find use in passenger vehicles especially for shorter range and lower cost.

- LMO – It is a cathode material composed of lithium, manganese, and oxygen. As it uses manganese it is inexpensive but at the same time is also vulnerable to high temperature. LMO batteries were used in the first EVs such as Nissan Leaf, on account of their high reliability and relatively low cost.

- NMC – It is a cathode material composed of lithium, nickel, manganese, cobalt, and oxygen. Simply put, it is LCO with nickel and manganese added. The proportion of cobalt within LCO was reduced to make room for nickel and cobalt. The proportion of nickel, cobalt, and manganese is usually 1:1:1 in NCM but recently R&D in progress are looking to increase nickel content for increased energy density while decrease cobalt, which is expensive. Cathode material with more than 60 percent nickel is also called high nickel. It is a cathode material with high energy density due to the higher nickel proportion which creates strong and instantaneous energy.

- NCA – It is a cathode material composed of lithium, nickel, cobalt, aluminum, and oxygen. It is an LCO with nickel and aluminum added. Usually nickel, cobalt, and aluminum are in 8:1:1 proportion. NCA cathode materials have a high proportion of nickel hence they are high in energy density have low stability. Therefore, they are used in smaller batteries rather than mid-to-large-sized batteries. Reports suggest these were the first commercial attempts to substitute some of the expensive cobalt in the LCO cathode by increasing the nickel content.

When it comes to cathodes for lithium-ion batteries, the leading battery manufacturers commonly use a combination of NMC or NCA.

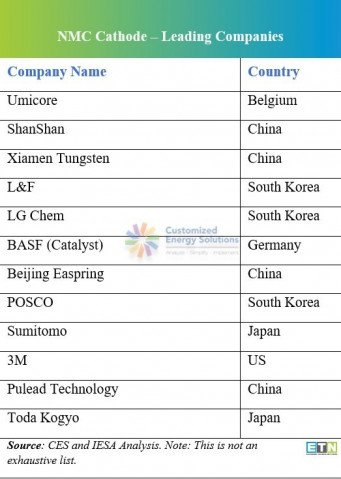

Leading cathode material companies

At present China produces over two-thirds of the global supply of cathodes from over 100 facilities (Benchmark).

In Q2 last year, leading cathode material producers Umicore, POSCO, BASF made announcements expanding their cathode capacity further in Asia and Europe to meet rising demand in 2022-23.

- In June 2020, Umicore, the European special chemicals and recycling company a €125 million ($140 million) loan from the European Investment Bank to finance its battery cathode materials production site in Nysa, Poland. This move is part of the European Commission's wider supply chain push that will help the company expand its cathode footprint in Europe. As per reports (Benchmark Minerals), the Nysa plant has two NCM (nickel cobalt manganese) lines under construction. The first line with a capacity of 10,000 tpa is due to begin production in 2022. Following this, a second high-nickel line is due by 2023, taking total capacity to 25,000 tpa. In addition to its capacity expansion in Europe, the group also has a further 8,000 tpa of NCM 811 capacity due to come online in China in 2022.

- In June 2020, BASF announced the construction of its precursor cathode active material (PCAM) plant in Harjavalta, Finland. The company secured the construction permits to start building a new cathode active material (CAM) plant in Schwarzheide, Germany, with both plants on schedule to start operations in 2022. As per reports, the plants are planned to have enough combined capacity to supply cathode active battery materials for around 400,000 full EVs per year.

- In 2020, POSCO announced to begin commercial production of NCMA cathodes (nickel cobalt manganese aluminum). The South Korean cathode material giant current capacity expansion plans are focused on NCM cathode chemistries, but it plans to move into NCMA in 2018. The company aims to have a 20 percent share of the cathode market by 2030.

Cathode materials cost and latest R&D

Cathodes make up roughly 40-45 percent (nearly half) of the material cost of the battery. The primary reason for this being: cobalt. Cobalt is one of the most expensive and least abundantly available components in cathodes.

Leading battery manufacturers like LG Chem use NCM as their preferred cathode material. Cathode materials are being researched and developed at LG Chem Advanced Materials Company. At present six different types of NCM are being developed: One of which is a high nickel cathode material NCM712, which has nickel, cobalt, manganese in a proportion of 7:1:2. Second is the recently developed cathode material NCMA, which is NCM with aluminum added for additional stability and it will go into production soon.

Companies around the globe are investing in R&D to discover which formulation of nickel, cobalt, manganese, and lithium would be best for improving battery performance.

For instance, LG Chem in July 2019 announced to invest more than 500 Korean won ($424.03 million) to build a factory until 2024 for cathode material production for Li-ion batteries in the fifth national industrial complex of the Gumi City in South Korea.

Additionally, there is research underway to explore cobalt-free, long-lasting, and safer cathode materials.

For instance, in July 2020, researchers from the Cockrell School of Engineering at The University of Texas at Austin (Arumugam Manthiram, a professor in the Walker Department of Mechanical Engineering and director of the Texas Materials Institute, Ph.D. student Steven Lee and Ph.D. graduate Wangda Li) reported that they had found a way to develop cobalt-free high-energy lithium-ion battery, eliminating the cobalt and reducing the costs of producing batteries while boosting performance.

The team reported a new class of cathodes and formed TexPower a startup that aims to commercialize the world's first cobalt-free, high-energy, drop-in cathode materials for lithium-ion battery (LIB) manufacturers across the U.S. and beyond.

In conclusion, every single component of the Li-ion battery is important as it cannot function with any one of the components missing. The cathode along with the anode determines the basic performance of a battery.

Emerging Technology News (ETN) undertook an exclusive interview with Mr. Jay Yang, Vice President - Battery Materials-Asia Pacific, BASF, one of the leading cathode material players for Li-ion batteries.

Q. Please tell us about BASF cathode materials?

A. Cathode materials are indeed one of the most important components of LIB (lithium-ion batteries) for various applications. It is a critical part of the value chain and responsible for around 50 percent of the value addition in batteries. Also, it is a major contributor to battery efficacy and performance. Currently, we at BASF offer all the important cathode active materials to customers globally, including NCM/NCA, NCMA (nickel, cobalt, manganese, and aluminum), etc. With these products, we serve electronics and the growing EV sector.

With global automakers embracing the transition to vehicle electrification, innovation in the advanced battery materials space also acts as an imperative measure for our company's growth. We have R&D in place for new manganese-rich chemistry-based products, that are expected to contribute more value to the growing LIB market.

Q: What are some of the markets BASF supplies to at present, and are there new markets that you plan on entering?

A: We are spread across all major regions and aim to expand our facilities in the US, EU, China, and Japan by 2022. These would be catering to local demand centers as well as India. Nevertheless, tracking the main demand centers globally for our materials and providing solutions internationally is always on our checklist for conducting business expansion activities in future.Q. How does BASF plan to create value for LIB manufacturers?

A. BASF caters to a huge customer base in various application areas. The requirements are unique and spread across various parameters, be it energy storage, density, safety, efficacy, efficient product life cycle, or cost-effectiveness. Therefore, we try to provide custom/tailor-made product chemistries to achieve customer satisfaction and strive to do so in the future as well.

Q. Please tell us more about BASF'S partnerships for innovations in battery materials?

A. BASF has a global presence which is strengthened further through its regional JVs and partnerships. For example, in Japan, we have BASF - TODA battery materials, catering to the growing demand for high nickel cathode active materials in the region. Also, very recently, we have recently announced a JV with Ningbo Shanshan, which is currently subject to approvals from relevant authorities. This is an important milestone for our company in expanding the company footprint in China and creating synergies globally.

Q. Name some of the major clients for your products.

A. BASF is serving all major OEMs and has maintained good relations with the automotive vendors. We examine several options from time to time, in various regions to further expand our production network and enhance customer support services. Our strategy remains simple: We invest where our customers are.

Q. What is your opinion on the ACC battery storage program approved by the Union Cabinet (Govt. of India) earlier in May?

A: Yes, it is very interesting to learn about the openness of the Indian government to identify new opportunities in battery storage space and providing incentives to the manufacturers. India is well-positioned to be a high-growth market for future EV sales. Therefore, this program will turn out to be a very positive platform to build a strong foundation for the automotive sector, especially to drive EV market growth in India.